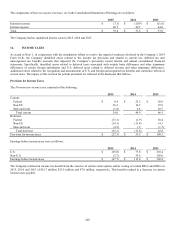

Lexmark 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

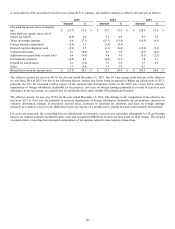

95

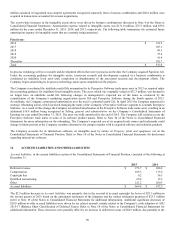

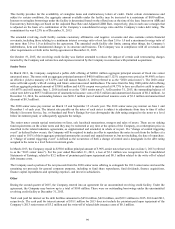

Accelerated depreciation and disposal of long-lived assets

The Company’s restructuring actions have resulted in shortened estimated useful lives of certain machinery and equipment and

buildings and subsequent disposal of machinery and equipment no longer in use. Refer to Note 5 of the Notes to Consolidated

Financial Statements for a discussion of these actions and the impact on earnings.

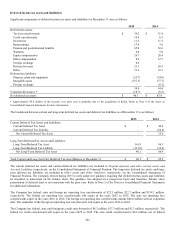

11. GOODWILL AND INTANGIBLE ASSETS

As discussed in Note 4 to the Consolidated Financial Statements the disclosures of goodwill and intangible assets shown below

include preliminary amounts that are subject to measurement period adjustments.

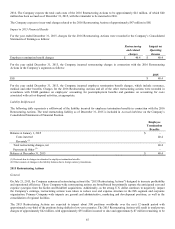

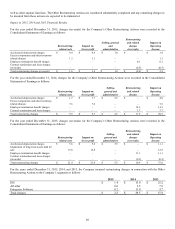

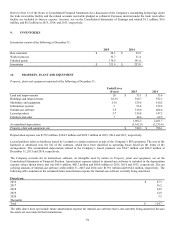

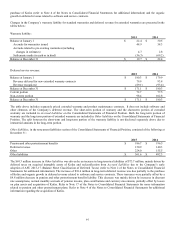

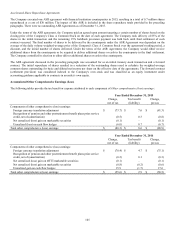

Goodwill

The following table summarizes the changes in the carrying amount of goodwill for each reportable segment and in total during 2015

and 2014.

Enterprise

ISS

Software

Total

Balance at January 1, 2014

$

20.8

$

433.9

$

454.7

Goodwill acquired during the period

–

178.3

178.3

Foreign currency translation

(2.0)

(27.6)

(29.6)

Balance at December 31, 2014

$

18.8

$

584.6

$

603.4

Goodwill acquired during the period

–

743.2

743.2

Foreign currency translation

(2.3)

(19.2)

(21.5)

Balance at December 31, 2015

$

16.5

$

1,308.6

$

1,325.1

Beginning in the third quarter of 2015, the Company elected to record measurement period adjustments in the period in which they are

determined, rather than retrospectively, as permitted under new accounting guidance issued in September 2015; refer to Note 2 of the

Notes to Consolidated Financial Statements for more information. Refer to Note 4 of the Notes to Consolidated Financial Statements

for information on goodwill resulting from business combinations and related measurement period adjustments. The Company does

not have any accumulated impairment charges as of December 31, 2015.

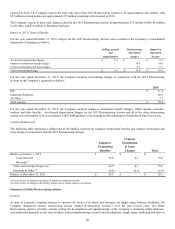

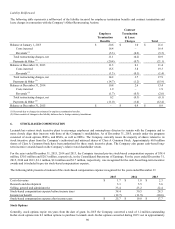

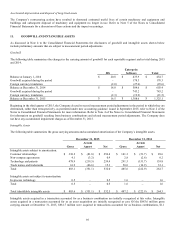

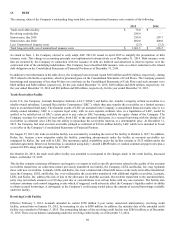

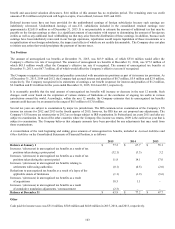

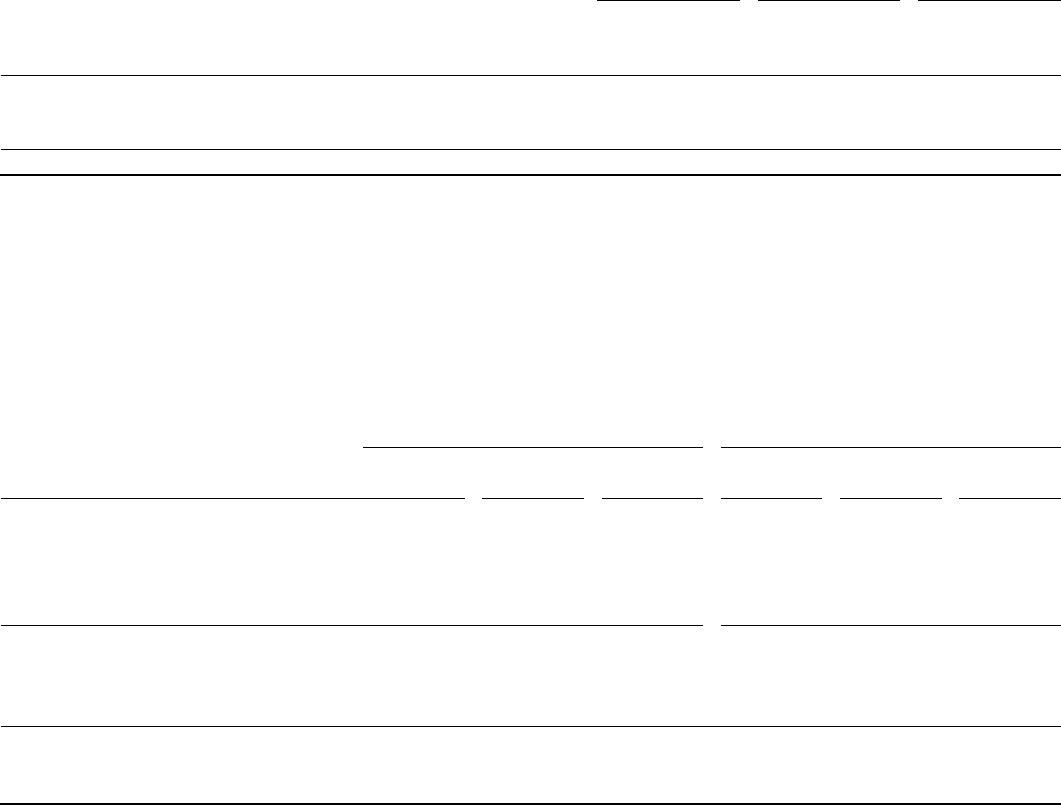

Intangible Assets

The following table summarizes the gross carrying amounts and accumulated amortization of the Company’s intangible assets.

December 31, 2015

December 31, 2014

Accum

Accum

Gross

Amort

Net

Gross

Amort

Net

Intangible assets subject to amortization:

Customer relationships

$

338.2

$

(81.8)

$

256.4

$

141.3

$

(51.7)

$

89.6

Non-compete agreements

4.1

(3.2)

0.9

2.8

(2.6)

0.2

Technology and patents

478.9

(219.5)

259.4

291.5

(151.7)

139.8

Trade names and trademarks

61.9

(46.6)

15.3

50.0

(16.9)

33.1

Total

883.1

(351.1)

532.0

485.6

(222.9)

262.7

Intangible assets not subject to amortization:

In-process technology

0.5

–

0.5

1.6

–

1.6

Total

0.5

–

0.5

1.6

–

1.6

Total identifiable intangible assets

$

883.6

$

(351.1)

$

532.5

$

487.2

$

(222.9)

$

264.3

Intangible assets acquired in a transaction accounted for as a business combination are initially recognized at fair value. Intangible

assets acquired in a transaction accounted for as an asset acquisition are initially recognized at cost. Of the $883.6 million gross

carrying amount at December 31, 2015, $861.7 million were acquired in transactions accounted for as business combinations, $1.1