Lexmark 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82

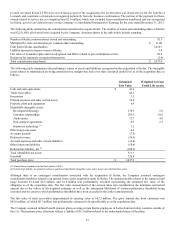

The goodwill resulting from the Kofax acquisition was assigned to the Company’s Enterprise Software (formerly Perceptive Software)

segment, and represents future revenue and profit growth related to future product development and expansion of the customer base of

the combined entity. Refer to Note 20 of the Notes to Consolidated Financial Statements for more information on the name of the

segment. Of the goodwill resulting from the acquisition, $5.8 million is preliminarily expected to be deductible for income tax

purposes.

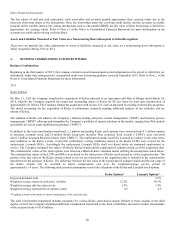

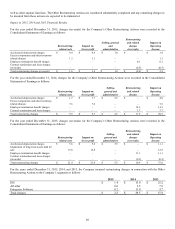

The total estimated fair value of intangible assets acquired was $398.8 million, with a weighted-average useful life of 7.5 years.

Developed technology assets and customer relationship assets related to bug fixes were valued using the multi-period excess earnings

method under the income approach, which estimates the value of the intangible assets by calculating the present value of the

incremental after-tax cash flows, or excess earnings, attributable solely to the assets over the estimated periods that they generate

revenues. After-tax cash flows were calculated by applying cost, expense, income tax, and contributory asset charge assumptions. The

remaining customer relationship assets were valued using the with or without method under the income approach, which estimates the

value of the intangible asset by quantifying the lost profits under a hypothetical condition where the customer relationships no longer

exist immediately following the acquisition and must be re-created. Trade name assets were valued using the relief from royalty

method under the income approach, which estimates the value of the intangible asset by discounting to fair value the hypothetical

royalty payments a market participant would be willing to pay to enjoy the benefits of the assets.

A change to the acquisition date value of the identifiable net assets during the measurement period (up to one year from the acquisition

date) will affect the amount of the purchase price allocated to goodwill. The values in the table above include measurement period

adjustments determined in 2015 that were based on information obtained subsequent to the acquisition related to conditions that

existed at the acquisition date. Measurement period adjustments related to the Company’s acquisition of Kofax were recognized in the

periods in which they were determined.

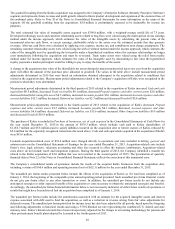

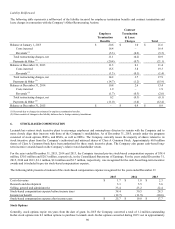

Measurement period adjustments determined in the third quarter of 2015 related to the acquisition of Kofax increased Cash and cash

equivalents $0.5 million, decreased Trade receivables $0.1 million, decreased Prepaid expenses and other current assets $2.0 million,

decreased Identifiable intangible assets $4.3 million, increased Accounts payable $0.1 million, decreased Accrued expenses and other

current liabilities $15.3 million, decreased Deferred tax liability, net $2.3 million and decreased Goodwill $5.8 million.

Measurement period adjustments determined in the fourth quarter of 2015 related to the acquisition of Kofax decreased Prepaid

expenses and other current assets $1.5 million, increased Accounts payable $0.1 million, decreased Accrued expenses and other

current liabilities $6.8 million, decreased Deferred tax liability, net $15.6 million, increased Other long-term liabilities $9.9 million

and decreased Goodwill $10.9 million.

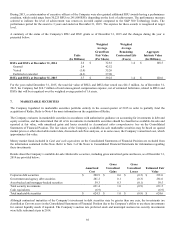

The purchase of Kofax is included in Purchase of businesses, net of cash acquired in the Consolidated Statements of Cash Flows for

the year ended December 31, 2015 in the amount of $976.3 million, which includes cash paid to Kofax shareholders of

$1,014.7 million and $5.8 million paid to satisfy liabilities incurred on the acquisition date to former owners of Kofax, reduced by

$2.6 million for the separately recognized transaction discussed above. Cash and cash equivalents acquired in the acquisition of Kofax

were $41.6 million.

Lexmark acquisition-related costs of $18.4 million were charged directly to operations and were included in Selling, general and

administrative on the Consolidated Statements of Earnings for the year ended December 31, 2015. Acquisition-related costs include

finder’s fees, legal, advisory, valuation, accounting and other fees incurred to effect the business combination. Acquisition-related

costs above do not include travel and integration expenses. During the third quarter of 2015, the Company identified a transfer tax

related to the Kofax acquisition of $3.0 million that was not recorded in the second quarter of 2015. The presentation of quarterly

financial data in Note 22 of the Notes to Consolidated Financial Statements reflects the correction of this immaterial error.

The Company’s consolidated results of operations include the results of the acquired Kofax businesses from the acquisition date,

including, revenue of $160.6 million and operating income (loss) of $(52.1) million for the year ended December 31, 2015.

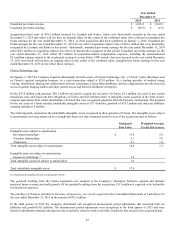

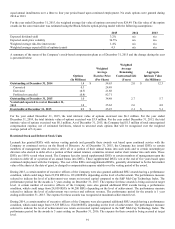

The unaudited pro forma results presented below include the effects of the acquisition of Kofax as if it had been completed as of

January 1, 2014, the beginning of the comparable prior annual reporting period presented. Such unaudited pro forma financial results

do not give pro forma effect to any other transaction or event. In addition, the unaudited pro forma results do not include any

anticipated synergies or other expected benefits of the acquisition or costs necessary to obtain the anticipated synergies and benefits.

Accordingly, the unaudited pro forma financial information below is not necessarily indicative of either future results of operations or

results that might have been achieved had the acquisition been completed as of January 1, 2014.

The unaudited pro forma results include the amortization associated with an estimate for the acquired intangible assets and interest

expense associated with debt used to fund the acquisition, as well as a reduction in revenue arising from fair value adjustments for

deferred revenue. The unaudited pro forma provision for income taxes has also been adjusted for all periods, based upon the foregoing

and following adjustments to historical results and using a 37.8% blended tax rate representing the combined U.S. federal and state

statutory rates. Kofax’s historical results have been retrospectively adjusted for the change in accounting methodology for pension and

other postretirement benefit plans adopted by Lexmark in the fourth quarter of 2013.