MetLife 2001 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

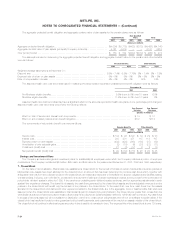

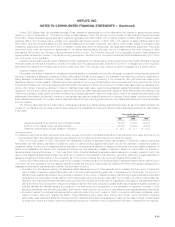

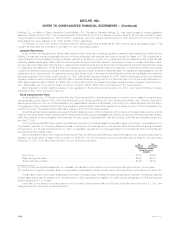

Deferred income taxes represent the tax effect of the differences between the book and tax bases of assets and liabilities. Net deferred income tax

assets and liabilities consisted of the following:

December 31,

2001 2000

(Dollars in millions)

Deferred income tax assets:

Policyholder liabilities and receivables***************************************************************** $ 3,727 $3,057

Net operating losses ****************************************************************************** 336 262

Employee benefits ******************************************************************************** 123 167

Litigation related ********************************************************************************** 279 232

Other ******************************************************************************************* 438 348

4,903 4,066

Less: Valuation allowance ************************************************************************** 114 78

4,789 3,988

Deferred income tax liabilities:

Investments ************************************************************************************** 2,157 1,330

Deferred policy acquisition costs ******************************************************************** 2,950 2,752

Net unrealized investment gains ********************************************************************* 1,079 621

Other ******************************************************************************************* 129 37

6,315 4,740

Net deferred income tax liability *********************************************************************** $(1,526) $ (752)

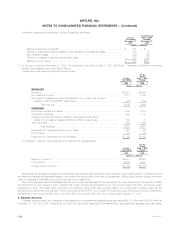

Domestic net operating loss carryforwards amount to $533 million at December 31, 2001 and expire in 2021. Foreign net operating loss

carryforwards amount to $401 million at December 31, 2001 and were generated in various foreign countries with expiration periods of five years to

infinity.

The Company has recorded a valuation allowance related to tax benefits of certain foreign net operating loss carryforwards. The valuation allowance

reflects management’s assessment, based on available information, that it is more likely than not that the deferred income tax asset for certain foreign net

operating loss carryforwards will not be realized. The tax benefit will be recognized when management believes that it is more likely than not that these

deferred income tax assets are realizable.

The Internal Revenue Service has audited the Company for the years through and including 1996. The Company is being audited for the years

1997, 1998, 1999 and 2000. The Company believes that any adjustments that might be required for open years will not have a material effect on the

Company’s consolidated financial statements.

15. Reinsurance

The Company’s life insurance operations participate in reinsurance in order to limit losses, minimize exposure to large risks, and to provide additional

capacity for future growth. Risks in excess of $25 million on single survivorship policies and $30 million on joint survivorship policies are 100 percent

coinsured. Life reinsurance is accomplished through various plans of reinsurance, primarily yearly renewable term and coinsurance. In addition, the

Company has exposure to catastrophes, which are an inherent risk of the property and casualty insurance business and could contribute to significant

fluctuations in the Company’s results of operations. The Company uses excess of loss and quota share reinsurance arrangements to limit its maximum

loss, provide greater diversification of risk and minimize exposure to larger risks. The Company is contingently liable with respect to ceded reinsurance

should any reinsurer be unable to meet its obligations under these agreements.

The Company is engaged in life reinsurance whereby it indemnifies other insurance companies for all or a portion of the insurance risk underwritten

by the ceding companies.

See Note 11 for information regarding certain excess of loss reinsurance agreements providing coverage for risks associated primarily with sales

practices claims.

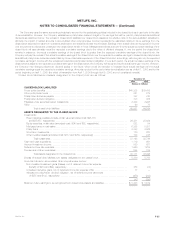

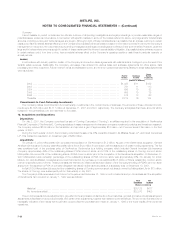

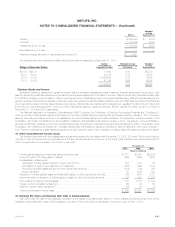

The amounts in the consolidated statements of income are presented net of reinsurance ceded. The effects of reinsurance were as follows:

Years ended December 31,

2001 2000 1999

(Dollars in millions)

Direct premiums ********************************************************************** $16,332 $15,661 $13,249

Reinsurance assumed ***************************************************************** 2,907 2,918 484

Reinsurance ceded ******************************************************************* (2,027) (2,262) (1,645)

Net premiums ************************************************************************ $17,212 $16,317 $12,088

Reinsurance recoveries netted against policyholder benefits ********************************** $ 2,002 $ 1,942 $ 1,626

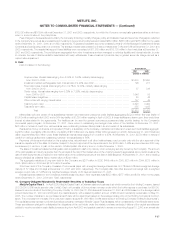

Reinsurance recoverables, included in premiums and other receivables, were $3,358 million and $3,410 million at December 31, 2001 and 2000,

respectively, including $1,356 million and $1,359 million, respectively, relating to reinsurance of long-term guaranteed interest contracts and structured

settlement lump sum contracts accounted for as a financing transaction. Reinsurance and ceded commissions payables, included in other liabilities,

were $295 million and $225 million at December 31, 2001 and 2000, respectively.

MetLife, Inc.

F-34