MetLife 2001 Annual Report Download - page 10

Download and view the complete annual report

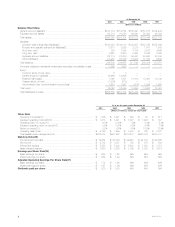

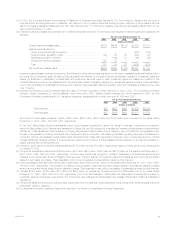

Please find page 10 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On the date of demutualization, the Holding Company conducted an initial public offering of 202,000,000 shares of its Common Stock and

concurrent private placements of an aggregate of 60,000,000 shares of its Common Stock at an offering price of $14.25 per share. The shares of

Common Stock issued in the offerings are in addition to 494,466,664 shares of Common Stock of the Holding Company distributed to the Metropolitan

Life Policyholder Trust for the benefit of policyholders of Metropolitan Life in connection with the demutualization. On April 10, 2000, the Holding Company

issued 30,300,000 additional shares of its Common Stock as a result of the exercise of over-allotment options granted to underwriters in the initial public

offering.

Concurrently with these offerings, MetLife, Inc. and MetLife Capital Trust I, a Delaware statutory business trust wholly-owned by MetLife, Inc., issued

20,125,000 8.00% equity security units for an aggregate offering price of $1,006 million. Each unit consists of (i) a contract to purchase shares of

Common Stock and (ii) a capital security of MetLife Capital Trust I.

On the date of demutualization, Metropolitan Life established a closed block for the benefit of holders of certain individual life insurance policies of

Metropolitan Life. See Note 7 of Notes to Consolidated Financial Statements.

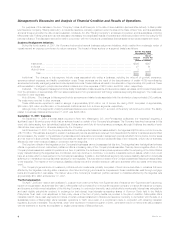

Acquisitions and Dispositions

In November 2001, the Company acquired Compania de Seguros de Vida Santander S.A. and Compania de Reaseguaros de Vida Soince Re S.

A., wholly-owned subsidiaries of Santander Central Hispano in Chile (collectively, the ‘‘Chilean acquisitions’’). These acquisitions mark MetLife’s entrance

into the Chilean insurance market and the newest addition to the Company’s Latin American operations.

In July 2001, the Company completed its sale of Conning Corporation (‘‘Conning’’), an affiliate acquired in the acquisition of GenAmerica.

In May 2001, the Company acquired Seguradora America Do Sul S.A. (‘‘Seasul’’), a life and pension company in Brazil. Seasul is being integrated

into MetLife’s wholly-owned Brazilian subsidiary, Metropolitan Life Seguros e Pr ˆevidencia Privada S.A, or MetLife Brazil.

In February 2001, the Holding Company consummated the purchase of Grand Bank, N.A. (‘‘Grand Bank’’). Grand Bank provides banking services

to individuals and small businesses in the Princeton, New Jersey area. On February 12, 2001, the Federal Reserve Board approved the Holding

Company’s application for bank holding company status and to become a financial holding company upon its acquisition of Grand Bank.

During the second half of 2000, Reinsurance Group of America, Incorporated (‘‘RGA’’) acquired the interest in RGA Financial Group, LLC it did not

already own.

In October 2000, the Company completed the sale of its 48% ownership interest in its affiliates, Nvest, L.P. and Nvest Companies L.P.

In July 2000, the Company acquired the workplace benefits division of Business Men’s Assurance Company (‘‘BMA’’), a Kansas City, Missouri-

based insurer.

In April 2000, Metropolitan Life acquired the outstanding shares of Conning common stock not already owned by Metropolitan Life.

In January 2000, Metropolitan Life completed its acquisition of GenAmerica for $1.2 billion. As part of the GenAmerica acquisition, General American

Life Insurance Company paid Metropolitan Life a fee of $120 million in connection with the assumption of certain funding agreements. The fee was

considered part of the purchase price of GenAmerica. GenAmerica is a holding company which included General American Life Insurance Company,

49% of the outstanding shares of RGA common stock, and 61% of the outstanding shares of Conning common stock, which was subsequently sold in

2001. Metropolitan Life owned 9% of the outstanding shares of RGA common stock prior to the completion of the GenAmerica acquisition. At

December 31, 2001 Metropolitan Life’s ownership percentage of the outstanding shares of RGA common stock was approximately 58%. On

January 30, 2002, MetLife, Inc. and its affiliated companies announced their intention to purchase up to $125 million of RGA’s outstanding common

stock over an unspecified period of time. These purchases are intended to offset potential future dilution of the Company’s holding of RGA’s common

stock arising from the issuance by RGA of company-obligated mandatorily redeemable securities of subsidiary trusts on December 10, 2001.

In November 1999, the Company acquired the individual disability income business of Lincoln National Life Insurance Company.

In September 1999, the Auto & Home segment acquired the standard personal lines property and casualty insurance operations of The St. Paul

Companies.

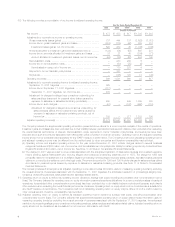

Summary of Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (‘‘GAAP’’) requires

management to adopt accounting policies and make estimates and assumptions that affect amounts reported in the consolidated financial statements.

The critical accounting policies and related judgments underlying the Company’s consolidated financial statements are summarized below. In applying

these policies, management makes subjective and complex judgments that frequently require estimates about matters that are inherently uncertain. Many

of these policies are common in the insurance and financial services industries; others are specific to the Company’s businesses and operations. The

Company’s general policies are described in detail in Note 1 of Notes to Consolidated Financial Statements.

Investments

The Company’s principal investments are in fixed maturities, mortgage loans and real estate, all of which are exposed to three primary sources of

investment risk: credit, interest rate and market valuation. The financial statement risks are those associated with the recognition of income, impairments

and the determination of fair values. In addition, the earnings on certain investments are dependent upon market conditions which could result in

prepayments and changes in amounts to be earned due to changing interest rates or equity markets.

Derivatives

The Company enters into freestanding derivative transactions to manage the risk associated with variability in cash flows related to the Company’s

financial assets and liabilities or to changing fair values. The Company also purchases investment securities and issues certain insurance policies with

embedded derivatives. The associated financial statement risk is the volatility in net income, which can result from (i) changes in fair value of derivatives

that are not designated as hedges, and (ii) ineffectiveness of designated hedges in an environment of changing interest rates or fair values. In addition,

accounting for derivatives is complex, as evidenced by significant interpretations of the primary accounting standards which continue to evolve, as well as

the significant judgments and estimates involved in determining fair value in the absence of quoted market values. These estimates are based on

valuation methodologies and assumptions deemed appropriate in the circumstances; however, the use of different assumptions may have a material

effect on the estimated fair value amounts.

Deferred Policy Acquisition Costs

The Company incurs significant costs in connection with acquiring new insurance business. These costs, which vary with and are primarily related to

the production of new business, are deferred. The recovery of such costs is dependent on the future profitability of the related business. The amount of

future profit is dependent principally on investment returns, mortality, morbidity, persistency, expenses to administer the business and certain economic

MetLife, Inc. 7