MetLife 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

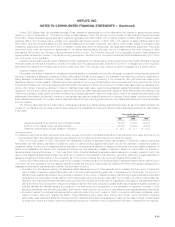

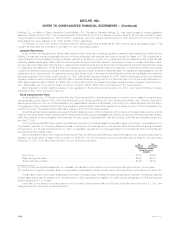

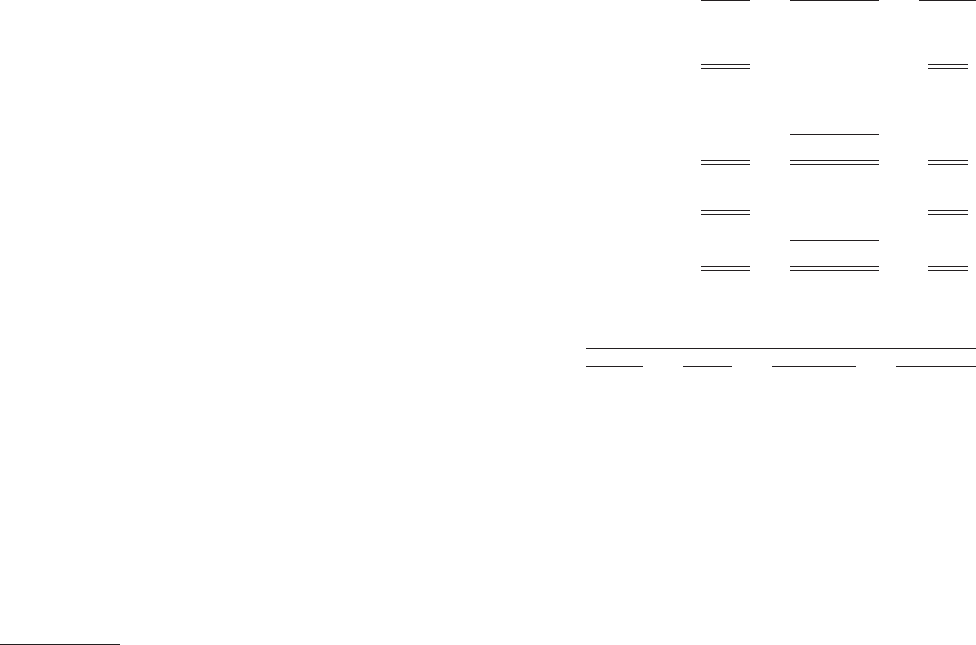

The following presents a reconciliation of the weighted average shares used in calculating basic earnings per share to those used in calculating

diluted earnings per share:

Net Per Share

Income Shares Amount

(Dollars in millions, except per share data)

For the year ended December 31, 2001

Amounts for basic earnings per share ************************************************* $ 473 741,041,654 $0.64

Incremental shares from assumed:

Conversion of forward purchase contracts******************************************** 25,974,114

Exercise of stock options ********************************************************** 1,133

Amounts for diluted earnings per share ************************************************ $ 473 767,016,901 $0.62

For the period April 7, 2000 through December 31, 2000

Amounts for basic earnings per share ************************************************* $1,173 772,027,666 $1.52

Incremental shares from assumed conversion of forward purchase contracts ***************** 16,480,028

Amounts for diluted earnings per share ************************************************ $1,173 788,507,694 $1.49

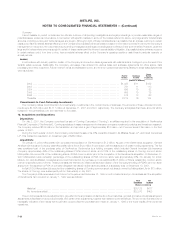

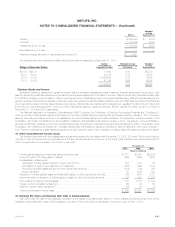

20. Quarterly Results of Operations (unaudited)

The unaudited quarterly results of operations for the years ended December 31, 2001 and 2000 are summarized in the table below:

Three Months Ended

March 31 June 30 September 30 December 31

(Dollars in millions, except per share data)

2001

Total revenues******************************************************* $7,971 $7,811 $7,970 $8,176

Total expenses ****************************************************** 7,544 7,318 7,731 8,596

Net income (loss) **************************************************** 287 320 162 (296)

Basic earnings (loss) per share***************************************** 0.38 0.43 0.22 (0.41)

Diluted earnings (loss) per share**************************************** 0.37 0.41 0.21 (0.41)

2000

Total revenues******************************************************* $7,607 $8,009 $7,672 $8,456

Total expenses ****************************************************** 7,187 7,992 7,360 7,789

Net income (loss) **************************************************** 236 (115)* 241 591

Basic earnings per share********************************************** N/A 0.44 0.31 0.77

Diluted earnings per share********************************************* N/A 0.44 0.31 0.74

N/A — not applicable

* Net income after date of demutualization is $341 million.

Due to changes in the number of average shares outstanding, quarterly earnings per share of common stock do not add to the totals for the years.

Earnings per share data is presented only for periods after the date of demutualization.

The unaudited pre-tax results of operations for the third quarter of 2001 include charges of $325 million related to the September 11, 2001

tragedies. The unaudited pre-tax results of operations for the fourth quarter of 2001 include charges of $250 million related to the anticipated resolution of

proceedings alleging race-conscious underwriting, $499 million related to business realignment initiatives and $118 million related to the establishment of

a policyholder liability for certain group annuity policies. The unaudited pre-tax results of operations for the fourth quarter of 2000 include an investment

gain of $663 million from the sale of the Company’s interest in Nvest, L.P. and Nvest Companies L.P. and a surplus tax credit of $175 million.

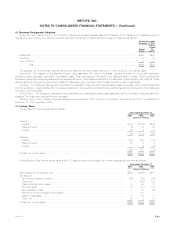

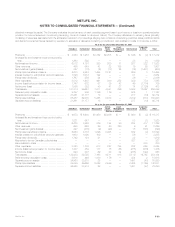

21. Business Segment Information

The Company provides insurance and financial services to customers in the United States, Canada, Central America, South America, Europe, South

Africa, Asia and Australia. The Company’s business is divided into six major segments: Individual, Institutional, Reinsurance, Auto & Home, Asset

Management and International. These segments are managed separately because they either provide different products and services, require different

strategies or have different technology requirements.

Individual offers a wide variety of individual insurance and investment products, including life insurance, annuities and mutual funds. Institutional offers

a broad range of group insurance and retirement and savings products and services, including group life insurance, non-medical health insurance such

as short and long-term disability, long-term care, and dental insurance, and other insurance products and services. Reinsurance provides life reinsurance

and international life and disability on a direct and reinsurance basis. Auto & Home provides insurance coverages, including private passenger

automobile, homeowners and personal excess liability insurance. Asset Management provides a broad variety of asset management products and

services to individuals and institutions. International provides life insurance, accident and health insurance, annuities and retirement and savings products

to both individuals and groups, and auto and homeowners coverage to individuals.

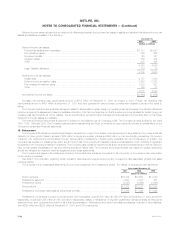

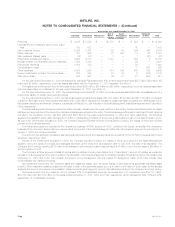

Set forth in the tables below is certain financial information with respect to the Company’s operating segments as of or for the years ended

December 31, 2001, 2000 and 1999. The accounting policies of the segments are the same as those described in the summary of significant

accounting policies, except for the method of capital allocation and the accounting for gains and losses from inter-company sales which are eliminated in

consolidation. The Company allocates capital to each segment based upon an internal capital allocation system that allows the Company to more

MetLife, Inc.

F-38