MetLife 2001 Annual Report Download - page 25

Download and view the complete annual report

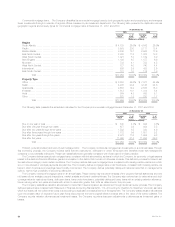

Please find page 25 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.debt and equity securities as described more fully therein. The Company issued debt in the amount of $1.25 billion in November 2001 under this

registration statement. See ‘‘— The Company — Financing’’ below.

Under the New York Insurance Law, Metropolitan Life is permitted without prior insurance regulatory clearance to pay a stockholder dividend to the

Holding Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the lesser of (i) 10% of its surplus to

policyholders as of the immediately preceding calendar year, and (ii) its statutory net gain from operations for the immediately preceding calendar year

(excluding realized capital gains). Metropolitan Life will be permitted to pay a stockholder dividend to the Holding Company in excess of the lesser of such

two amounts only if it files notice of its intention to declare such a dividend and the amount thereof with the Superintendent and the Superintendent does

not disapprove the distribution. Under the New York Insurance Law, the Superintendent has broad discretion in determining whether the financial

condition of a stock life insurance company would support the payment of such dividends to its stockholders. The New York Insurance Department (the

‘‘Department’’) has established informal guidelines for such determinations. The guidelines, among other things, focus on the insurer’s overall financial

condition and profitability under statutory accounting practices. Management of the Company cannot provide assurance that Metropolitan Life will have

statutory earnings to support payment of dividends to the Holding Company in an amount sufficient to fund its cash requirements and pay cash dividends

or that the Superintendent will not disapprove any dividends that Metropolitan Life must submit for the Superintendent’s consideration. MetLife’s other

insurance subsidiaries are also subject to restrictions on the payment of dividends to their respective parent companies.

The dividend limitation is based on statutory financial results. Statutory accounting practices, as prescribed by the Department, differ in certain

respects from accounting principles used in financial statements prepared in conformity with GAAP. The significant differences relate to deferred policy

acquisition costs, deferred income taxes, required investment reserves, reserve calculation assumptions, goodwill and surplus notes.

Based on the historic cash flows and the current financial results of Metropolitan Life, subject to any dividend limitations which may be imposed upon

Metropolitan Life or its subsidiaries by regulatory authorities, management believes that cash flows from operating activities, together with the dividends

Metropolitan Life is permitted to pay without prior insurance regulatory clearance, will be sufficient to enable the Holding Company to make payments on

the debentures issued to MetLife Capital Trust I and the senior notes, make dividend payments on its Common Stock, pay all operating expenses and

meet its other obligations.

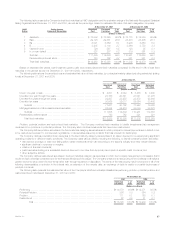

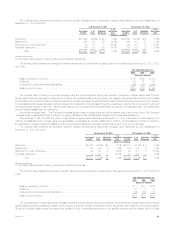

On March 28, 2001, the Holding Company’s Board of Directors authorized a $1 billion common stock repurchase program. This program began

after the completion of an earlier $1 billion repurchase program that was announced on June 27, 2000. Under these authorizations, the Holding

Company may purchase its common stock from the MetLife Policyholder Trust, in the open market and in privately negotiated transactions. Under these

programs, as of December 31, 2001, MetLife has repurchased 60,065,224 shares of common stock for $1,723 million. At December 31, 2001,

$277 million of the March 28, 2001 authorization remained available for common stock repurchases. On February 19, 2002, the Holding Company’s

Board of Directors authorized an additional $1 billion common stock repurchase program. This program will begin after the completion of the March 28,

2001 repurchase program.

On August 7, 2001, the Company purchased 10 million shares of its common stock as part of the sale of 25 million shares of MetLife common

stock by Santusa Holdings, S.L., an affiliate of Banco Santander. The sale by Santusa Holdings, S.L. was made pursuant to a shelf registration

statement, effective June 29, 2001.

Restrictions and Limitations on Bank Holding Companies and Financial Holding Companies — Capital. MetLife, Inc. and its insured depository

institution subsidiaries are subject to risk-based and leverage capital guidelines issued by the federal banking regulatory agencies for banks and financial

holding companies. The federal banking regulatory agencies are required by law to take specific prompt corrective actions with respect to institutions that

do not meet minimum capital standards. At December 31, 2001 MetLife, Inc. and its insured depository institution subsidiaries were in compliance with

the aforementioned guidelines.

Restrictions and Limitations on Bank Holding Companies and Financial Holding Companies — Change of Control. As a ‘‘financial holding

company’’ and ‘‘bank holding company’’ under the federal banking laws, the Company is required to obtain the prior approval of the Board of Governors

of the Federal Reserve System for the changes of control. A change of control is conclusively presumed upon acquisitions of 25% or more of any class of

voting securities and rebuttably presumed upon acquisitions of 10% or more of any class voting securities. Further, as a result of MetLife, Inc.’s

ownership of MetLife Bank, N.A., a national bank, the Office of the Comptroller of the Currency’s approval would be required in connection with a change

of control (generally presumed upon the acquisition of 10% or more of any class of voting securities) of MetLife, Inc.

The Company

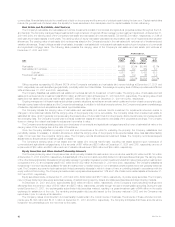

Liquidity sources. The Company’s principal cash inflows from its insurance activities come from life insurance premiums, annuity considerations

and deposit funds. A primary liquidity concern with respect to these cash inflows is the risk of early contractholder and policyholder withdrawal. The

Company seeks to include provisions limiting withdrawal rights on many of its products, including general account institutional pension products

(generally group annuities, including guaranteed interest contracts and certain deposit fund liabilities) sold to employee benefit plan sponsors.

The Company’s principal cash inflows from its investment activities result from repayments of principal, proceeds from maturities and sales of

invested assets and investment income. The primary liquidity concerns with respect to these cash inflows are the risk of default by debtors, and interest

rate and other market volatilities. The Company closely monitors and manages these risks.

Additional sources of liquidity to meet unexpected cash outflows are available from the Company’s portfolio of liquid assets. These liquid assets

include substantial holdings of U.S. Treasury securities, short-term investments, marketable fixed maturity securities and common stocks. The Com-

pany’s available portfolio of liquid assets was approximately $108 billion and $101 billion at December 31, 2001 and 2000, respectively.

Sources of liquidity also include facilities for short- and long-term borrowing as needed, arranged through the Holding Company and MetLife

Funding, Inc., a subsidiary of Metropolitan Life. See ‘‘— Financing’’ below.

Liquidity uses. The Company’s principal cash outflows primarily relate to the liabilities associated with its various life insurance, annuity and group

pension products, operating expenses and income taxes, as well as principal and interest on its outstanding debt obligations. Liabilities arising from its

insurance activities primarily relate to benefit payments under the above-named products, as well as payments for policy surrenders, withdrawals and

loans.

The Company’s management believes that its sources of liquidity are more than adequate to meet its current cash requirements, particularly

considering the level of liquid assets referred to in the section above. The nature of the Company’s diverse product portfolio and customer base lessen

MetLife, Inc.

22