MetLife 2001 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

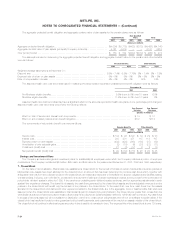

Based on this information, Metropolitan Life concluded that certain claims that previously were considered as only reasonably possible of assertion

were probable of assertion, increasing the number of assumed claims to approximately three times the number assumed in prior periods. As a result of

this reassessment, Metropolitan Life increased its liability for asbestos-related claims to $1,278 million at December 31, 1998.

During 1998, Metropolitan Life paid $878 million in premiums for excess insurance policies for asbestos-related claims. The excess insurance

policies for asbestos-related claims provide for recovery of losses up to $1,500 million, which is in excess of a $400 million self-insured retention. The

asbestos-related policies are also subject to annual and per-claim sublimits. Amounts are recoverable under the policies annually with respect to claims

paid during the prior calendar year. As a result of the excess insurance policies, $878 million was recorded as a recoverable at December 31, 2001,

2000 and 1999. Although amounts paid in any given year that are recoverable under the policies will be reflected as a reduction in the Company’s

operating cash flows for that year, management believes that the payments will not have a material adverse effect on the Company’s liquidity. Each

asbestos-related policy contains an experience fund and a reference fund that provides for payments to the Company at the commutation date if

experience under the policy to such date has been favorable, or pro rata reductions from time to time in the loss reimbursements to the Company if the

cumulative return on the reference fund is less than the return specified in the experience fund. It is likely that a claim will be made under the excess

insurance policies in 2003 for a portion of the amounts paid with respect to asbestos litigation in 2002. If at some point in the future, the Company

believes the liability for probable and estimable losses for asbestos-related claims should be increased, an expense would be recorded and the

insurance recoverable would be adjusted subject to the terms, conditions and limits of the excess insurance policies. Portions of the change in the

insurance recoverable would be deferred and amortized into income over the estimated remaining settlement period of the insurance policies.

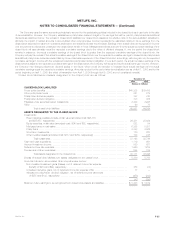

The Company believes adequate provision has been made in its consolidated financial statements for all reasonably probable and estimable losses

for asbestos-related claims. Estimates of the Company’s asbestos exposure are very difficult to predict due to the limitations of available data and the

substantial difficulty of predicting with any certainty numerous variables that can affect liability estimates, including the number of future claims, the cost to

resolve claims and the impact of any possible future adverse verdicts and their amounts. Recent bankruptcies of other companies involved in asbestos

litigation, as well as advertising by plaintiffs’ asbestos lawyers, may be resulting in an increase in the number of claims and the cost of resolving claims, as

well as the number of trials and possible verdicts Metropolitan Life may experience. Plaintiffs are seeking additional funds from defendants, including

Metropolitan Life, in light of such recent bankruptcies by certain other defendants. Metropolitan Life is studying its recent claims experience, published

literature regarding asbestos claims experience in the United States and numerous variables that can affect its asbestos liability exposure, including the

recent bankruptcies of other companies involved in asbestos litigation and legislative and judicial developments, to identify trends and to assess their

impact on the previously recorded asbestos liability. It is reasonably possible that the Company’s total exposure to asbestos claims may be greater than

the liability recorded by the Company in its consolidated financial statements and that future charges to income may be necessary. While the potential

future charges could be material in particular quarterly or annual periods in which they are recorded, based on information currently known by

management, it does not believe any such charges are likely to have a material adverse effect on the Company’s consolidated financial position.

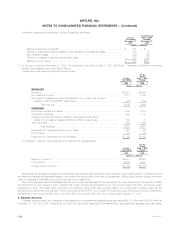

Property and Casualty Actions

A purported class action suit involving policyholders in four states was filed in a Rhode Island state court against a Metropolitan Life subsidiary,

Metropolitan Property and Casualty Insurance Company, with respect to claims by policyholders for the alleged diminished value of automobiles after

accident-related repairs. After the court denied plaintiffs’ motion for class certification, the plaintiffs dismissed the lawsuit with prejudice. Similar

‘‘diminished value’’ purported class action suits have been filed in Texas and Tennessee against Metropolitan Property and Casualty Insurance Company;

a Texas trial court recently denied plaintiffs’ motion for class certification and a hearing on plaintiffs’ motion in Tennessee for class certification is to be

scheduled. A purported class action has been filed against Metropolitan Property and Casualty Insurance Company’s subsidiary, Metropolitan Casualty

Insurance Company, in Florida. The complaint alleges breach of contract and unfair trade practices with respect to allowing the use of parts not made by

the original manufacturer to repair damaged automobiles. Discovery is ongoing and a motion for class certification is pending. A two-plaintiff individual

lawsuit brought in Alabama alleges that Metropolitan Property and Casualty Insurance Company and CCC, a valuation company, violated state law by

failing to pay the proper valuation amount for a total loss. Total loss valuation methods also are the subject of national class actions involving other

insurance companies. A Pennsylvania state court purported class action lawsuit filed in August 2001 alleges that Metropolitan Property and Casualty

Insurance Company improperly took depreciation on partial homeowner losses where the insured replaced the covered item. In addition, in Florida,

Metropolitan Property and Casualty Insurance Company has been named in a class action alleging that it improperly established preferred provider

organizations (hereinafter ‘‘PPO’’). Other insurers have been named in both the Pennsylvania and the PPO cases. Metropolitan Property and Casualty

Insurance Company and Metropolitan Casualty Insurance Company are vigorously defending themselves against these lawsuits.

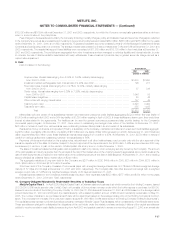

Demutualization Actions

Several lawsuits were brought in 2000 challenging the fairness of Metropolitan Life’s plan of reorganization and the adequacy and accuracy of

Metropolitan Life’s disclosure to policyholders regarding the plan. These actions name as defendants some or all of Metropolitan Life, the Holding

Company, the individual directors, the New York Superintendent of Insurance and the underwriters for MetLife, Inc.’s initial public offering, Goldman

Sachs & Company and Credit Suisse First Boston. Five purported class actions pending in the Supreme Court of the State of New York for New York

County have been consolidated within the commercial part. Metropolitan Life has moved to dismiss these consolidated cases on a variety of grounds. In

addition, there remains a separate purported class action in New York state court in New York County that Metropolitan Life also has moved to dismiss.

Another purported class action in New York state court in Kings County has been voluntarily held in abeyance by plaintiffs. The plaintiffs in the state court

class actions seek injunctive, declaratory and compensatory relief, as well as an accounting and, in some instances, punitive damages. Some of the

plaintiffs in the above described actions also have brought a proceeding under Article 78 of New York’s Civil Practice Law and Rules challenging the

Opinion and Decision of the New York Superintendent of Insurance that approved the plan. In this proceeding, petitioners seek to vacate the

Superintendent’s Opinion and Decision and enjoin him from granting final approval of the plan. This case also is being held in abeyance by plaintiffs.

Another purported class action is pending in the Supreme Court of the State of New York for New York County and has been brought on behalf of a

purported class of beneficiaries of Metropolitan Life annuities purchased to fund structured settlements claiming that the class members should have

received common stock or cash in connection with the demutualization. Metropolitan Life has moved to dismiss this case on a variety of grounds. Three

purported class actions were filed in the United States District Court for the Eastern District of New York claiming violation of the Securities Act of 1933.

MetLife, Inc.

F-30