Lexmark 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

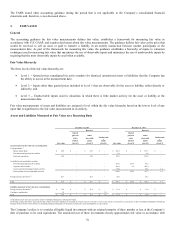

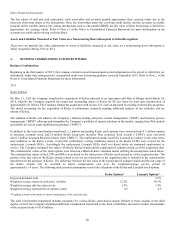

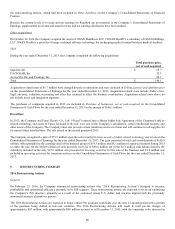

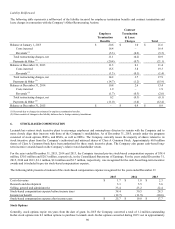

Year Ended

December 31

2015

2014

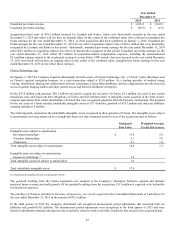

Unaudited pro forma revenue

$

3,656.5

$

3,965.2

Unaudited pro forma earnings

$

(50.5)

$

(6.3)

Acquisition-related costs of $38.2 million incurred by Lexmark and Kofax, which were historically recorded in the year ended

December 31, 2015 and which will not have an ongoing effect on the results of the combined entity were reflected in unaudited pro

forma earnings for the year ended December 31, 2014, as if the acquisition had been completed on January 1, 2014. Unaudited pro

forma earnings for the year ended December 31, 2015 do not reflect acquisition-related costs of $38.2 million that were historically

recognized by Lexmark and Kofax in this period. Additionally, unaudited pro forma earnings for the year ended December 31, 2014

reflect $0.1 million of acquisition-related costs that were historically recognized in that period. Unaudited pro forma earnings for the

year ended December 31, 2014 reflect $8.7 million of acquisition-related compensation expenses, including the aforementioned

$2.6 million expense related to the accelerated vesting of certain Kofax LTIP awards, that were incurred in the year ended December

31, 2015 and which will not have an ongoing effect on the results of the combined entity; unaudited pro forma earnings for the year

ended December 31, 2015 do not reflect these expenses.

Claron Technology, Inc.

On January 2, 2015 the Company acquired substantially all of the assets of Claron Technology, Inc., (“Claron”) other than those used

in Claron’s surgical navigation business, in a cash transaction valued at $33.0 million. As a leading provider of medical image

viewing, distribution, sharing and collaboration software technology, Claron helps healthcare delivery organizations provide universal

access to patient imaging studies and other content across and between healthcare enterprises.

Of the $33.0 million cash payment, $30.3 million was paid to acquire the net assets of Claron, $2.2 million was used to pay certain

transaction costs and long-term debt obligations of Claron and $0.5 million relates to intangible assets acquired in the form of non-

compete agreements from certain shareholders of Claron that were recognized separately from the business combination. The payment

for the net assets of Claron includes identifiable intangible assets of $17.4 million, goodwill of $14.7 million and other net liabilities

assumed totaling $1.8 million.

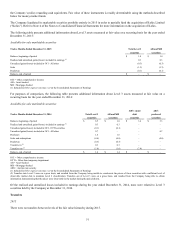

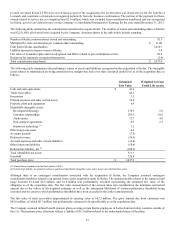

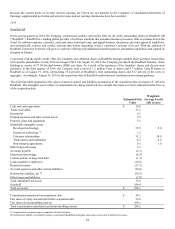

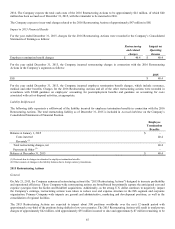

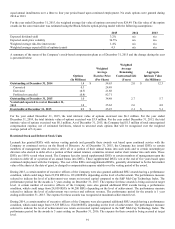

The following table summarizes the identifiable intangible assets recognized in the acquisition of Claron. The intangible assets subject

to amortization are being amortized on a straight-line basis over their estimated useful lives as of the acquisition date as follows.

Estimated

Weighted-Average

Fair Value

Useful Life (years)

Intangible assets subject to amortization:

Developed technology

$

13.8

5.0

Customer relationships

2.1

7.0

Trade name

0.1

1.0

Total intangible assets subject to amortization

16.0

5.3

Intangible assets not subject to amortization:

In-process technology (1)

1.4

Total intangible assets not subject to amortization

1.4

Total identifiable intangible assets

$

17.4

(1) Amortization commenced in the second quarter of 2015.

The goodwill resulting from the Claron acquisition was assigned to the Company’s Enterprise Software segment and includes

projected future revenue and profit growth. Of the goodwill resulting from the acquisition, $11.0 million is expected to be deductible

for income tax purposes.

The purchase of Claron is included in Purchase of businesses, net of cash acquired in the Consolidated Statements of Cash Flows for

the year ended December 31, 2015 in the amount of $30.3 million.

In the third quarter of 2015 the Company determined and recognized measurement period adjustments that increased both net

liabilities and goodwill $0.2 million. The measurement period adjustments were recognized in the third quarter of 2015 and were

based on information obtained subsequent to the acquisition related to trade receivables conditions that existed at the acquisition date.