Lexmark 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

13. DEBT

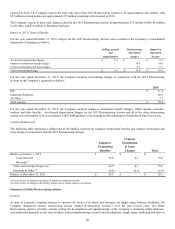

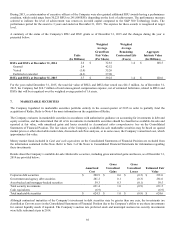

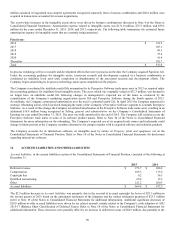

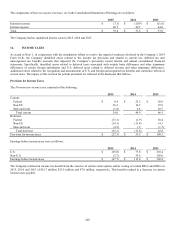

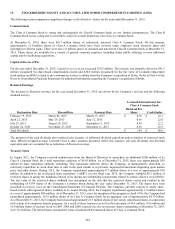

The carrying value of the Company’s outstanding long-term debt, net of unamortized issuance costs consists of the following:

2015

2014

Trade receivables facility

$

76.0

$

–

Revolving credit facility

288.0

–

Senior notes, due 2018

299.8

299.7

Senior notes, due 2020

400.0

400.0

Less: Unamortized issuance costs

(2.5)

(3.2)

Total long-term debt, net of unamortized issuance costs

$

1,061.3

$

696.5

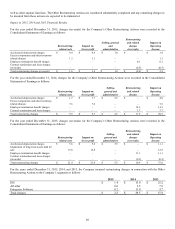

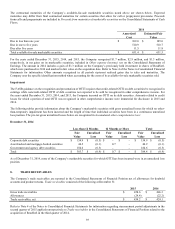

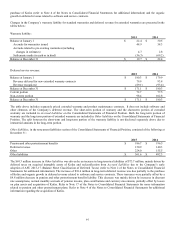

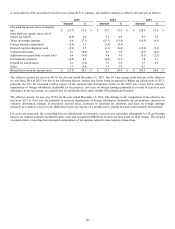

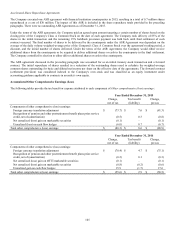

As stated in Note 1, the Company elected to early adopt ASU 2015-03 issued in April 2015 to simplify the presentation of debt

issuance costs. This change in accounting principle was implemented retrospectively as of December 31, 2014. Debt issuance costs

that are incurred by the Company in connection with the issuance of debt are deferred and amortized to interest expense over the

contractual term of the underlying indebtedness. The Company has reclassified debt issuance costs as a direct reduction to the related

debt obligation on the Consolidated Statements of Financial Position as of December 31, 2014.

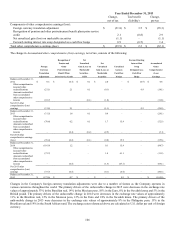

In addition to the information in the table above, the Company borrowed and repaid $418 million and $54 million, respectively, during

2015 related to the Kofax acquisition, which is presented gross on the Consolidated Statements of Cash Flows. The Company presents

borrowings and repayments of less than 90 days on a net basis on the Consolidated Statements of Cash Flows and such amounts were

$466 million and $466 million, respectively, for the year ended December 31, 2015, $430 million and $430 million, respectively, for

the year ended December 31, 2014 and $20 million and $20 million, respectively, for the year ended December 31, 2013.

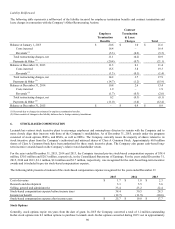

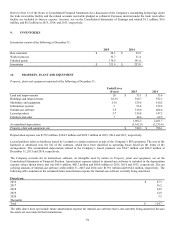

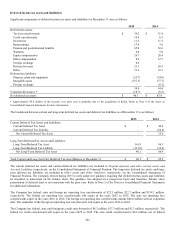

Trade Receivables Facility

In the U.S., the Company, Lexmark Enterprise Software, LLC (“LESL”) and Kofax, Inc. transfer a majority of their receivables to a

wholly-owned subsidiary, Lexmark Receivables Corporation (“LRC”), which then may transfer the receivables on a limited recourse

basis to an unrelated third party. The financial results of LRC are included in the Company’s consolidated financial results since it is a

wholly-owned subsidiary. LRC is a separate legal entity with its own separate creditors who, in a liquidation of LRC, would be

entitled to be satisfied out of LRC’s assets prior to any value in LRC becoming available for equity claims of the Company. The

Company accounts for transfers of receivables from LRC to the unrelated third party as a secured borrowing with the pledge of its

receivables as collateral since LRC has the ability to repurchase the receivables interests at a determinable price. At December 31,

2015, the Company had total accounts receivable pledged as collateral of $114.6 million held by LRC which were included in Trade

receivables in the Company’s Consolidated Statements of Financial Position.

On August 27, 2015, the trade receivables facility was amended by extending the term of the facility to October 6, 2017. In addition,

Kofax, Inc. became a new originator under the facility, permitting advancements under the facility as accounts receivables are

originated by Kofax, Inc. and sold to LRC. The maximum capital availability under the facility remains at $125 million under the

amended agreement. Interest on borrowings is calculated using daily 1-month LIBOR index or conduit commercial paper rates plus a

spread of 0.40% along with a liquidity fee of 0.40%.

On October 20, 2015, the trade receivables facility was amended to correspond to the changes made to the credit facility, discussed

below, on October 19, 2015.

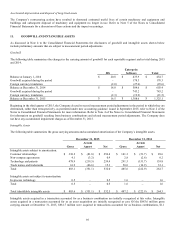

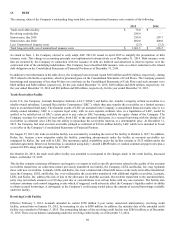

This facility contains customary affirmative and negative covenants as well as specific provisions related to the quality of the accounts

receivables transferred. As collections reduce previously transferred receivables, the Company, LESL and Kofax, Inc. may replenish

these with new receivables. Lexmark, LESL and Kofax, Inc. bear a limited risk of bad debt losses on the trade receivables transferred,

since the Company, LESL and Kofax, Inc. over-collateralize the receivables transferred with additional eligible receivables. Lexmark,

LESL and Kofax, Inc. address this risk of loss in the allowance for doubtful accounts. Receivables transferred to the unrelated third-

party may not include amounts over 90 days past due or concentrations over certain limits with any one customer. The facility also

contains customary cash control triggering events which, if triggered, could adversely affect the Company’s liquidity and/or its ability

to obtain secured borrowings. A downgrade in the Company’s credit rating would reduce the amount of secured borrowings available

under the facility.

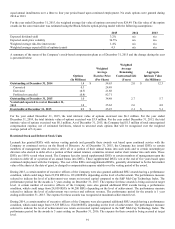

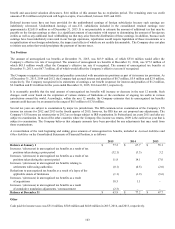

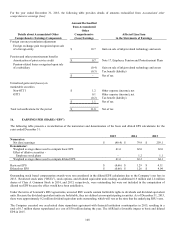

Revolving Credit Facility

Effective February 5, 2014, Lexmark amended its current $350 million 5-year senior, unsecured, multicurrency revolving credit

facility, entered into on January 18, 2012, by increasing its size to $500 million. In addition, the maturity date of the amended credit

facility was extended to February 5, 2019. The outstanding balance of the revolving credit facility was $288.0 million as of December

31, 2015. There was no balance outstanding under the revolving credit facility as of December 31, 2014.