MetLife 2001 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Summary

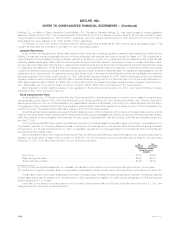

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses, except as noted above in connection with specific matters. In some of the matters referred to above, very large and/or indeterminate

amounts, including punitive and treble damages, are sought. Although in light of these considerations it is possible that an adverse outcome in certain

cases could have a material adverse effect upon the Company’s consolidated financial position, based on information currently known by the Company’s

management, in its opinion, the outcomes of such pending investigations and legal proceedings are not likely to have such an effect. However, given the

large and/or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that an adverse outcome

in certain matters could, from time to time, have a material adverse effect on the Company’s operating results or cash flows in particular quarterly or

annual periods.

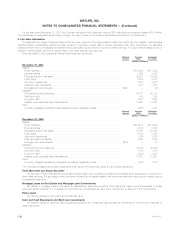

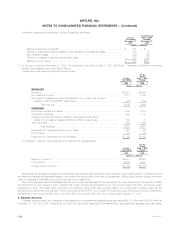

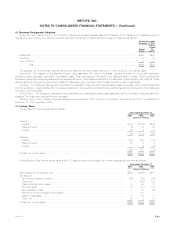

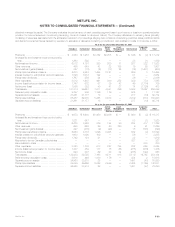

Leases

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants is contingent upon the level of the

tenants’ sales revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for office space, data

processing and other equipment. Future minimum rental and sublease income, and minimum gross rental payments relating to these lease agreements

were as follows:

Gross

Rental Sublease Rental

Income Income Payments

(Dollars in millions)

2002 *************************************************************************** $1,023 $11 $132

2003 *************************************************************************** 761 11 113

2004 *************************************************************************** 699 10 92

2005 *************************************************************************** 609 10 76

2006 *************************************************************************** 512 10 60

Thereafter *********************************************************************** 2,219 16 134

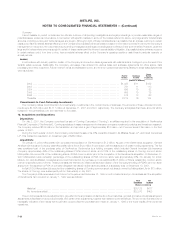

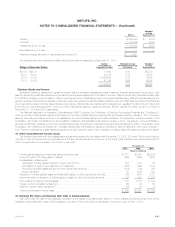

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded commit-

ments were $1,898 million and $1,311 million at December 31, 2001 and 2000, respectively. The Company anticipates that these amounts will be

invested in the partnerships over the next three to five years.

12. Acquisitions and Dispositions

Dispositions

On July 2, 2001, the Company completed its sale of Conning Corporation (‘‘Conning’’), an affiliate acquired in the acquisition of GenAmerica

Financial Corporation (‘‘GenAmerica’’). Conning specializes in asset management for insurance company investment portfolios and investment research.

The Company received $108 million in the transaction and reported a gain of approximately $16 million, net of income taxes of $9 million, in the third

quarter of 2001.

During the fourth quarter of 2000, the Company completed the sale of its 48% ownership interest in its affiliates, Nvest, L.P. and Nvest Companies

L.P. This transaction resulted in an investment gain of $663 million.

Acquisitions

On January 6, 2000, Metropolitan Life completed its acquisition of GenAmerica for $1.2 billion. As part of the GenAmerica acquisition, General

American Life Insurance Company paid Metropolitan Life a fee of $120 million in connection with the assumption of certain funding agreements. The fee

was considered part of the purchase price of GenAmerica. GenAmerica is a holding company which included General American Life Insurance

Company, approximately 49% of the outstanding shares of RGA common stock, and 61.0% of the outstanding shares of Conning common stock.

Metropolitan Life owned 9% of the outstanding shares of RGA common stock prior to the completion of the GenAmerica acquisition. At December 31,

2001 Metropolitan Life’s ownership percentage of the outstanding shares of RGA common stock was approximately 58%. On January 30, 2002,

MetLife, Inc. and its affiliated companies announced their intention to purchase up to an additional $125 million of RGA’s outstanding common stock,

over an unspecified period of time. These purchases are intended to offset potential future dilution of the Company’s holding of RGA’s common stock

arising from the issuance by RGA of company-obligated mandatorily redeemable securities of a subsidiary trust on December 10, 2001.

In April 2000, Metropolitan Life acquired the outstanding shares of Conning common stock not already owned by Metropolitan Life for $73 million.

The shares of Conning were subsequently sold in their entirety in July 2001.

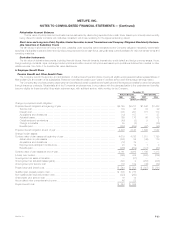

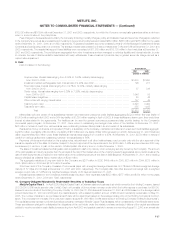

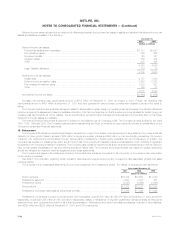

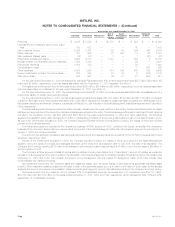

The Company’s total revenues and net income for the year ended December 31, 1999 on both a historical and pro forma basis as if the acquisition

of GenAmerica had occurred on January 1, 1999 were as follows:

Total Net

Revenues Income

(Dollars in millions)

Historical *********************************************************************************** $25,128 $617

Pro forma (unaudited) ************************************************************************* $28,973 $403

The pro forma results include adjustments to give effect to the amortization of discounts on fixed maturities, goodwill and value of business acquired,

adjustments to liabilities for future policy benefits, and certain other adjustments, together with related income tax effects. The pro forma information is not

necessarily indicative of the results that would have occurred had the purchase been made on January 1, 1999 or the future results of the combined

operations.

MetLife, Inc.

F-32