Lexmark 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.85

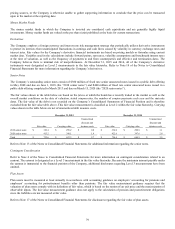

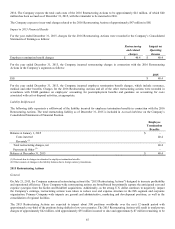

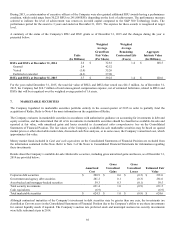

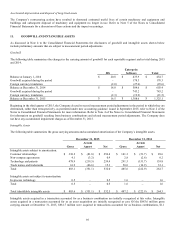

The values above include measurement period adjustments determined subsequent to the acquisition that were due to trade

receivables, income taxes and other conditions that existed at the acquisition date.

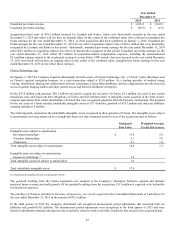

Measurement period adjustments determined in the second quarter of 2015 increased the acquisition date balance of Trade receivables

$2.6 million, with a corresponding decrease to Goodwill. The December 31, 2014 balances of Trade receivables and Goodwill on the

Consolidated Statements of Financial Position were increased $2.4 million and decreased $2.4 million, respectively, to include the

effect of the measurement period adjustments determined in the second quarter of 2015. The difference between the change to the

acquisition date balances and the change to the December 31, 2014 balances is due to foreign currency translation.

Measurement period adjustments determined and recognized in the third quarter of 2015 decreased Trade receivables $1.2 million,

decreased Accrued expenses and other current liabilities $3.3 million, increased Other long-term liabilities $1.7 million, increased

Deferred tax liability, net $4.1 million and increased Goodwill $3.7 million.

The fair value of trade receivables approximates its carrying value of $31.1 million. The gross amount due from customers is $34.3

million, of which $3.2 million was estimated to be uncollectible as of the date of acquisition.

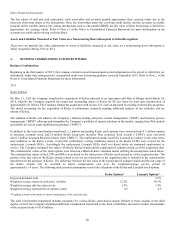

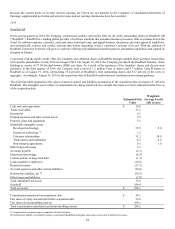

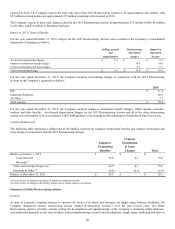

The goodwill resulting from the ReadSoft acquisition was assigned to the Company’s Enterprise Software segment. The goodwill

recognized includes projected future revenue and profit growth, as well as an expanded international presence for Enterprise Software

and certain synergies specific to the combined entity. None of the goodwill acquired is expected to be deductible for income tax

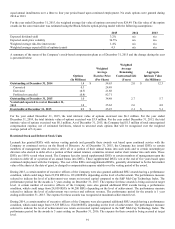

purposes. The total estimated fair value of intangible assets acquired was $93.2 million, with a weighted-average useful life of 6.6

years.

The Short-term borrowings assumed as of the acquisition date were repaid after the acquisition date in the third quarter of 2014. The

outstanding Loans payable to employees issued as part of ReadSoft’s incentive programs were considered a liability assumed by the

Company on the acquisition date. Cash payments to the holders of the loans occurred after the acquisition date in the third quarter of

2014. The payments for both of these liabilities are included in Repayment of assumed debt in the financing section of the Company’s

Consolidated Statements of Cash Flows for the year ended December 31, 2014. The difference between the amounts shown in the

table above and the amount shown on the Company’s Consolidated Statements of Cash Flows is due to foreign currency translation

effects.

The Current portion of long-term debt assumed consists of a loan that was outstanding at the acquisition date and was subsequently

repaid under its contractual terms in the fourth quarter of 2014.

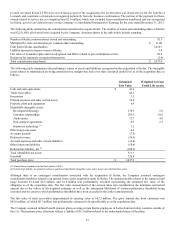

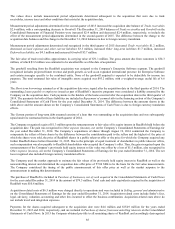

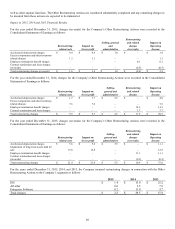

The Company recognized a gain of $1.3 million upon the remeasurement to fair value of its equity interest in ReadSoft held before the

acquisition date. The gain was recognized in Other expense (income), net on the Company’s Consolidated Statements of Earnings for

the year ended December 31, 2014. The Company’s acquisitions of shares through August 19, 2014 committed the Company to

compensate the sellers of those shares by the difference between the consideration paid to the sellers and the highest of: the price at

which the shares were sold, the price of ReadSoft shares in a public takeover offer or the price for which the Company acquired any

further ReadSoft shares before December 31, 2015. Due to the principle of equal treatment of shareholders in public takeover offers,

such compensation was also payable to ReadSoft shareholders who accepted the Company’s offer. Thus, the gain recognized upon the

remeasurement of the Company’s previously held equity interest to fair value was offset by a loss of $1.5 million, also recognized in

Other expense (income), net on the Company’s Consolidated Statements of Earnings for the year ended December 31, 2014. The net

loss recognized also included foreign currency translation effects.

The Company used the market approach to estimate the fair values of its previously held equity interest in ReadSoft as well as the

noncontrolling interest and determined the acquisition date offer price of 57.00 SEK to be the basis for the fair value measurements.

The Company considered the timing of the public announcement of this offer price as well as the market response to the

announcement in making this determination.

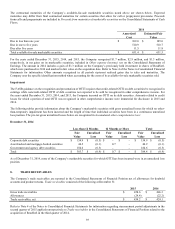

The purchase of ReadSoft is included in Purchase of businesses, net of cash acquired in the Consolidated Statements of Cash Flows

for the year ended December 31, 2014 in the amount of $79.3 million. Total cash and cash equivalents acquired in the acquisition of

ReadSoft were $10.8 million.

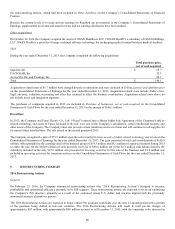

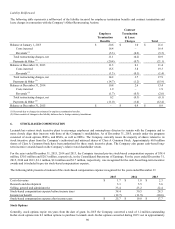

Acquisition-related costs of $6.5 million were charged directly to operations and were included in Selling, general and administrative

on the Consolidated Statements of Earnings for the year ended December 31, 2014. Acquisition-related costs include finder’s fees,

legal, advisory, valuation, accounting and other fees incurred to effect the business combination. Acquisition-related costs above do

not include travel and integration expenses.

Payments for the shares acquired subsequent to the acquisition date were $4.6 million and $154.9 million for the years ended

December 31, 2015 and 2014, respectively, and are included in Purchase of shares from noncontrolling interests on the Consolidated

Statements of Cash Flows. In 2015 the Company obtained pre-title to all remaining shares of ReadSoft and accordingly derecognized