Lexmark 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

Lexmark International, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular Dollars in Millions, Except Per Share Amounts)

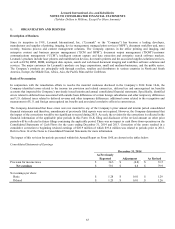

1. ORGANIZATION AND BUSINESS

Description of Business

Since its inception in 1991, Lexmark International, Inc. (“Lexmark” or the “Company”) has become a leading developer,

manufacturer and supplier of printing, imaging, device management, managed print services (“MPS”), document workflow and, more

recently, business process and content management solutions. The Company operates in the office printing and imaging, and

enterprise content and business process management (“ECM and BPM”), document output management (“DOM”)/customer

communications management (“CCM”), intelligent content capture and data extraction and enterprise search software markets.

Lexmark’s products include laser printers and multifunction devices, dot matrix printers and the associated supplies/solutions/services,

as well as ECM, BPM, DOM, intelligent data capture, search and web-based document imaging and workflow software solutions and

services. The major customers for Lexmark’s products are large corporations, small and medium businesses, and the public sector.

The Company’s products are principally sold through resellers, retailers and distributors in various countries in North and South

America, Europe, the Middle East, Africa, Asia, the Pacific Rim and the Caribbean.

Basis of Presentation

In conjunction with the remediation efforts to resolve the material weakness disclosed in the Company’s 2014 Form 10-K, the

Company identified errors related to the income tax provision and related current tax, deferred tax and unrecognized tax benefits

accounts that impacted the Company’s previously issued interim and annual consolidated financial statements. Specifically, identified

errors related to deferred taxes associated with outside basis differences of certain foreign subsidiaries and other temporary differences

and U.S. deferred taxes related to deferred revenue and other temporary differences; additional errors related to the recognition and

measurement of U.S. and foreign unrecognized tax benefits and associated correlative offsets in current taxes.

The Company determined that these errors were not material to any of the Company’s prior annual and interim period consolidated

financial statements and therefore, amendments of previously filed reports were not required. However, the Company determined that

the impact of the corrections would be too significant to record during 2015. As such, the revision for the corrections is reflected in the

financial information of the applicable prior periods in this Form 10-K filing and disclosure of the revised amount on other prior

periods will be reflected in future filings containing the applicable period. There was no impact to cash flows from operations on the

Consolidated Statements of Cash Flows for the years ending December 31, 2014 and 2013. Correction of the errors resulted in a

cumulative correction to beginning retained earnings of $20.9 million of which $19.4 million was related to periods prior to 2012.

Refer to Note 14 of the Notes to Consolidated Financial Statements for more information.

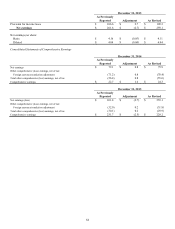

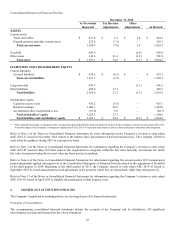

The impact of this revision for periods presented within this Annual Report on Form 10-K are shown in the tables below:

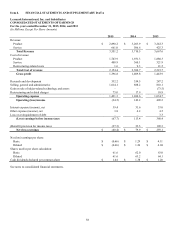

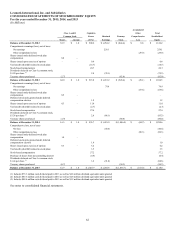

Consolidated Statements of Earnings

December 31, 2014

As Previously

Reported

Adjustment

As Revised

Provision for income taxes

$

34.3

$

(0.8)

$

33.5

Net earnings

$

79.1

$

0.8

$

79.9

Net earnings per share:

Basic

$

1.28

$

0.01

$

1.29

Diluted

$

1.25

$

0.01

$

1.26