Lexmark 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

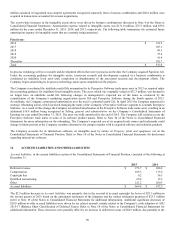

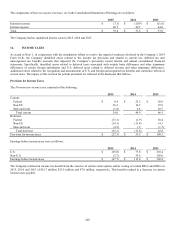

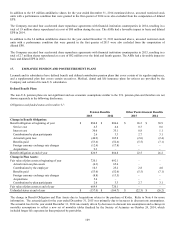

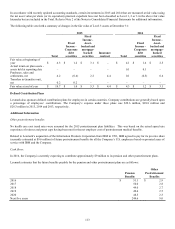

106

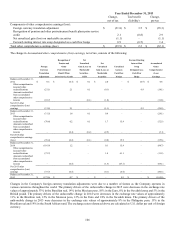

Year Ended December 31, 2013

Change,

Tax benefit

Change,

net of tax

(liability)

pre-tax

Components of other comprehensive earnings (loss):

Foreign currency translation adjustment

$

(31.8)

$

3.5

$

(35.3)

Recognition of pension and other postretirement benefit plans prior service

credit

2.1

(0.8)

2.9

Net unrealized gain (loss) on marketable securities

(1.1)

–

(1.1)

Forward starting interest rate swap designated as a cash flow hedge

0.9

(0.5)

1.4

Total other comprehensive earnings (loss)

$

(29.9)

$

2.2

$

(32.1)

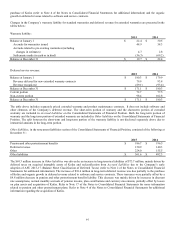

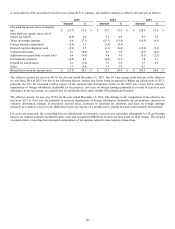

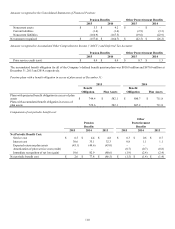

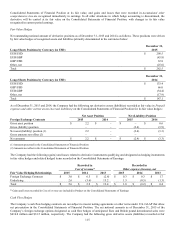

The change in Accumulated other comprehensive (loss) earnings, net of tax, consists of the following:

Recognition of

Net

Forward-Starting

Pension and

Unrealized

Net

Interest Rate

Accumulated

Foreign

Other

Gain (Loss) on

Unrealized

Unrealized

Swap

Other

Currency

Postretirement

Marketable

Gain (Loss) on

Gain on

Designated as a

Comprehensive

Translation

Benefit Plans

Securities –

Marketable

Cash Flow

Cash Flow

(Loss)

Adjustment

Prior Service Credit

OTTI

Securities

Hedges

Hedge

Earnings

Balance at December 31,

2012

$

0.3

$

(0.7)

$

0.1

$

2.0

–

$

(0.9)

$

0.8

Other comprehensive

income before

reclassifications

(21.1)

2.1

0.1

(0.1)

–

0.9

(18.1)

Amounts reclassified

from accumulated

other comprehensive

income

(10.7)

–

(0.1)

(1.0)

–

–

(11.8)

Net 2013 other

comprehensive (loss)

earnings

(31.8)

2.1

–

(1.1)

–

0.9

(29.9)

Balance at December 31,

2013

(31.5)

1.4

0.1

0.9

–

–

(29.1)

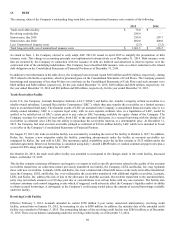

Other comprehensive

income before

reclassifications

(70.4)

0.2

0.1

1.7

15.9

–

(52.5)

Amounts reclassified

from accumulated

other comprehensive

income

–

(0.4)

(0.2)

(2.5)

–

–

(3.1)

Net 2014 other

comprehensive earnings

(loss)

(70.4)

(0.2)

(0.1)

(0.8)

15.9

–

(55.6)

Balance at December 31,

2014

(101.9)

1.2

–

0.1

15.9

–

(84.7)

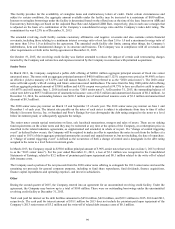

Other comprehensive

income before

reclassifications

(73.7)

–

–

1.4

61.1

–

(11.2)

Amounts reclassified

from accumulated

other comprehensive

income

–

(0.5)

–

(1.5)

(67.1)

–

(69.1)

Net 2015 other

comprehensive (loss)

earnings

(73.7)

(0.5)

–

(0.1)

(6.0)

–

(80.3)

Balance at December 31,

2015

$

(175.6)

$

0.7

$

–

$

–

9.9

$

–

$

(165.0)

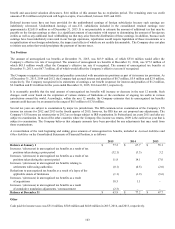

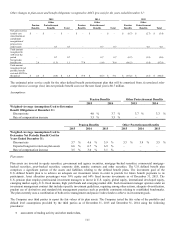

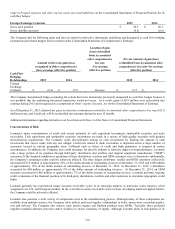

Changes in the Company's foreign currency translation adjustments were due to a number of factors as the Company operates in

various currencies throughout the world. The primary drivers of the unfavorable change in 2015 were decreases in the exchange rate

values of approximately 33% in the Brazilian real, 14% in the Mexican peso, 10% in the Euro, 8% in the Swedish krona and 5% in the

British pound. The primary drivers of the unfavorable change in 2014 were decreases in the exchange rate values of approximately

11% in the Brazilian real, 12% in the Mexican peso, 12% in the Euro and 18% in the Swedish krona. The primary drivers of the

unfavorable change in 2013 were decreases in the exchange rate values of approximately 8% in the Philippine peso, 13% in the

Brazilian real and 19% in the South African rand. The exchange rates referenced above are calculated as U.S. dollar per unit of foreign

currency.