Lexmark 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

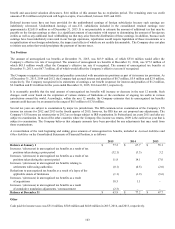

109

In addition to the 0.9 million antidilutive shares for the year ended December 31, 2014 mentioned above, unvested restricted stock

units with a performance condition that were granted in the first quarter of 2014 were also excluded from the computation of diluted

EPS.

The Company executed four accelerated share repurchase agreements with financial institution counterparties in 2014, resulting in a

total of 1.9 million shares repurchased at a cost of $80 million during the year. The ASRs had a favorable impact to basic and diluted

EPS in 2014.

In addition to the 2.4 million antidilutive shares for the year ended December 31, 2013 mentioned above, unvested restricted stock

units with a performance condition that were granted in the first quarter of 2013 were also excluded from the computation of

diluted EPS.

The Company executed four accelerated share repurchase agreements with financial institution counterparties in 2013, resulting in a

total of 2.7 million shares repurchased at a cost of $82 million over the third and fourth quarter. The ASRs had a favorable impact to

basic and diluted EPS in 2013.

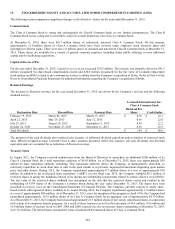

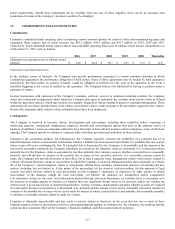

17. EMPLOYEE PENSION AND POSTRETIREMENT PLANS

Lexmark and its subsidiaries have defined benefit and defined contribution pension plans that cover certain of its regular employees,

and a supplemental plan that covers certain executives. Medical, dental and life insurance plans for retirees are provided by the

Company and certain of its non-U.S. subsidiaries.

Defined Benefit Plans

The non-U.S. pension plans are not significant and use economic assumptions similar to the U.S. pension plan and therefore are not

shown separately in the following disclosures.

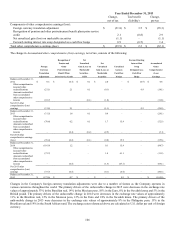

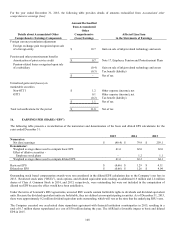

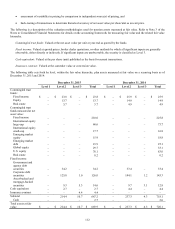

Obligations and funded status at December 31:

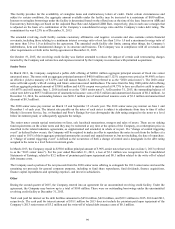

Pension Benefits

Other Postretirement Benefits

2015

2014

2015

2014

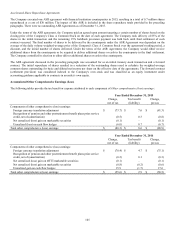

Change in Benefit Obligation:

Benefit obligation at beginning of year

$

884.8

$

806.6

$

26.2

$

30.9

Service cost

6.5

4.4

0.3

0.6

Interest cost

30.6

35.1

0.8

1.1

Contributions by plan participants

2.6

3.3

2.7

3.1

Actuarial (gain) loss

(40.9)

105.8

(2.0)

(2.4)

Benefits paid

(53.6)

(52.6)

(5.5)

(7.1)

Foreign currency exchange rate changes

(12.4)

(17.8)

–

–

Acquisitions

9.3

–

–

–

Benefit obligation at end of year

826.9

884.8

22.5

26.2

Change in Plan Assets:

Fair value of plan assets at beginning of year

720.1

692.1

–

–

Actual return on plan assets

(6.3)

65.6

–

–

Contributions by the employer

10.3

25.2

2.8

4.0

Benefits paid

(53.6)

(52.6)

(5.5)

(7.1)

Foreign currency exchange rate changes

(8.8)

(13.5)

–

–

Acquisitions

5.6

–

–

–

Contributions by plan participants

2.6

3.3

2.7

3.1

Fair value of plan assets at end of year

669.9

720.1

–

–

Unfunded status at end of year

$

(157.0)

$

(164.7)

$

(22.5)

$

(26.2)

The change in Benefit Obligation and Plan Assets due to Acquisitions relates to the purchase of Kofax. Refer to Note 4 for more

information. The actuarial gain for the year ended December 31, 2015 was primarily due to increases in discount rate assumptions.

The actuarial loss for the year ended December 31, 2014 was mainly driven by decreases in discount rate assumptions and a change in

mortality assumptions to reflect a new set of mortality tables finalized by the Society of Actuaries on October 24, 2014, which

included longer life expectancies than projected by past tables.