MetLife 2001 Annual Report Download - page 24

Download and view the complete annual report

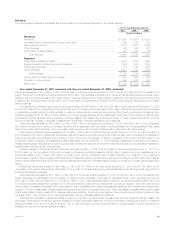

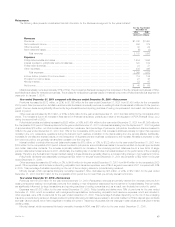

Please find page 24 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Payments of $327 million related to Metropolitan Life’s demutualization were made during the second quarter of 2000 to holders of certain policies

transferred to Clarica Life Insurance Company in connection with the sale of a substantial portion of the Company’s Canadian operations in 1998.

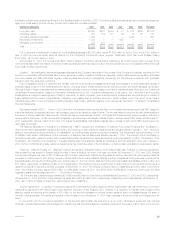

Other expenses increased by $37 million, or 13%, to $329 million for the year ended December 31, 2001 from $292 million in the comparable 2000

period. Argentina’s other expenses rose by $15 million due to a write-off of deferred policy acquisition costs, resulting from a revision in the calculation of

estimated gross margins and profits caused by the anticipated impact of recent economic and political events in that country. Mexico and South Korea’s

other expenses grew by $13 million and $10 million, respectively, primarily due to the growth in business in these countries. Brazil’s other expenses rose

by $7 million primarily due to the acquisition of Seasul. In addition, the Chilean acquisitions contributed $3 million to this variance. These variances were

partially offset by an $11 million decrease in Spain’s other expenses due to a reduction in payroll, commissions, and administrative expenses as a result

of a planned cessation of product lines offered through a joint venture with Banco Santander. The remainder of the variance is attributable to minor

fluctuations in several countries.

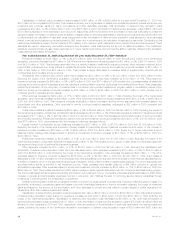

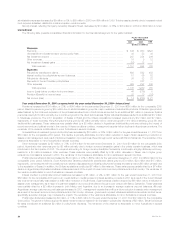

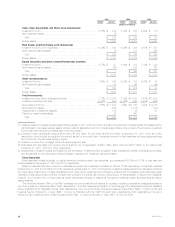

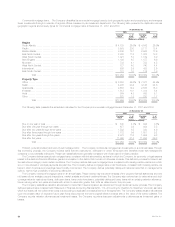

Year ended December 31, 2000 compared with the year ended December 31, 1999—International

Premiums increased by $137 million, or 26%, to $660 million in 2000 from $523 million in 1999. Mexico’s premiums increased by $45 million,

primarily due to new business growth in the group life and major medical products. South Korea’s increase in premiums of $29 million is mainly

attributable to the establishment of a new professional agency force resulting in higher productivity levels and an improvement in the individual life

business’ persistency. The majority of Taiwan’s premium increase of $28 million is due to overall growth in the individual life business. Increased sales

from the direct auto business is the principal driver behind Spain’s premium increase of $18 million. Brazil’s premiums increased by $14 million resulting

predominately from business expansion. Brazil began selling business late in the second quarter of 1999 and acquired two large blocks of business in

the beginning of 2000. The remainder of the increase is due to minor increases in several other countries.

Universal life and investment-type product policy fees increased by $10 million, or 23%, to $53 million in 2000 from $43 million in 1999, primarily

due to expanded business operations in both Argentina and Spain.

Other revenues decreased by $3 million to $9 million in 2000 from $12 million in 1999. This decrease is attributable to variances in several countries.

Policyholder benefits and claims increased by $104 million, or 23%, to $562 million in 2000 from $458 million in 1999. Mexico, Taiwan, South Korea

and Brazil’s policyholder benefits and claims increased by $35 million, $32 million, $14 million and $8 million, respectively, commensurate with the overall

premium growth discussed above. Spain’s policyholder benefits and claims increased by $11 million, primarily due to increases in auto claims. This is

consistent with the premium growth discussed above. The remainder of the increase is primarily due to expanded business operations in several other

countries.

Interest credited to policyholder account balances increased by $4 million, or 8%, to $56 million in 2000 from $52 million in 1999 as a result of

growth in policyholder account balances in Argentina and Mexico.

Policyholder dividends increased by $10 million, or 45%, to $32 million in 2000 from $22 million in 1999. This increase is largely attributable to

growth in Mexico’s participating group business and is in line with the increase in premiums discussed above.

Payments of $327 million related to Metropolitan Life’s demutualization were made during the second quarter of 2000 to holders of certain policies

transferred to Clarica Life Insurance Company in connection with the sale of a substantial portion of the Company’s Canadian operations in 1998.

Other expenses increased by $44 million, or 18%, to $292 million in 2000 from $248 million in 1999. This increase is partially attributable to

business expansion initiatives in Brazil and Uruguay and the establishment of operations in Poland, the Philippines, and India in 2000. The remaining

increase in other expenses is commensurate with the overall growth discussed above.

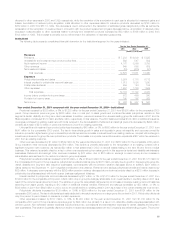

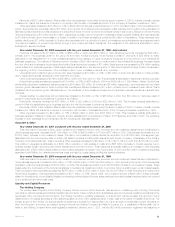

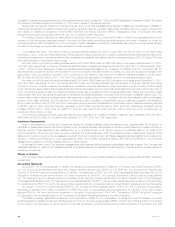

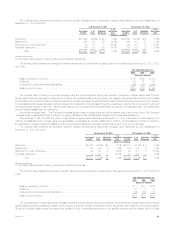

Corporate & Other

Year ended December 31, 2001 compared with the year ended December 31, 2000

Total revenues for Corporate & Other, which consist of net investment income, other revenues, and net investment losses that are not allocated to

other business segments, decreased by $1,364 million, or 372%, to $(997) million in 2001 from $367 million in 2000. This decrease is primarily due to a

$1,263 million increase in net investment losses. This rise in net investment losses reflects the elimination of a $1,526 million inter-segment gain

associated with the inter-company sale of certain real estate properties to Metropolitan Insurance and Annuity Company, a subsidiary of the Holding

Company, from Metropolitan Life. Total Corporate & Other expenses decreased by $6 million, or 1%, to $777 million in 2001 from $783 million in 2000.

This decline in expenses is attributable to a $230 million reduction in demutualization costs and a $58 million decrease in interest expense due to

reduced average levels in borrowing and a lower interest rate environment in 2001. These variances are partially offset by an increase in other expenses

associated with a $250 million charge related to race-conscious litigation recorded in the fourth quarter of 2001 and $29 million of additional expenses

associated with MetLife, Inc. shareholder services costs and start-up costs relating to MetLife’s banking initiatives.

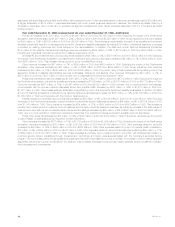

Year ended December 31, 2000 compared with the year ended December 31, 1999

Total revenues for Corporate & Other, which consist of net investment income, other revenues, and net investment losses that are not allocated to

other business segments, increased by $33 million, or 10%, to $367 million in 2000 from $334 million in 1999. Excluding the impact of the GenAmerica

acquisition, total revenues decreased by $100 million, or 30%. This decrease is primarily due to a $163 million increase in net investment losses. These

losses reflect the continuation of the Company’s strategy to reposition its investment portfolio to provide a higher operating return on its invested assets.

Total Corporate & Other expenses decreased by $275 million, or 26%, to $783 million in 2000 from $1,058 million in 1999. Excluding the impact of the

GenAmerica acquisition, total expenses decreased by $371 million, or 35%. During 1999, the Company reported a $499 million charge principally

related to the settlement of a multidistrict litigation proceeding involving alleged improper sales practices, accruals for sales practices claims not covered

by the settlement and other legal costs.

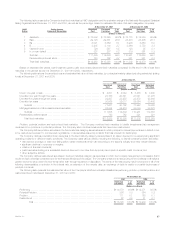

Liquidity and Capital Resources

The Holding Company

The primary uses of liquidity of the Holding Company include: common stock dividends, debt service on outstanding debt, including the interest

payments on debentures issued to MetLife Capital Trust I and senior notes, contributions to subsidiaries, payment of general operating expenses and the

repurchase of the Company’s common stock. The Holding Company irrevocably guarantees, on a senior and unsecured basis, the payment in full of

distributions on the capital securities and the stated liquidation amount of the capital securities, in each case to the extent of available trust funds. The

primary source of the Holding Company’s liquidity is dividends it receives from Metropolitan Life. Other sources of liquidity also include programs for

short- and long-term borrowing, as needed, arranged through the Holding Company and MetLife Funding, Inc., a subsidiary of Metropolitan Life. In

addition, the Holding Company filed a shelf registration statement, effective June 1, 2001, with the SEC which permits the registration and issuance of

MetLife, Inc. 21