Lexmark 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

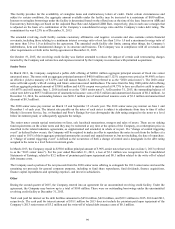

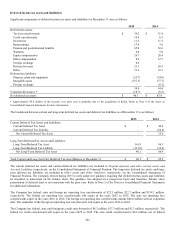

benefit and associated valuation allowances. $4.6 million of this amount has no expiration period. The remaining state tax credit

amount of $3.6 million carryforward will begin to expire, if not utilized, between 2023 and 2030.

Deferred income taxes have not been provided for the undistributed earnings of foreign subsidiaries because such earnings are

indefinitely reinvested. Undistributed earnings of non-U.S. subsidiaries included in the consolidated retained earnings were

approximately $2,651.0 million as of December 31, 2015. It is not practicable to estimate the amount of additional tax that may be

payable on the foreign earnings as there is a significant amount of uncertainty with respect to determining the amount of foreign tax

credits as well as any additional local withholding tax that may arise from the distribution of these earnings. In addition, because such

earnings have been indefinitely reinvested in our foreign operations, repatriation would require liquidation of those investments or a

recapitalization of our foreign subsidiaries, the impact and effects of which are not readily determinable. The Company does not plan

to initiate any action that would precipitate the payment of income taxes.

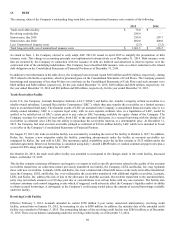

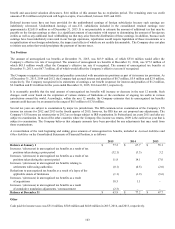

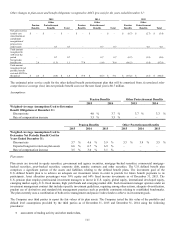

Tax Positions

The amount of unrecognized tax benefits at December 31, 2015, was $63.9 million, of which $53.8 million would affect the

Company’s effective tax rate if recognized. The amount of unrecognized tax benefits at December 31, 2014, was $77.2 million of

which $45.5 million would affect the Company’s effective tax rate if recognized. The amount of unrecognized tax benefits at

December 31, 2013, was $67.7 million, all of which would affect the Company’s effective tax rate if recognized.

The Company recognizes accrued interest and penalties associated with uncertain tax positions as part of its income tax provision. As

of December 31, 2015, 2014 and 2013, the Company had accrued interest and penalties of $8.7 million, $5.9 million and $2.9 million,

respectively. The Company recognized in its statements of earnings a net benefit (expense) for interest and penalties of $1.2 million,

$2.0 million and $1.0 million for the years ended December 31, 2015, 2014 and 2013, respectively.

It is reasonably possible that the total amount of unrecognized tax benefits will increase or decrease in the next 12 months. Such

changes could occur based on the expiration of various statutes of limitations or the conclusion of ongoing tax audits in various

jurisdictions around the world. Accordingly, within the next 12 months, the Company estimates that its unrecognized tax benefits

amount could decrease by an amount in the range of $0.5 million to $13.0 million.

Several tax years are subject to examination by major tax jurisdictions. The IRS commenced an examination of the Company’s US

income tax returns for 2012 and 2013 in the fourth quarter of 2015; however, the IRS has not yet proposed any adjustments. The

Company’s US income tax returns prior to 2012 are no longer subject to IRS examination. In Switzerland, tax years 2011 and after are

subject to examination. In most of the other countries where the Company files income tax returns, 2009 is the earliest tax year that is

subject to examination. The Company believes that adequate amounts have been provided for any adjustments that may result from

those examinations.

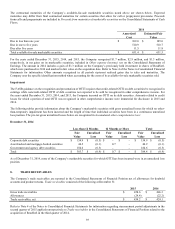

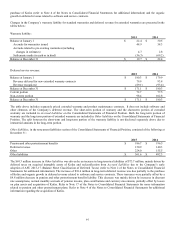

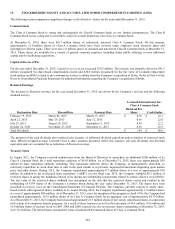

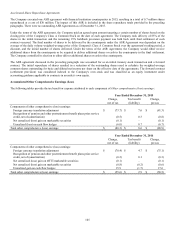

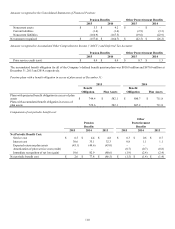

A reconciliation of the total beginning and ending gross amounts of unrecognized tax benefits, included in Accrued liabilities and

Other liabilities on the Consolidated Statements of Financial Position, is as follows:

2015

2014

2013

Balance at January 1

$

77.2

$

67.7

$

55.1

Increases / (decreases) in unrecognized tax benefits as a result of tax

positions taken during a prior period

(32.1)

(3.3)

3.2

Increases / (decreases) in unrecognized tax benefits as a result of tax

positions taken during the current period

11.8

14.1

17.0

Increases / (decreases) in unrecognized tax benefits relating to

settlements with taxing authorities

(0.1)

(0.5)

(2.0)

Reductions to unrecognized tax benefits as a result of a lapse of the

applicable statute of limitations

(1.1)

(1.9)

(5.6)

Increases / (decreases) in unrecognized tax benefits as a result

of acquisitions

10.5

1.1

–

Increases / (decreases) in unrecognized tax benefits as a result

of cumulative translation adjustments / remeasurement

(2.3)

–

–

Balance at December 31

$

63.9

$

77.2

$

67.7

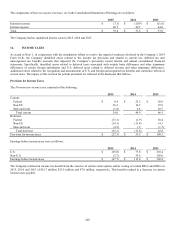

Other

Cash paid for income taxes was $51.8 million, $50.8 million and $60.8 million in 2015, 2014, and 2013, respectively.