Lexmark 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

Certain unvested Kofax LTIPs were accelerated as part of the acquisition; the acceleration was deemed to be for the benefit of

Lexmark and constitutes a transaction recognized separately from the business combination. The portion of the payment for these

awards related to service not yet completed was $2.6 million, which was excluded from consideration transferred and was recognized

in Selling, general and administrative on the Company’s Consolidated Statements of Earnings for the year ended December 31, 2015.

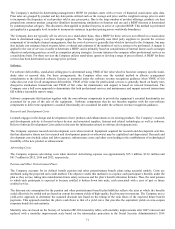

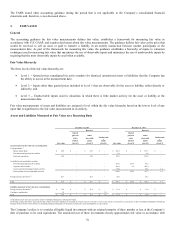

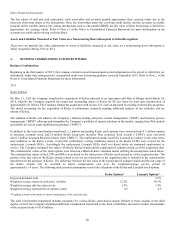

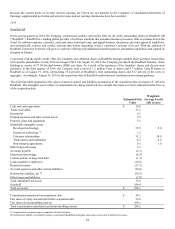

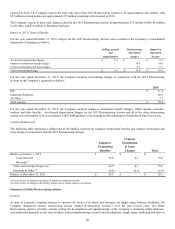

The following table summarizes the consideration transferred to acquire Kofax. The number of issued and outstanding shares of Kofax

was 92,251,889, all of which were acquired by the Company. Amounts shown in the table below include rounding.

Number of Kofax common shares issued and outstanding

92.3

Multiplied by cash consideration per common share outstanding

$

11.00

Cash paid to Kofax shareholders

1,014.7

Liability incurred to former owners of Kofax

5.8

Fair value of Lexmark replacement stock options and RSUs related to pre-combination service

20.0

Reduction for separately recognized transaction

(2.6)

Total consideration transferred

$

1,037.9

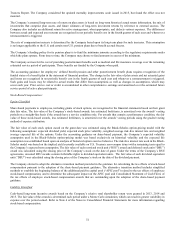

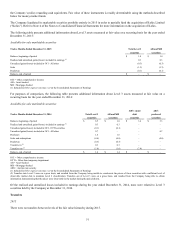

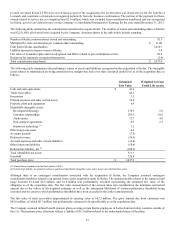

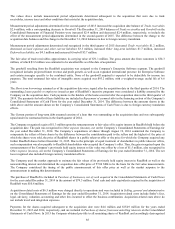

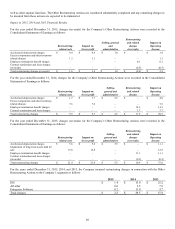

The following table summarizes the preliminary values of assets and liabilities recognized in the acquisition of Kofax. The intangible

assets subject to amortization are being amortized on a straight-line basis over their estimated useful lives as of the acquisition date as

follows.

Estimated

Weighted-Average

Fair Value

Useful Life (years)

Cash and cash equivalents

$

41.6

Trade receivables

42.3

Inventories

1.1

Prepaid expenses and other current assets

16.0

Property, plant and equipment

6.9

Identifiable intangible assets:

Developed technology

178.5

5.0

Customer relationships

205.2

10.0

Trade names

12.7

4.0

Non-compete agreements

0.9

2.2

In-process technology (1)

1.5

Other long-term assets

4.4

Accounts payable

(7.5)

Deferred revenue

(39.6)

Accrued expenses and other current liabilities

(31.4)

Other long-term liabilities

(18.6)

Deferred tax liability, net (2)

(100.9)

Total identifiable net assets

313.1

Goodwill

724.8

Total purchase price

$

1,037.9

(1) Amortization commenced in the third quarter of 2015.

(2) Deferred tax liability, net primarily relates to purchased identifiable intangible assets and is shown net of deferred tax assets.

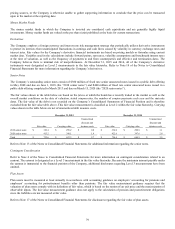

Although there is no contingent consideration associated with the acquisition of Kofax, the Company assumed contingent

consideration liabilities related to an earnout from a prior acquisition made by Kofax. The amount payable related to the earnout could

range between $1.0 and $2.2 million, and $1.0 million was preliminarily recorded representing the estimated fair value of the

obligation as of the acquisition date. The fair value measurement of the earnout takes into consideration the minimum contractual

amount due to the sellers of the acquired company as well as the anticipated likelihood of certain performance thresholds being

exceeded and the extent to which performance thresholds have been exceeded in the earlier earnout periods.

The fair value of trade receivables approximated its carrying value of $42.3 million. The gross amount due from customers was

$43.0 million, of which $0.7 million was preliminarily estimated to be uncollectible as of the acquisition date.

The Company assumed defined benefit pension plans covering certain Kofax employees in Switzerland and other countries outside of

the U.S. The purchase price allocation reflects a liability of $5.5 million related to the underfunded status of the plans.