Lexmark 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

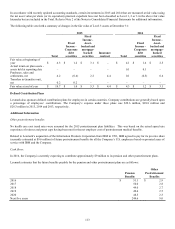

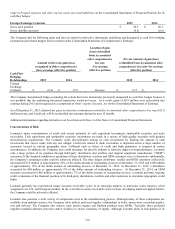

Operating (loss) income noted above for the year ended December 31, 2013 includes a Gain on sale of inkjet-related technology and

assets of $103.1 million in ISS and $(29.6) million in All other. Operating (loss) income noted above for the year ended December 31,

2013 includes restructuring charges of $25.2 million in ISS, $4.7 million in Enterprise Software, and $7.9 million in All other.

Operating (loss) income related to Enterprise Software for the year ended December 31, 2013 includes $56.4 million of amortization

expense related to intangible assets acquired by the Company. Operating (loss) income related to All other for the year ended

December 31, 2013 includes a pension and other postretirement benefit plan asset and actuarial net gain of $83.0 million.

During 2015, 2014 and 2013, no one customer accounted for more than 10% of the Company’s total revenues.

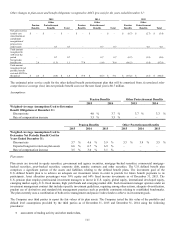

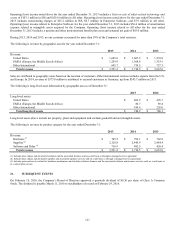

The following is revenue by geographic area for the year ended December 31:

2015

2014

2013

Revenue:

United States

$

1,645.6

$

1,607.2

$

1,576.8

EMEA (Europe, the Middle East & Africa)

1,259.9

1,368.8

1,353.5

Other International

645.7

734.5

737.3

Total revenue

$

3,551.2

$

3,710.5

$

3,667.6

Sales are attributed to geographic areas based on the location of customers. Other International revenue includes exports from the U.S.

and Europe. In 2014, revenue of $375.8 million is attributed to external customers in Germany, up from $343.7 million in 2013.

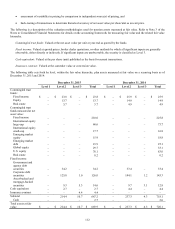

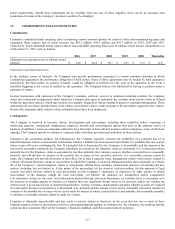

The following is long-lived asset information by geographic area as of December 31:

2015

2014

Long-lived assets:

United States

$

469.9

$

476.7

EMEA (Europe, the Middle East & Africa)

80.7

89.4

Other International

189.6

220.0

Total long-lived assets

$

740.2

$

786.1

Long-lived assets above include net property, plant and equipment and exclude goodwill and net intangible assets.

The following is revenue by product category for the year ended December 31:

2015

2014

2013

Revenue:

Hardware (1)

$

705.5

$

782.1

$

762.8

Supplies (2)

2,128.8

2,445.9

2,484.4

Software and Other (3)

716.9

482.5

420.4

Total revenue

$

3,551.2

$

3,710.5

$

3,667.6

(1) Includes laser, inkjet, and dot matrix hardware and the associated features sold on a unit basis or through a managed service agreement

(2) Includes laser, inkjet, and dot matrix supplies and associated supplies services sold on a unit basis or through a managed service agreement

(3) Includes parts and service related to hardware maintenance and includes software licenses and the associated software maintenance services sold on a unit basis or

as a subscription service

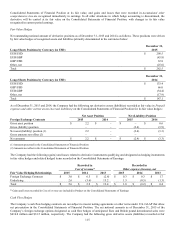

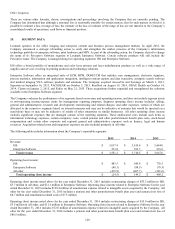

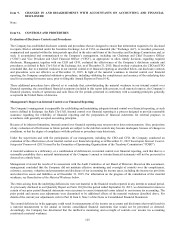

21. SUBSEQUENT EVENTS

On February 18, 2016, the Company’s Board of Directors approved a quarterly dividend of $0.36 per share of Class A Common

Stock. The dividend is payable March 11, 2016 to stockholders of record on February 29, 2016.