MetLife 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

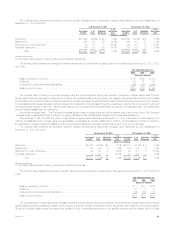

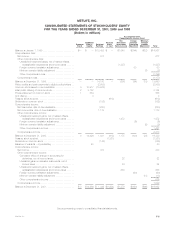

METLIFE, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2001, 2000 and 1999

(Dollars in millions)

Accumulated Other

Comprehensive Income (Loss)

Net Foreign Minimum

Additional Treasury Unrealized Currency Pension

Common Paid-in Retained Stock Investment Translation Liability

Stock Capital Earnings at Cost Gains (Losses) Adjustment Adjustment Total

Balance at January 1, 1999 *************************** $— $ — $ 13,483 $ — $1,540 $(144) $(12) $14,867

Comprehensive loss:

Net income *************************************** 617 617

Other comprehensive loss:

Unrealized investment losses, net of related offsets,

reclassification adjustments and income taxes ****** (1,837) (1,837)

Foreign currency translation adjustments ************* 50 50

Minimum pension liability adjustment **************** (7) (7)

Other comprehensive loss************************* (1,794)

Comprehensive loss******************************** (1,177)

Balance at December 31, 1999************************ — — 14,100 — (297) (94) (19) 13,690

Policy credits and cash payments to eligible policyholders ** (2,958) (2,958)

Common stock issued in demutualization **************** 5 10,917 (10,922) —

Initial public offering of common stock******************* 2 3,152 3,154

Private placement of common stock ******************** 1 854 855

Unit offering***************************************** 33

Treasury stock acquired******************************* (613) (613)

Dividends on common stock ************************** (152) (152)

Comprehensive income:

Net loss before date of demutualization**************** (220) (220)

Net income after date of demutualization*************** 1,173 1,173

Other comprehensive income:

Unrealized investment gains, net of related offsets,

reclassification adjustments and income taxes ****** 1,472 1,472

Foreign currency translation adjustments ************* (6) (6)

Minimum pension liability adjustment **************** (9) (9)

Other comprehensive income ********************** 1,457

Comprehensive income ***************************** 2,410

Balance at December 31, 2000************************ 8 14,926 1,021 (613) 1,175 (100) (28) 16,389

Treasury stock acquired******************************* (1,321) (1,321)

Dividends on common stock ************************** (145) (145)

Issuance of warrants — by subsidiary ******************* 40 40

Comprehensive income:

Net income *************************************** 473 473

Other comprehensive income:

Cumulative effect of change in accounting for

derivatives, net of income taxes ****************** 22 22

Unrealized gains on derivative instruments, net of

income taxes ********************************* 24 24

Unrealized investment gains, net of related offsets,

reclassification adjustments and income taxes ****** 658 658

Foreign currency translation adjustments ************* (60) (60)

Minimum pension liability adjustment **************** (18) (18)

Other comprehensive income ********************** 626

Comprehensive income ***************************** 1,099

Balance at December 31, 2001************************ $ 8 $14,966 $ 1,349 $(1,934) $1,879 $(160) $(46) $16,062

See accompanying notes to consolidated financial statements.

MetLife, Inc. F-5