Lexmark 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

The outstanding balance of the revolving credit facility was $288.0 million as of December 31, 2015. There was no balance

outstanding under the revolving credit facility as of December 31, 2014. The average daily balance under the revolving credit facility

during 2015 and 2014 was $182.2 million and $0.8 million, respectively.

Uncommitted Revolving Credit Facility

On June 10, 2015, the Company entered into an agreement for an uncommitted revolving credit facility. Under this agreement, the

Company may borrow up to a total of $100.0 million. There were no outstanding borrowings under the uncommitted revolving credit

facility at December 31, 2015. The average daily balance under the uncommitted revolving credit facility since its inception was $36.8

million.

Credit Ratings and Other Information

The Company’s credit ratings by Standard & Poor’s Ratings Services, Moody’s Investors Service, Inc. and Fitch Rating, Inc. are

BBB-, Baa3 and BBB-, respectively. The ratings remain investment grade.

The Company’s credit rating can be influenced by a number of factors, including overall economic conditions, demand for the

Company’s products and services and ability to generate sufficient cash flow to service the Company’s debt. A downgrade in the

Company’s credit rating to non-investment grade would decrease the maximum availability under its trade receivables facility,

potentially increase the cost of borrowing under the revolving credit facility and increase the coupon payments on the Company’s

public debt, and likely have an adverse effect on the Company’s ability to obtain access to new financings in the future. The Company

does not have any rating downgrade triggers that accelerate the maturity dates of its Facility or public debt.

The Company was in compliance with all covenants and other requirements set forth in its debt agreements at December 31, 2015.

The Company believes that it is reasonably likely that it will continue to be in compliance with such covenants in the near future.

Off-Balance Sheet Arrangements

At December 31, 2015, the Company had no off-balance sheet arrangements that have, or are reasonably likely to have, a material

current or future effect on financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity,

capital expenditures or capital resources. Refer to Note 19 of the Notes to Consolidated Financial Statements for information

regarding the Company’s future minimum lease rentals under the terms of non-cancelable operating leases.

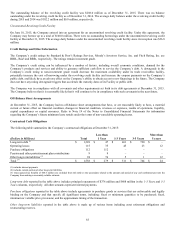

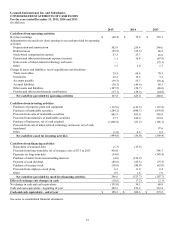

Contractual Cash Obligations

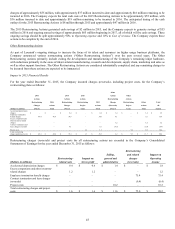

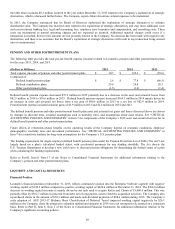

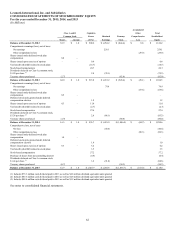

The following table summarizes the Company’s contractual obligations at December 31, 2015:

Less than

More than

(Dollars in Millions)

Total

1 Year

1-3 Years

3-5 Years

5 years

Long-term debt (1)

$

1,228

$

47

$

461

$

720

$

–

Operating leases

115

35

45

23

12

Purchase obligations

112

112

–

–

–

Pension and other postretirement plan contributions

9

9

–

–

–

Other long-term liabilities (2)

94

76

5

1

12

Total (3)

$

1,558

$

279

$

511

$

744

$

24

(1) includes interest payments

(2) includes current portion of other long-term liabilities

(3) Unrecognized tax benefits of $64.6 million are excluded from this table as the uncertainty related to the amount and period of any cash settlement prevents the

Company from making a reasonably reliable estimate.

Long-term debt reported in the table above includes principal repayments of $376 million and $688 million in the 1-3 Years and 3-5

Years columns, respectively. All other amounts represent interest payments.

Purchase obligations reported in the table above include agreements to purchase goods or services that are enforceable and legally

binding on the Company and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed,

minimum or variable price provisions; and the approximate timing of the transaction.

Other long-term liabilities reported in the table above is made up of various items including asset retirement obligations and

restructuring reserves.