Lexmark 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

because the credit was retroactively extended to include 2012, the Company recognized the full benefit of the 2012 credit in the first

quarter of 2013 effectively including two years of rate benefit within the 2013 effective income tax rate.

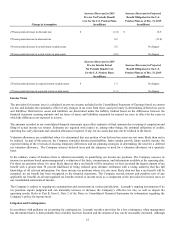

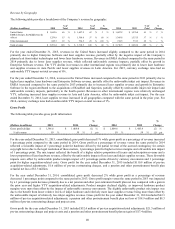

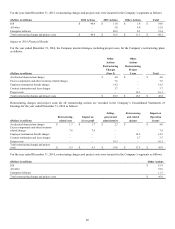

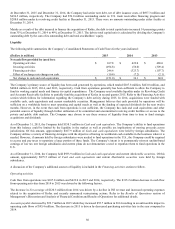

Net Earnings and Earnings per Share

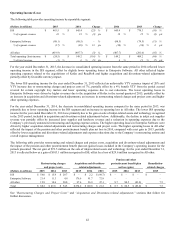

The following table summarizes net (loss) earnings and basic and diluted net (loss) earnings per share:

(Dollars in millions, except per share amounts)

2015

2014

2013

Net (loss) earnings

$

(40.4)

$

79.9

$

259.1

Basic (loss) earnings per share

$

(0.66)

$

1.29

$

4.11

Diluted (loss) earnings per share

$

(0.66)

$

1.26

$

4.04

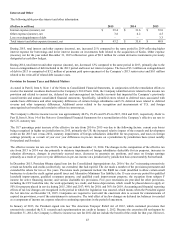

Net earnings for the year ended December 31, 2015 declined 151% from the prior year primarily due to lower operating income. For

2015, the YTY decrease in basic and diluted earnings per share was primarily due to lower net earnings, partially offset by a reduction

in weighted-average shares outstanding.

Net earnings for the year ended December 31, 2014 declined 69% from the prior year primarily due to lower operating income. For

2014, the YTY decrease in basic and diluted earnings per share was primarily due to lower net earnings, partially offset by a reduction

in weighted-average shares outstanding, due to the Company’s share repurchases.

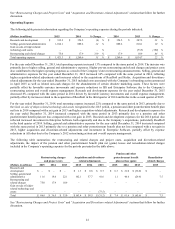

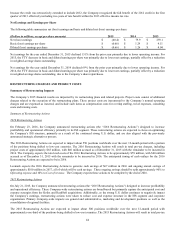

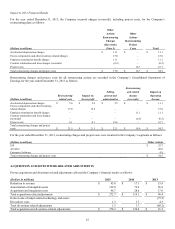

RESTRUCTURING CHARGES AND PROJECT COSTS

Summary of Restructuring Impacts

The Company’s 2015 financial results are impacted by its restructuring plans and related projects. Project costs consist of additional

charges related to the execution of the restructuring plans. These project costs are incremental to the Company’s normal operating

charges and are expensed as incurred, and include such items as compensation costs for overlap staffing, travel expenses, consulting

costs and training costs.

Summary of Restructuring Actions

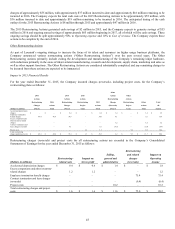

2016 Restructuring Actions

On February 23, 2016, the Company announced restructuring actions (the “2016 Restructuring Actions”) designed to increase

profitability and operational efficiency primarily in its ISS segment. These restructuring actions are expected to focus on optimizing

the Company’s ISS structure, primarily as a result of the continued strong U.S. dollar, and are also aligned with the previously

announced strategic alternatives process.

The 2016 Restructuring Actions are expected to impact about 550 positions worldwide over the next 12-month period with a portion

of the positions being shifted to low-cost countries. The 2016 Restructuring Actions will result in total pre-tax charges, including

project costs of approximately $65 million, with $40 million accrued as of December 31, 2015 with the remainder to be incurred in

2016. The Company expects the total cash costs of the 2016 Restructuring Actions to be approximately $59 million, with $40 million

accrued as of December 31, 2015 with the remainder to be incurred in 2016. The anticipated timing of cash outlays for the 2016

Restructuring Actions are expected to be in 2016.

Lexmark expects the 2016 Restructuring Actions to generate cash savings of $67 million in 2016 and ongoing annual savings of

approximately $100 million in 2017, all of which will be cash savings. These ongoing savings should be split approximately 90% to

Operating expense and 10% to Cost of revenue. The Company expects these actions to be complete by the end of 2016.

2015 Restructuring Actions

On July 21, 2015, the Company announced restructuring actions (the “2015 Restructuring Actions”) designed to increase profitability

and operational efficiency. These Company-wide restructuring actions are broad-based but primarily capture the anticipated cost and

expense synergies from the Kofax and ReadSoft acquisitions. Additionally, as the strong U.S. dollar continues to negatively impact

the Company’s earnings, restructuring actions were taken to reduce cost and expense structure in the ISS segment and corporate

organization. Primary Company-wide impacts are general and administrative, marketing and development positions as well as the

consolidation of regional facilities.

The 2015 Restructuring Actions are expected to impact about 500 positions worldwide over the next 12-month period with

approximately one-third of the positions being shifted to low-cost countries. The 2015 Restructuring Actions will result in total pre-tax