Lexmark 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

assessment of variability in pricing by comparison to independent source(s) of pricing, and

back-testing of transactions to determine historical accuracy of net asset value per share/unit as an exit price.

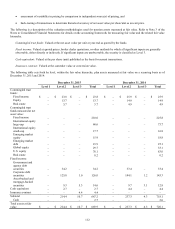

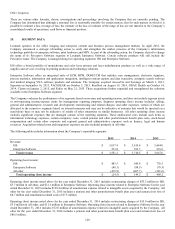

The following is a description of the valuation methodologies used for pension assets measured at fair value. Refer to Note 3 of the

Notes to Consolidated Financial Statements for details on the accounting framework for measuring fair value and the related fair value

hierarchy.

Commingled trust funds: Valued at the net asset value per unit at year end as quoted by the funds.

Fixed income: Valued at quoted prices, broker dealer quotations, or other methods by which all significant inputs are generally

observable, either directly or indirectly. If significant inputs are unobservable, the security is classified as Level 3.

Cash equivalent: Valued at the per share (unit) published as the basis for current transactions.

Insurance contract: Valued at the surrender value or conversion value.

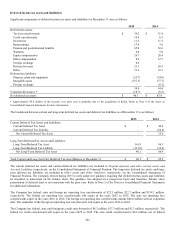

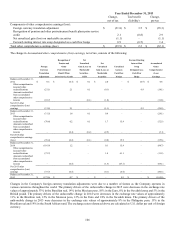

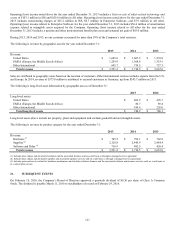

The following table sets forth by level, within the fair value hierarchy, plan assets measured at fair value on a recurring basis as of

December 31, 2015 and 2014:

December 31, 2015

December 31, 2014

Level 1

Level 2

Level 3

Total

Level 1

Level 2

Level 3

Total

Commingled trust

funds:

Fixed income

$

–

$

23.8

$

–

$

23.8

$

–

$

25.9

$

–

$

25.9

Equity

–

13.7

–

13.7

–

14.9

–

14.9

Real estate

–

5.7

–

5.7

–

4.9

–

4.9

Commingled trust

funds measured at net

asset value:

Fixed income

–

–

–

210.0

–

–

–

225.8

International equity

large-cap

–

–

–

68.6

–

–

–

73.7

International equity

small-cap

–

–

–

17.7

–

–

–

16.8

Emerging market

equity

–

–

–

15.9

–

–

–

18.8

Emerging market

debt

–

–

–

23.9

–

–

–

25.1

Global equity

–

–

–

29.7

–

–

–

33.1

U.S. equity

–

–

–

76.1

–

–

–

83.0

Real estate

–

–

–

0.2

–

–

–

0.2

Fixed income:

Government and

agency debt

securities

–

34.2

–

34.2

–

33.4

–

33.4

Corporate debt

securities

–

125.0

1.0

126.0

–

144.1

1.2

145.3

Asset-backed and

mortgage-backed

securities

–

9.3

5.3

14.6

–

9.7

3.1

12.8

Cash equivalent

–

2.7

–

2.7

–

4.4

–

4.4

Insurance contract

–

–

4.4

4.4

–

–

–

–

Subtotal

–

214.4

10.7

667.2

–

237.3

4.3

718.1

Cash

–

–

–

2.7

–

–

–

2.0

Total assets at fair

value

$

–

$

214.4

$

10.7

$

669.9

$

–

$

237.3

$

4.3

$

720.1