Lexmark 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

Consolidated Statements of Financial Position at its fair value, and gains and losses that were recorded in Accumulated other

comprehensive loss are recognized immediately in earnings. In all other situations in which hedge accounting is discontinued, the

derivative will be carried at its fair value on the Consolidated Statements of Financial Position, with changes in its fair value

recognized in current period earnings.

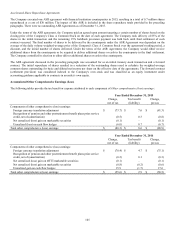

Fair Value Hedges

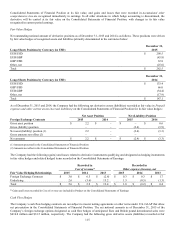

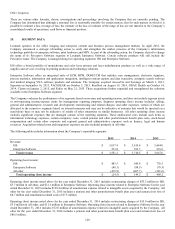

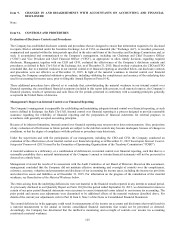

Net outstanding notional amount of derivative positions as of December 31, 2015 and 2014 is as follows. These positions were driven

by fair value hedges of recognized assets and liabilities primarily denominated in the currencies below:

December 31,

Long (Short) Positions by Currency (in USD)

2015

EUR/USD

$

298.5

EUR/GBP

(43.8)

GBP/USD

32.8

Other, net

(25.0)

Total

$

262.5

December 31,

Long (Short) Positions by Currency (in USD)

2014

EUR/USD

$

133.4

GBP/USD

66.0

EUR/GBP

(34.4)

Other, net

(17.9)

Total

$

147.1

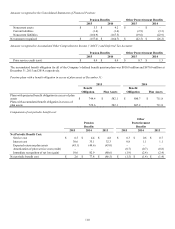

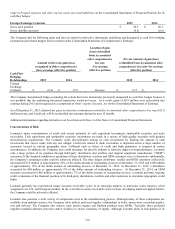

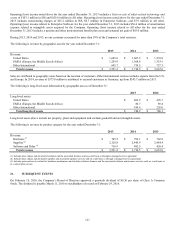

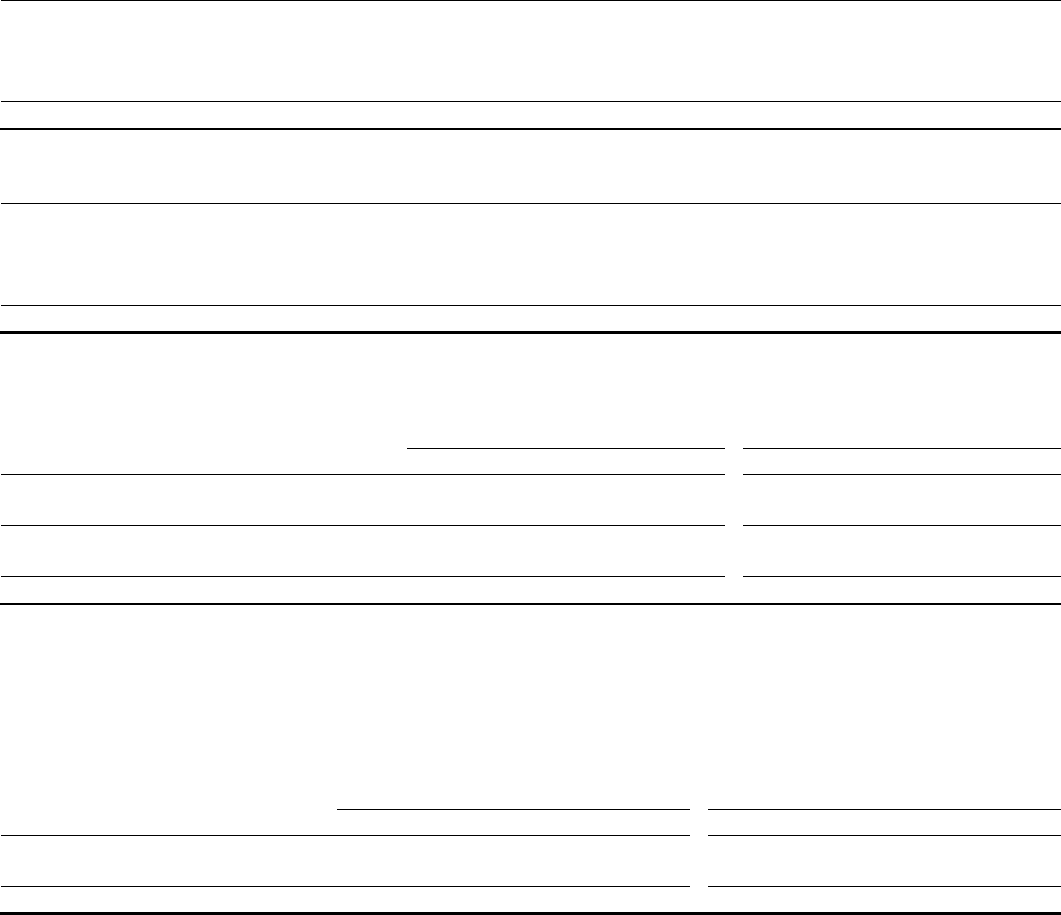

As of December 31, 2015 and 2014, the Company had the following net derivative assets (liabilities) recorded at fair value in Prepaid

expenses and other current assets (Accrued liabilities) on the Consolidated Statements of Financial Position for its fair value hedges:

Net Asset Position

Net (Liability) Position

Foreign Exchange Contracts

2015

2014

2015

2014

Gross asset position

$

2.2

$

–

$

–

$

0.6

Gross (liability) position

–

–

(2.4)

(3.9)

Net asset (liability) position (1)

2.2

–

(2.4)

(3.3)

Gross amounts not offset (2)

–

–

–

–

Net amounts

$

2.2

$

–

$

(2.4)

$

(3.3)

(1) Amounts presented in the Consolidated Statements of Financial Position

(2) Amounts not offset in the Consolidated Statements of Financial Position

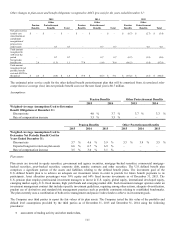

The Company had the following (gains) and losses related to derivative instruments qualifying and designated as hedging instruments

in fair value hedges and related hedged items recorded on the Consolidated Statements of Earnings:

Recorded in

Recorded in

Cost of revenue*

Other expense (income), net

Fair Value Hedging Relationships

2015

2014

2013

2015

2014

2013

Foreign Exchange Contracts

$

3.0

$

6.5

$

(2.8)

$

0.3

$

0.3

$

1.7

Underlying

2.6

(3.6)

15.2

1.5

(0.5)

(1.3)

Total

$

5.6

$

2.9

$

12.4

$

1.8

$

(0.2)

$

0.4

* Gains and losses recorded in Cost of revenue are included in Product on the Consolidated Statements of Earnings

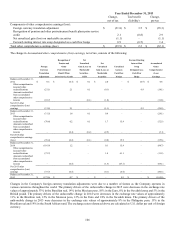

Cash Flow Hedges

The Company’s cash flow hedging contracts are not subject to master netting agreements or other terms under U.S. GAAP that allow

net presentation in the Consolidated Statements of Financial Position. The net notional amounts as of December 31, 2015 of the

Company’s foreign exchange options designated as cash flow hedges of anticipated Euro and British pound denominated sales were

$616.0 million and $33.5 million, respectively. The Company had the following gross derivative assets (liabilities) recorded at fair