MetLife 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The Company uses the same accounting principles to account for the participating policies included in the closed block as it used prior to the date

of demutualization. However, the Company establishes a policyholder dividend obligation for earnings that will be paid to policyholders as additional

dividends as described below. The excess of closed block liabilities over closed block assets at the effective date of the demutualization (adjusted to

eliminate the impact of related amounts in accumulated other comprehensive income) represents the estimated maximum future earnings from the

closed block expected to result from operations attributed to the closed block after income taxes. Earnings of the closed block are recognized in income

over the period the policies and contracts in the closed block remain in-force. Management believes that over time the actual cumulative earnings of the

closed block will approximately equal the expected cumulative earnings due to the effect of dividend changes. If, over the period the closed block

remains in existence, the actual cumulative earnings of the closed block is greater than the expected cumulative earnings of the closed block, the

Company will pay the excess of the actual cumulative earnings of the closed block over the expected cumulative earnings to closed block policyholders

as additional policyholder dividends unless offset by future unfavorable experience of the closed block and, accordingly, will recognize only the expected

cumulative earnings in income with the excess recorded as a policyholder dividend obligation. If over such period, the actual cumulative earnings of the

closed block is less than the expected cumulative earnings of the closed block, the Company will recognize only the actual earnings in income. However,

the Company may change policyholder dividend scales in the future, which would be intended to increase future actual earnings until the actual

cumulative earnings equal the expected cumulative earnings. Amounts reported for the period after demutualization are as of April 1, 2000 and for the

period beginning on April 1, 2000 (the effect of transaction from April 1, 2000 through April 6, 2000 are not considered material).

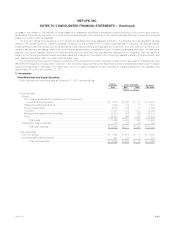

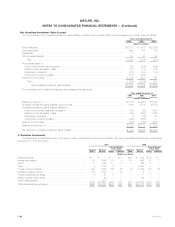

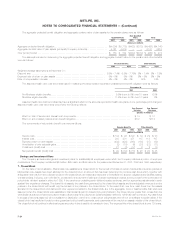

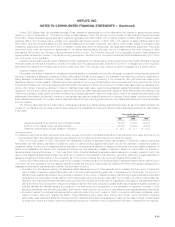

Closed block liabilities and assets designated to the closed block are as follows:

December 31,

2001 2000

(Dollars in millions)

CLOSED BLOCK LIABILITIES

Future policy benefits *********************************************************************** $40,325 $39,415

Other policyholder funds ******************************************************************** 321 278

Policyholder dividends payable *************************************************************** 757 740

Policyholder dividend obligation *************************************************************** 708 385

Payables under securities loaned transactions ************************************************** 3,350 3,268

Other ************************************************************************************ 90 78

Total closed block liabilities ********************************************************** 45,551 44,164

ASSETS DESIGNATED TO THE CLOSED BLOCK

Investments:

Fixed maturities available-for-sale, at fair value (amortized cost: $25,761

and $25,657, respectively) ************************************************************** 26,331 25,634

Equity securities, at fair value (amortized cost: $240 and $52, respectively) ************************ 282 54

Mortgage loans on real estate ************************************************************** 6,358 5,801

Policy loans ***************************************************************************** 3,898 3,826

Short-term investments******************************************************************** 170 223

Other invested assets (amortized cost: $137 and $250, respectively) ***************************** 159 248

Total investments******************************************************************* 37,198 35,786

Cash and cash equivalents ****************************************************************** 1,119 661

Accrued investment income****************************************************************** 550 557

Deferred income tax receivable *************************************************************** 1,060 1,234

Premiums and other receivables ************************************************************** 244 158

Total assets designated to the closed block ******************************************** 40,171 38,396

Excess of closed block liabilities over assets designated to the closed block************************* 5,380 5,768

Amounts included in accumulated other comprehensive income:

Net unrealized investment gains (losses), net of deferred income tax expense

(benefit) of $219 and $(9), respectively **************************************************** 389 (14)

Unrealized derivative gains, net of deferred income tax expense of $9 **************************** 17 —

Allocated to policyholder dividend obligation, net of deferred income tax benefit

of $255 and $143, respectively ********************************************************** (453) (242)

(47) (256)

Maximum future earnings to be recognized from closed block assets and liabilities******************** $ 5,333 $ 5,512

MetLife, Inc. F-25