Lexmark 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

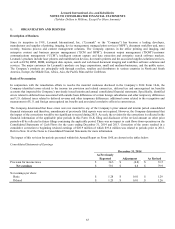

Inventories:

Inventories are stated at the lower of average cost or market, using standard cost which approximates the average cost method of

valuing its inventories and related cost of goods sold.

Lexmark writes down its inventory for estimated obsolescence or unmarketable inventory by an amount equal to the difference

between the cost of inventory and the estimated market value. The Company estimates the difference between the cost of obsolete or

unmarketable inventory and its market value based upon product demand requirements, product life cycle, product pricing and quality

issues. Also, Lexmark records an adverse purchase commitment liability when anticipated market sales prices are lower than

committed costs.

Property, Plant and Equipment:

Property, plant and equipment are stated at cost and depreciated over their estimated useful lives using the straight-line method. The

Company capitalizes interest related to the construction of certain fixed assets if the effect of capitalization is deemed material.

Property, plant and equipment accounts are relieved of the cost and related accumulated depreciation when assets are disposed of or

otherwise retired. Gains or losses on the dispositions of property, plant and equipment are included in the Consolidated Statements of

Earnings.

Internal-Use Software Costs:

Lexmark capitalizes direct costs incurred during the application development and implementation stages for developing, purchasing,

or otherwise acquiring software for internal use. These software costs are included in Property, plant and equipment, net, on the

Consolidated Statements of Financial Position and are amortized over the estimated useful life of the software. All costs incurred

during the preliminary project stage are expensed as incurred.

Software Development Costs:

Software development costs incurred subsequent to a product establishing technological feasibility are usually not significant. As

such, Lexmark capitalizes a limited amount of costs for software to be sold, leased or otherwise marketed.

Business Combinations:

The financial results of the businesses that Lexmark has acquired are included in the Company’s consolidated financial results based

on the respective dates of the acquisitions. The Company allocates the purchase consideration to the identifiable assets acquired and

liabilities assumed in the business combination based on their acquisition-date fair values (with certain limited exceptions). The excess

of the purchase consideration over the amounts assigned to the identifiable assets and liabilities is recognized as goodwill. Factors

giving rise to goodwill generally include synergies that are anticipated as a result of the business combination, including enhanced

product and service offerings and access to new customers. The fair values of identifiable intangible assets acquired in business

combinations are generally determined using an income approach, requiring financial forecasts and estimates as well as market

participant assumptions.

Goodwill and Intangible Assets:

Lexmark assesses its goodwill and indefinite-lived intangible assets for impairment annually as of December 31 or between annual

tests if an event occurs or circumstances change that lead management to believe it is more likely than not that an impairment exists.

Examples of such events or circumstances include a deterioration in general economic conditions, increased competitive environment,

or a decline in overall financial performance of the Company. Goodwill is tested at the reporting unit level, which is an operating

segment or one level below an operating segment (a “component”) if the component constitutes a business for which discrete financial

information is available and regularly reviewed by segment management. Components are aggregated as a single reporting unit if they

have similar economic characteristics. The Company’s operating segments are ISS and Enterprise Software; the Company’s reporting

units and reportable segments are consistent with these operating segments. Goodwill is assigned to reporting units of the Company

that are expected to benefit from the synergies of the related acquisition.

Although the qualitative assessment for goodwill impairment testing is available to Lexmark, the Company performed a quantitative

test of impairment in 2015 and 2014. To estimate fair value for goodwill impairment testing, the Company generally considers both a

discounted cash flow analysis, which requires judgments such as projected future earnings and weighted average cost of capital, as

well as certain market-based measurements, including multiples developed from prices paid in observed market transactions of

comparable companies. In estimating the fair value of its Enterprise Software reporting unit, the Company used an equally-weighted

measure based on a discounted cash flow analysis and certain market-based measurements. In estimating the fair value of its ISS

reporting unit, the Company used a discounted cash flow analysis.