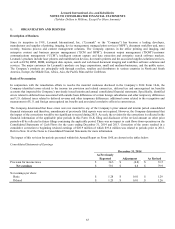

Lexmark 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

labor hours to be the most reliable available measure of progress on these projects, and any adjustments to estimates to complete are

made in the periods in which facts resulting in a change become known. Maintenance and support includes the right to receive

unspecified upgrades or enhancements on a when-and-if-available basis and is typically billed up front, deferred and recognized

ratably over the term of the support period which is generally twelve months. Costs related to professional services and maintenance

and support are recognized as incurred.

Software as a service and subscription revenue are recognized ratably over the duration of the contract, which is generally one to five

years. The customer does not typically have the right to take possession of the software in hosted arrangements.

Revenue from royalties on sales of the Company’s software by original equipment manufacturers, where no other deliverables are

included, is recognized in the period earned based on royalty reports from our original equipment manufacturer customers, and

provided that all other revenue recognition criteria have been met.

Multiple Element Revenue Arrangements

General:

Lexmark enters into agreements with customers that contain multiple elements, such as the provisions of hardware, supplies,

separately priced extended warranty and product maintenance services, and other professional services (such as installation,

maintenance, and enhanced warranty services). These arrangements may involve upfront purchase or lease of hardware products with

services and supplies provided per contract terms or as needed. Lexmark also enters into agreements with customers that contain

software deliverables which are discussed separately in the section to follow.

The guidance on multiple element arrangements requires that the arrangement consideration be allocated to each deliverable based on

its relative selling price and recognized as revenue when the revenue recognition criteria for each deliverable has been met. However,

if a deliverable in a multiple element arrangement is subject to other authoritative guidance, such as leased equipment, software and

related services, or separately priced maintenance services, that deliverable is separated from the arrangement and accounted for in

accordance with such specific guidance. This is generally done by allocating the arrangement consideration on a relative selling price

basis to the lease deliverables, the software element group, and the individual deliverables not subject to other authoritative guidance

based on the selling price hierarchy discussed below. Separately priced extended warranties are accounted for using the stated

contractual price provided they represent a separate purchasing decision at a price that is reasonable in relation to the services being

sold.

Under the guidance for multiple element arrangements, the arrangement is separated into more than one unit of accounting if both of

the following criteria are met:

The delivered item(s) has value to the customer on a stand-alone basis; and

If the arrangement includes a general right of return relative to the delivered item(s), delivery or performance of the

undelivered item(s) is considered probable and substantially within the Company’s control.

If these criteria are not met, the arrangement is accounted for as one unit of accounting and the recognition of revenue is deferred until

delivery is complete or is recognized ratably over the contract period as appropriate.

If these criteria are met, consideration is allocated at inception of the arrangement to all deliverables on the basis of the relative selling

price. The Company has generally met these criteria in that all of the deliverables in its multiple deliverable arrangements have stand-

alone value in that either the customer can resell that item or another vendor sells that item separately. In cases of deliverables with

variable quantities, such as when the quantities delivered are based upon usage, the Company’s practice is to consider these a separate

deliverable in the original arrangement instead of an optional purchase when the customer does not have the option but to purchase

future quantities from the Company. The Company typically does not offer a general right of return in regards to its multiple

deliverable arrangements.

The selling price of each deliverable is determined by establishing VSOE, third party evidence (“TPE”) or best estimate of selling

price (“BESP”) for each delivered item. If VSOE or TPE is not determinable, the Company utilizes its BESP in order to allocate

consideration for those deliverables.

The Company uses its BESP when allocating the transaction price for most of its non-software deliverables due to variability in

pricing or lack of stand-alone sales as well as the unique and customized nature of certain deliverables. BESP for the Company’s

product deliverables is determined by utilizing a weighted average price approach. BESP for the Company’s service deliverables is

determined primarily by utilizing a cost plus margin approach, and in some instances uses an average price per hour. These

approaches are described further in the paragraphs below.