MetLife 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

additional guidance relating to the accounting for derivatives under SFAS 133, which may result in further adjustments to the Company’s treatment of

derivatives in subsequent accounting periods.

Effective April 1, 2001, the Company adopted certain additional accounting and reporting requirements of SFAS No. 140, Accounting for Transfers

and Servicing of Financial Assets and Extinguishments of Liabilities — a replacement of FASB Statement No. 125, relating to the derecognition of

transferred assets and extinguished liabilities and the reporting of servicing assets and liabilities. The adoption of these requirements had no material

impact on the Company’s consolidated financial statements.

Effective April 1, 2001, the Company adopted EITF 99-20. This pronouncement requires investors in certain asset-backed securities to record

changes in their estimated yield on a prospective basis and to apply specific evaluation methods to these securities for an other-than-temporary decline

in value. The adoption of EITF 99-20 had no material impact on the Company’s consolidated financial statements.

In June 2001, the FASB issued SFAS No. 141, Business Combinations (‘‘SFAS 141’’), and SFAS 142, Goodwill and Other Intangible Assets

(‘‘SFAS 142’’). SFAS 141, which was generally effective July 1, 2001, requires the purchase method of accounting for all business combinations and

separate recognition of intangible assets apart from goodwill if such intangible assets meet certain criteria. SFAS 142, effective for fiscal years beginning

after December 15, 2001, eliminates the systematic amortization and establishes criteria for measuring the impairment of goodwill and certain other

intangible assets by reporting unit. Amortization of goodwill and other intangible assets was $48 million, $101 million and $65 million for the years ended

December 31, 2001, 2000 and 1999, respectively. These amounts are not necessarily indicative of the amortization that will not be recorded in future

periods in accordance with SFAS 142. The Company is in the process of developing an estimate of the impact of the adoption of SFAS 142, if any, on its

consolidated financial statements. The Company has tentatively determined that there will be no significant reclassifications between goodwill and other

intangible asset balances, and no significant impairment of other intangible assets as of January 1, 2002. The Company will complete the first step of the

impairment test, the comparison of the reporting units’ fair value to carrying value, by June 30, 2002 and, if necessary, will complete the second step, the

estimate of goodwill impairment, by December 31, 2002.

In July 2001, the SEC released Staff Accounting Bulletin (‘‘SAB’’) No. 102, Selected Loan Loss Allowance and Documentation Issues (‘‘SAB 102’’).

SAB 102 summarizes certain of the SEC’s views on the development, documentation and application of a systematic methodology for determining

allowances for loan and lease losses. The application of SAB 102 by the Company did not have a material impact on the Company’s consolidated

financial statements.

In October 2001, the FASB issued SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (‘‘SFAS 144’’). SFAS 144

provides a single model for accounting for long-lived assets to be disposed of by superceding SFAS No. 121, Accounting for the Impairment of Long-

Lived Assets and for Long-Lived Assets to be Disposed Of (‘‘SFAS 121’’), and the accounting and reporting provisions of Accounting Principles Board

Opinion No. 30, Reporting the Results of Operations — Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual and

Infrequently Occurring Events and Transactions (‘‘APB 30’’). Under SFAS 144, discontinued operations are measured at the lower of carrying value or fair

value less costs to sell, rather than on a net realizable value basis. Future operating losses relating to discontinued operations also are no longer

recognized before they occur. SFAS 144 broadens the definition of a discontinued operation to include a component of an entity (rather than a segment

of a business). SFAS 144 also requires long-lived assets to be disposed of other than by sale to be considered held and used until disposed. SFAS 144

retains the basic provisions of (i) APB 30 regarding the presentation of discontinued operations in the statements of income, (ii) SFAS 121 relating to

recognition and measurement of impaired long-lived assets (other than goodwill) and (iii) SFAS 121 relating to the measurement of long-lived assets

classified as held for sale. SFAS 144 must be adopted beginning January 1, 2002. The adoption of SFAS 144 by the Company is not expected to have a

material impact on the Company’s consolidated financial statements at the date of adoption.

Effective October 1, 2000, the Company adopted SAB No. 101, Revenue Recognition in Financial Statements (‘‘SAB 101’’). SAB 101 summarizes

certain of the Securities and Exchange Commission’s views in applying GAAP to revenue recognition in financial statements. The requirements of

SAB 101 did not have a material effect on the Company’s consolidated financial statements.

Effective January 1, 2000, the Company adopted Statement of Position (‘‘SOP’’) No. 98-7, Accounting for Insurance and Reinsurance Contracts

That Do Not Transfer Insurance Risk (‘‘SOP 98-7’’). SOP 98-7 provides guidance on the method of accounting for insurance and reinsurance contracts

that do not transfer insurance risk, defined in the SOP as the deposit method. SOP 98-7 classifies insurance and reinsurance contracts for which the

deposit method is appropriate into those that (i) transfer only significant timing risk, (ii) transfer only significant underwriting risk, (iii) transfer neither

significant timing nor underwriting risk and (iv) have an indeterminate risk. Adoption of SOP 98-7 did not have a material effect on the Company’s

consolidated financial statements.

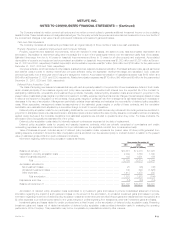

The FASB is currently deliberating the issuance of an interpretation of SFAS No. 94, Consolidation of All Majority-Owned Subsidiaries, to provide

additional guidance to assist companies in identifying and accounting for special purpose entities, including when SPEs should be consolidated by the

investor. The interpretation would introduce a concept that consolidation would be required by the primary beneficiary of the activities of a special

purpose entity unless the SPE can meet certain substantive independent economic substance criteria. It is not possible to determine at this time what

conclusions will be included in the final interpretation; however, the result could impact the accounting treatment of these entities.

The FASB is currently deliberating the issuance of a proposed statement that would amend SFAS No. 133. The proposed statement will address

and resolve certain pending Derivatives Implementation Group (‘‘DIG’’) issues. The outcome of the pending DIG issues and other provisions of the

statement could impact the Company’s accounting for beneficial interests, loan commitments and other transactions deemed to be derivatives under the

new statement. The Company’s accounting for such transactions is currently based on management’s best interpretation of the accounting literature as

of March 18, 2002.

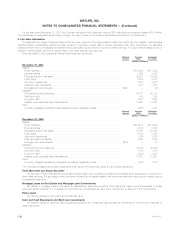

2. September 11, 2001 Tragedies

On September 11, 2001 a terrorist attack occurred in New York, Washington D.C. and Pennsylvania (collectively, the ‘‘tragedies’’) triggering a

significant loss of life and property which had an adverse impact on certain of the Company’s businesses. The Company has direct exposures to this

event with claims arising from its Individual, Institutional, Reinsurance and Auto & Home insurance coverages, although it believes the majority of such

claims have been reported or otherwise analyzed by the Company.

As of December 31, 2001, the Company’s estimate of the total insurance losses related to the tragedies is $208 million, net of income tax of $117

million. This estimate is subject to revision in subsequent periods as claims are received from insureds and claims to reinsurers are identified and

MetLife, Inc.

F-14