Lexmark 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

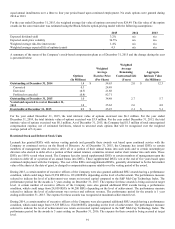

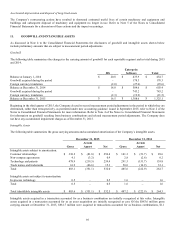

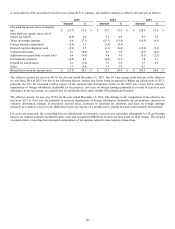

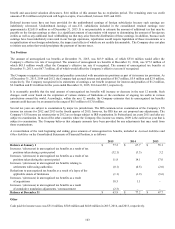

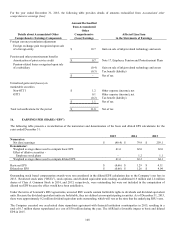

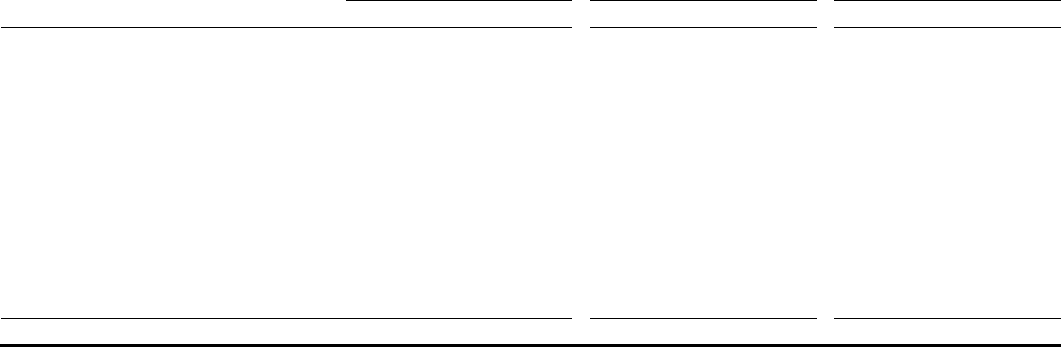

A reconciliation of the provision for income taxes using the U.S. statutory rate and the Company’s effective tax rate was as follows:

2015

2014

2013

Amount

%

Amount

%

Amount

%

Provision for income taxes at statutory

rate

$

(23.7)

35.0

%

$

39.7

35.0

%

$

128.9

35.0

%

State and local income taxes, net of

federal tax benefit

(4.5)

6.6

5.1

4.5

9.3

2.5

Taxes on foreign earnings

4.8

(7.1)

(13.3)

(11.8)

(16.5)

(4.5)

Foreign statutory impairment

(2.0)

2.9

(2.4)

(2.0)

–

–

Research and development credit

(5.9)

8.7

(6.9)

(6.0)

(12.2)

(3.3)

Valuation allowance

0.3

(0.4)

4.3

3.8

(0.7)

(0.2)

Adjustments to previously accrued taxes

0.6

(0.9)

6.6

5.8

(9.1)

(2.5)

Uncertain tax positions

(0.4)

0.6

(4.2)

(3.7)

7.8

2.1

Prepaid tax amortization

2.2

(3.2)

2.3

2.0

1.7

0.5

Other

1.3

(1.9)

2.3

2.0

0.1

–

(Benefit) provision for income taxes

$

(27.3)

40.3

%

$

33.5

29.6

%

$

109.3

29.6

%

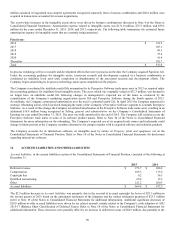

The effective income tax rate was 40.3% for the year ended December 31, 2015. The 10.7 percentage point increase of the effective

tax rate from 2014 to 2015 was due to the following factors: current year losses being recognized in higher tax jurisdictions in 2015,

primarily the US; the increased relative impact of the research and development credit on the 2015 rate versus 2014, statutory

impairments of foreign subsidiaries deductible for tax purposes, and taxes on foreign earnings primarily as a result of year over year

differences in pre-tax income on a jurisdiction by jurisdiction basis (most notably Switzerland and Sweden).

The effective income tax rate was 29.6% for the year ended December 31, 2014. The changes in the composition of the effective tax

rate from 2013 to 2014 was due primarily to statutory impairments of foreign subsidiaries deductible for tax purposes, increases in

valuation allowances, changes in previously accrued taxes, decreases in uncertain tax positions, and taxes on foreign earnings

primarily as a result of year over year differences in pre-tax income on a jurisdiction by jurisdiction basis (most notably Switzerland).

For each year presented, the reconciling item for adjustments to previously accrued taxes represents adjustments to US and foreign

income tax expense amounts recorded in prior years and recognized differences in taxes accrued based on filed returns. The prepaid

tax amortization reconciling item represents amortization of tax expense related to intercompany transactions.