MetLife 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

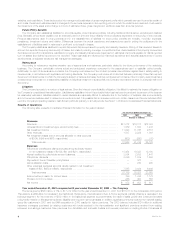

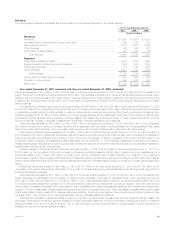

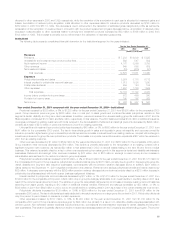

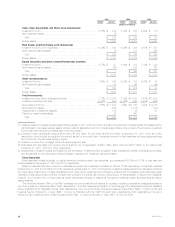

Reinsurance

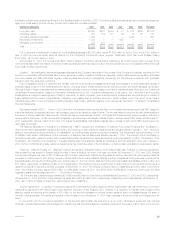

The following table presents consolidated financial information for the Reinsurance segment for the years indicated:

For the Year Ended

December 31,

2001 2000

(Dollars in millions)

Revenues

Premiums *********************************************************************************** $1,762 $1,450

Net investment income ************************************************************************ 390 379

Other revenues ****************************************************************************** 42 29

Net investment losses************************************************************************* (6) (2)

Total revenues *************************************************************************** 2,188 1,856

Expenses

Policyholder benefits and claims **************************************************************** 1,484 1,096

Interest credited to policyholder account balances ************************************************* 122 109

Policyholder dividends************************************************************************* 24 21

Other expenses ****************************************************************************** 439 446

Total expenses*************************************************************************** 2,069 1,672

Income before provision for income taxes ******************************************************** 119 184

Provision for income taxes ********************************************************************* 27 48

Minority interest ****************************************************************************** 52 67

Net income********************************************************************************** $40$69

MetLife beneficially owns approximately 58% of RGA. The Company’s Reinsurance segment is comprised of the life reinsurance business of RGA,

and MetLife’s ancillary life reinsurance business. The ancillary life reinsurance business was an immaterial component of MetLife’s Individual segment for

years prior to January 1, 2000.

Year ended December 31, 2001 compared with the year ended December 31, 2000—Reinsurance

Premiums increased by $312 million, or 22%, to $1,762 million for the year ended December 31, 2001 from $1,450 million for the comparable

2000 period. New premiums from facultative and automatic treaties and renewal premiums on existing blocks of business all contributed to the premium

growth. Premium levels are significantly influenced by large transactions and reporting practices of ceding companies and, as a result, can fluctuate from

period to period.

Other revenues increased by $13 million, or 45%, to $42 million for the year ended December 31, 2001 from $29 million for the comparable 2000

period. The increase is due to an increase in fees earned on financial reinsurance, primarily as a result of the acquisition of RGA Financial Group, LLC

during the second half of 2000.

Policyholder benefits and claims increased by $388 million, or 35%, to $1,484 million for the year ended December 31, 2001 from $1,096 million for

the comparable 2000 period. Claims experience for the year ended December 31, 2001, includes claims arising from the September 11, 2001 tragedies

of approximately $16 million, net of amounts recoverable from reinsurers. As a percentage of premiums, policyholder benefits and claims increased to

84% for the year ended December 31, 2001 from 76% for the comparable 2000 period. This increase is attributed primarily to higher than expected

mortality in the U.S. reinsurance operations during the first and fourth quarters, in addition to the claims arising from the terrorist attacks. Additionally,

increases for benefits and adverse results on the reinsurance of Argentine pension business contributed to the increase. Mortality is expected to vary

from period to period, but generally remains fairly constant over the long-term.

Interest credited to policyholder account balances increased by $13 million, or 12%, to $122 million for the year ended December 31, 2001 from

$109 million for the comparable 2000 period. Interest credited to policyholder account balances relates to amounts credited on deposit-type contracts

and certain cash-value contracts. The increase is primarily related to an increase in the underlying account balances due to a new block of single

premium deferred annuities reinsured in 2001. Additionally, the crediting rate on certain blocks of annuities is based on the performance of the underlying

assets. Therefore, any fluctuations in interest credited related to these blocks are generally offset by a corresponding change in net investment income.

Policyholder dividends were essentially unchanged at $24 million for the year ended December 31, 2001 as compared to $22 million for the year

ended December 31, 2000.

Other expenses decreased by $7 million, or 2%, to $439 million for the year ended December 31, 2001 from $446 million for the comparable 2000

period. Other expenses, which include underwriting, acquisition and insurance expenses, were 20% of segment revenues in 2001 compared with 24%

in 2000. This percentage fluctuates depending on the mix of the underlying insurance products being reinsured.

Minority interest, which represents third-party ownership interests in RGA, decreased by $15 million, or 22%, to $52 million for the year ended

December 31, 2001 from $67 million for the comparable 2000 period due to lower RGA pre-minority interest net income.

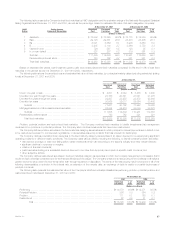

Year ended December 31, 2000—Reinsurance

Revenues were $1,856 million for the year ended December 31, 2000. Reinsurance revenues are primarily derived from renewal premiums from

existing reinsurance treaties, new business premiums from existing or new reinsurance treaties and income earned on invested assets. Premium levels

are significantly influenced by large transactions and reporting practices of ceding companies and, as a result, can fluctuate from period to period.

Expenses were $1,672 million for the year ended December 31, 2000. Policy benefits and claims were 76% of premiums for the year ended

December 31, 2000, which is consistent with management’s expectations. Underwriting, acquisition and insurance expenses, which are included in

other expenses, were 24% of premiums for the year ended December 31, 2000. This percentage fluctuates depending on the mix of the underlying

insurance products being reinsured. Interest credited to policyholder account balances are related to amounts credited on RGA’s deposit-type contracts

and cash value products, which have a significant mortality component. This amount fluctuates with the changes in cash values and changes in interest

crediting rates.

Minority interest, which represents third-party ownership interests in RGA, was $67 million for the year ended December 31, 2000.

MetLife, Inc. 17