MetLife 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

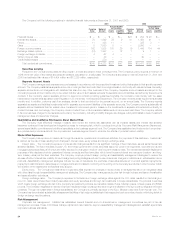

commodities. Financial risks include the overall level of debt on the property and the amount of principal repaid during the loan term. Capital market risks

include the general level of interest rates, the liquidity for these securities in the marketplace and the capital available for loan refinancing.

Real Estate and Real Estate Joint Ventures

The Company’s real estate and real estate joint venture investments consist of commercial and agricultural properties located throughout the U.S.

and Canada. The Company manages these investments through a network of regional offices overseen by its investment department. At December 31,

2001 and 2000, the carrying value of the Company’s real estate and real estate joint ventures was $5,730 and $5,504 million, respectively, or 3.4% of

total cash and invested assets in both years. The carrying value of equity real estate was stated at depreciated cost net of impairments and valuation

allowances. The carrying value of real estate joint ventures was stated at the Company’s equity in the real estate joint ventures net of impairments and

valuation allowances. These holdings consist of real estate, interests in real estate joint ventures and real estate acquired upon foreclosure of commercial

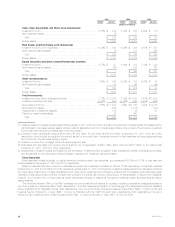

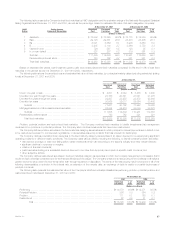

and agricultural mortgage loans. The following table presents the carrying value of the Company’s real estate and real estate joint ventures at

December 31, 2001 and 2000:

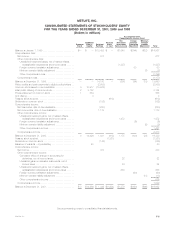

At December 31,

2001 2000

Carrying % of Carrying % of

Type Value Total Value Total

(Dollars in millions)

Real estate ************************************************************************ $5,325 92.9% $5,069 92.1%

Real estate joint ventures ************************************************************ 356 6.2 369 6.7

Subtotal ****************************************************************** 5,681 99.1 5,438 98.8

Foreclosed real estate*************************************************************** 49 0.9 66 1.2

Total ********************************************************************* $5,730 100.0% $5,504 100.0%

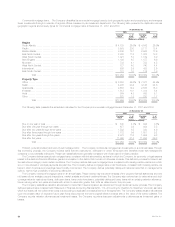

Office properties representing 63.5% and 66.1% of the Company’s real estate and real estate joint venture holdings at December 31, 2001 and

2000, respectively, are well diversified geographically, principally within the United States. The average occupancy level of office properties was 92% and

94% at December 31, 2001 and 2000, respectively.

The Company classifies real estate and real estate joint ventures as held-for-investment or held-for-sale. The carrying value of real estate and real

estate joint ventures held-for-investment was $5,633 million and $5,223 million at December 31, 2001 and 2000, respectively. The carrying value of real

estate and real estate joint ventures held-for-sale was $97 million and $281 million at December 31, 2001 and 2000, respectively.

Ongoing management of these investments includes quarterly valuations, as well as an annual market update and review of each property’s budget,

financial returns, lease rollover status and the Company’s exit strategy. In addition to individual property reviews, the Company employs an overall strategy

of selective dispositions and acquisitions as market opportunities arise.

The Company adjusts the carrying value of real estate and real estate joint ventures held-for-investment for impairments whenever events or

changes in circumstances indicate that the carrying value of the property may not be recoverable. The Company writes down impaired real estate to

estimated fair value, which it generally computes using the present value of future cash flows from the property, discounted at a rate commensurate with

the underlying risks. The Company records write-downs as investment losses and reduces the cost basis of the properties accordingly. The Company

does not change the revised cost basis for subsequent recoveries in value.

The Company records real estate acquired upon foreclosure of commercial and agricultural mortgage loans at the lower of estimated fair value or the

carrying value of the mortgage loan at the date of foreclosure.

Once the Company identifies a property to be sold and commences a firm plan for marketing the property, the Company establishes and

periodically revises, if necessary, a valuation allowance to adjust the carrying value of the property to its expected sales value, less associated selling

costs, if it is lower than the property’s carrying value. The Company records allowances as investment losses. The Company records subsequent

adjustments to allowances as investment gains or losses.

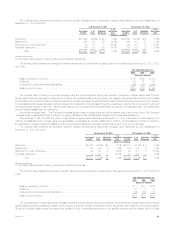

The Company’s carrying value of real estate and real estate joint ventures held-for-sale, including real estate acquired upon foreclosure of

commercial and agricultural mortgage loans, in the amounts of $97 million and $281 million at December 31, 2001 and 2000, respectively, are net of

impairments of $88 million and $97 million and net of valuation allowances of $35 million and $39 million, respectively.

Equity Securities and Other Limited Partnership Interests

The Company’s carrying value of equity securities, which primarily consists of investments in common stocks, was $3,063 million and $2,193 million

at December 31, 2001 and 2000, respectively. Substantially all of the common stock is publicly traded on major securities exchanges. The carrying value

of the other limited partnership interests (which primarily represent ownership interests in pooled investment funds that make private equity investments in

companies in the U.S. and overseas) was $1,637 million and $1,652 million at December 31, 2001 and 2000, respectively. The Company classifies its

investments in common stocks as available-for-sale and marks them to market except for non-marketable private equities which are generally carried at

cost. The Company accounts for its investments in limited partnership interests in which it does not have a controlling interest in accordance with the

equity method of accounting. The Company’s investments in equity securities represented 1.8% and 1.4% of cash and invested assets at December 31,

2001 and 2000, respectively.

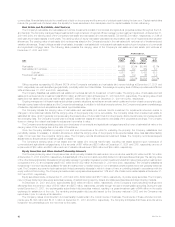

Equity securities include, at December 31, 2001 and 2000, $329 million and $577 million, respectively, of private equity securities. The Company

may not freely trade its private equity securities because of restrictions imposed by federal and state securities laws and illiquid trading markets.

At December 31, 2001 and 2000, approximately $238 million and $313 million, respectively, of the Company’s equity securities holdings were

effectively fixed at a minimum value of $195 million and $257 million, respectively, primarily through the use of exchangeable securities. During the year

ended December 31, 2001, two exchangeable subordinated debt securities matured, resulting in a gross investment gain of $44 million on the equity

exchanged in satisfaction of the note. The remaining exchangeable debt security issued by the Company matures in 2002 and the Company may

repurchase it prior to maturity at its discretion.

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded commit-

ments were $1,898 million and $1,311 million at December 31, 2001 and 2000, respectively. The Company anticipates that these amounts will be

invested in the partnerships over the next three to five years.

MetLife, Inc.

32