Lexmark 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

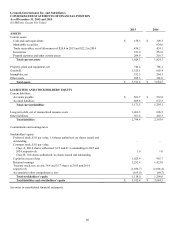

At December 31, 2015 and December 31, 2014, the Company had senior note debt, net of debt issuance costs, of $697.3 million and

$696.5 million, respectively. The Company had $76.0 million outstanding under its U.S. trade receivables financing program and

$288.0 million under its revolving credit facility at December 31, 2015. There were no amounts outstanding under either facility at

December 31, 2014.

Mainly as a result of the debt incurred to finance the acquisition of Kofax, the debt to total capital ratio increased 14 percentage points

from 35% at December 31, 2014 to 49% at December 31, 2015. The debt to total capital ratio is calculated by dividing the Company’s

outstanding debt by the sum of its outstanding debt and total stockholders’ equity.

Liquidity

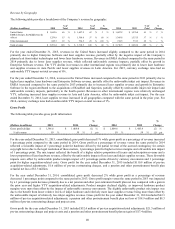

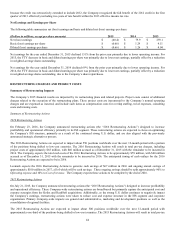

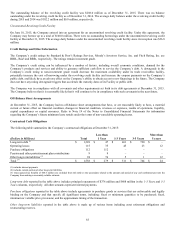

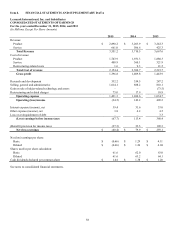

The following table summarizes the Company’s Consolidated Statements of Cash Flows for the years indicated:

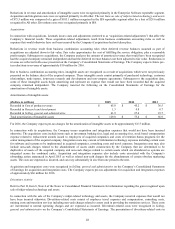

(Dollars in millions)

2015

2014

2013

Net cash flow provided by (used for):

Operating activities

$

107.8

$

423.0

$

480.0

Investing activities

(494.8)

(56.0)

(309.4)

Financing activities

246.6

(323.7)

(107.7)

Effect of exchange rate changes on cash

(10.6)

(7.2)

(2.1)

Net change in cash and cash equivalents

$

(151.0)

$

36.1

$

60.8

The Company’s primary source of liquidity has been cash generated by operations, which totaled $107.8 million, $423.0 million, and

$480.0 million in 2015, 2014, and 2013, respectively. Cash from operations generally has been sufficient to allow the Company to

fund its working capital needs and finance its capital expenditures. The Company used available liquidity under its Revolving Credit

and Accounts Receivable facilities to partially fund the acquisition of Kofax in second quarter 2015. Refer to the Financing Activities

section which follows for information regarding the Company’s debt activity during 2015. In 2014, acquisitions were funded with

available cash, cash equivalents and current marketable securities. Management believes that cash provided by operations will be

sufficient on a worldwide basis to meet operating and capital needs as well as the funding of expected dividends for the next twelve

months. However, in the event that cash from operations is not sufficient, the Company has cash and cash equivalents and other

potential sources of liquidity through further utilization of its committed and uncommitted revolving credit facilities or access to the

private and public debt markets. The Company may choose to use these sources of liquidity from time to time to fund strategic

acquisitions and dividends.

As of December 31, 2015, the Company held $158.3 million in Cash and cash equivalents. The Company’s ability to fund operations

from this balance could be limited by the liquidity in the market as well as possible tax implications of moving proceeds across

jurisdictions. Of this amount, approximately $107.9 million of Cash and cash equivalents were held by foreign subsidiaries. The

Company utilizes a variety of financing strategies with the objective of having its worldwide cash available in the locations where it is

needed. However, if amounts held by foreign subsidiaries were needed to fund operations in the U.S., the Company could be required

to accrue and pay taxes to repatriate a large portion of these funds. The Company’s intent is to permanently reinvest undistributed

earnings of low tax rate foreign subsidiaries and current plans do not demonstrate a need to repatriate them to fund operations in the

U.S.

As of December 31, 2014, the Company held $933.9 million in Cash and cash equivalents and current Marketable securities. Of this

amount, approximately $875.5 million of Cash and cash equivalents and current Marketable securities were held by foreign

subsidiaries.

A discussion of the Company’s additional sources of liquidity is included in the Financing activities section to follow.

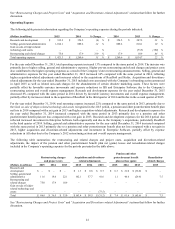

Operating activities

Cash flow from operations was $107.8 million and $423.0 in 2015 and 2014, respectively. The $315.2 million decrease in cash flow

from operating activities from 2014 to 2015 was driven by the following factors.

The decrease in Net earnings of $120.3 million from 2014 was driven by a decline in ISS revenue and increased operating expenses

related to the acquisition of Kofax and recently announced restructuring actions. Refer to the Results of Operations section of

Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional details.

Accounts payable decreased by $39.7 million in 2015 while they increased $55.7 million in 2014 resulting in an unfavorable impact to

operating cash flows of $95.4 million. The decrease in 2015 is driven by decreased purchasing activities late in the year compared to

2014.