Lexmark 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

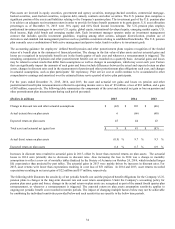

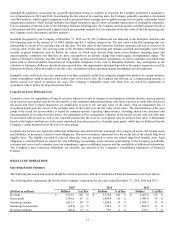

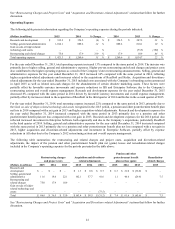

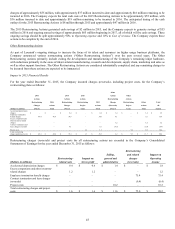

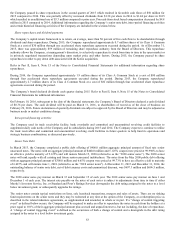

Interest and Other

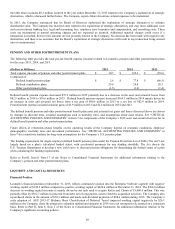

The following table provides interest and other information:

(Dollars in millions)

2015

2014

2013

Interest expense (income), net

$

39.4

$

31.6

$

33.0

Other expense (income), net

3.8

4.2

4.5

Loss on extinguishment of debt

–

–

3.3

Total interest and other expense (income), net

$

43.2

$

35.8

$

40.8

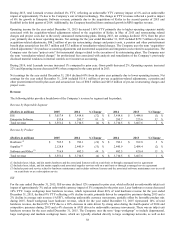

During 2015, total interest and other expense (income), net, increased 21% compared to the same period in 2014 reflecting higher

interest expense for borrowings and lower interest income on investments both related to the acquisition of Kofax. Other expense

(income), net for the year ended December 31, 2015 reflected net gains of $0.9 million for certain derivative instruments previously

designated as cash flow hedges.

During 2014, total interest and other expense (income), net, decreased 12% compared to the same period in 2013, primarily due to the

loss on extinguishment of debt included in the 2013 period and lower net interest expense. The loss of $3.3 million on extinguishment

of debt in 2013 is comprised of $3.2 million of premium paid upon repayment of the Company’s 2013 senior notes and $0.1 million

related to the write-off of related debt issuance costs.

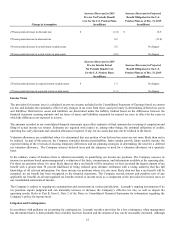

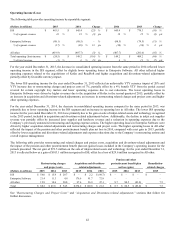

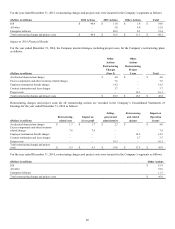

Provision for Income Taxes and Related Matters

As stated in Part II, Item 8, Note 1 of the Notes to Consolidated Financial Statements, in conjunction with the remediation efforts to

resolve the material weakness disclosed in the Company’s 2014 Form 10-K, the Company identified errors related to the income tax

provision and related to current tax, deferred tax and unrecognized tax benefits accounts that impacted the Company’s previously

issued interim and annual consolidated financial statements. Specifically, identified errors related to deferred taxes associated with

outside basis differences and other temporary differences of certain foreign subsidiaries and U.S. deferred taxes related to deferred

revenue and other temporary differences. Additional errors related to the recognition and measurement of U.S. and foreign

unrecognized tax benefits and correlative offsets in current taxes.

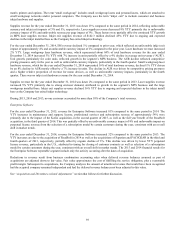

The Company’s effective income tax rate was approximately 40.3%, 29.6% and 29.6% in 2015, 2014 and 2013, respectively. Refer to

Part II, Item 8, Note 14 of the Notes to Consolidated Financial Statements for a reconciliation of the Company’s effective tax rate to

the U.S. statutory rate.

The 10.7 percentage point increase of the effective tax rate from 2014 to 2015 was due to the following factors: current year losses

being recognized in higher tax jurisdictions in 2015, primarily the US; the increased relative impact of the research and development

credit on the 2015 rate versus 2014, statutory impairments of foreign subsidiaries deductible for tax purposes, and taxes on foreign

earnings primarily as a result of year over year differences in pre-tax income on a jurisdiction by jurisdiction basis (most notably

Switzerland and Sweden).

The effective income tax rate was 29.6% for the year ended December 31, 2014. The changes in the composition of the effective tax

rate from 2013 to 2014 was due primarily to statutory impairments of foreign subsidiaries deductible for tax purposes, increases in

valuation allowances, changes in previously accrued taxes, decreases in uncertain tax positions, and taxes on foreign earnings

primarily as a result of year over year differences in pre-tax income on a jurisdiction by jurisdiction basis (most notably Switzerland).

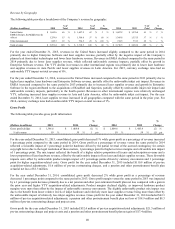

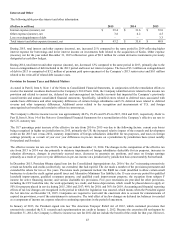

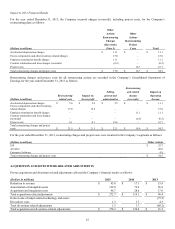

In December 2015, President Obama signed into law the Consolidated Appropriations Act, 2016 (“the Act”) reinstating retroactively

certain tax benefits and credits (collectively, tax extenders) that had expired. The Act made a number of the provisions permanent and

extended the others for two or five years. Provisions made permanent include: the R&D tax credit (modified to allow certain small

businesses to claim the credit against payroll taxes and Alternative Minimum Tax liability); the 15-year recovery period for qualified

leasehold improvements, qualified restaurant property, and qualified retail improvement property; the exception from subpart F

income for active financing income; and various charitable tax provisions. Five-year extensions are provided for other provisions,

including the CFC look-thru rule, the work opportunity tax credit, and bonus depreciation, which would be phased down to apply at:

50% for property placed in service during 2015, 2016 and 2017; 40% for 2018; and 30% for 2019. Accounting and financial reporting

effects of tax law changes are recognized in the period in which the legislation was enacted, which means when the President signed

the Act into law on December 18, 2015. Companies are required to wait until the enactment date to account for reinstatements of

expired tax provisions, even if the reinstatement is retroactive. The total effect of tax law changes on deferred tax balances is recorded

as a component of income tax expense related to continuing operations in the period of enactment.

In January of 2013, the President signed into law The American Taxpayer Relief Act of 2012, which contained provisions that

retroactively extended the U.S. research and experimentation tax credit to January 1, 2012. Because the extension did not happen by

December 31, 2012, the Company’s effective income tax rate for 2012 did not include the benefit of the credit for that year. However,