Lexmark 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

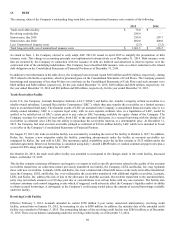

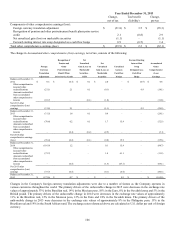

15. STOCKHOLDERS’ EQUITY AND ACCUMULATED OTHER COMPREHENSIVE EARNINGS (LOSS)

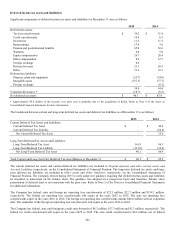

The following section summarizes significant changes in Stockholders’ Equity for the year ended December 31, 2015.

Common Stock

The Class A Common Stock is voting and exchangeable for Class B Common Stock in very limited circumstances. The Class B

Common Stock is non-voting and is convertible, subject to certain limitations, into Class A Common Stock.

At December 31, 2015, there were 801.7 million shares of authorized, unissued Class A Common Stock. Of this amount,

approximately 12.0 million shares of Class A Common Stock have been reserved under employee stock incentive plans and

nonemployee director plans. There were also 1.8 million shares of unissued and unreserved Class B Common Stock at December 31,

2015. These shares are available for a variety of general corporate purposes, including future public offerings to raise additional

capital and for facilitating acquisitions.

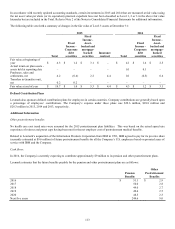

Capital in Excess of Par

For the year ended December 31, 2015, Capital in excess of par increased $70.2 million. The increase was primarily driven by $41.5

million recognized for share-based compensation awards and $20.0 million recognized for the fair value of Lexmark replacement

stock options and RSUs related to pre-combination services resulting from the Company’s acquisition of Kofax. Refer to Note 4 of the

Notes to Consolidated Financial Statements for additional information regarding the Company’s acquisition of Kofax.

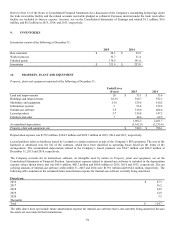

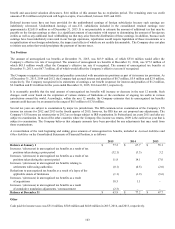

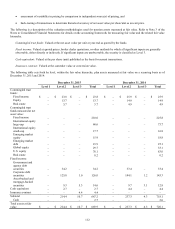

Retained Earnings

The decrease in Retained earnings for the year ended December 31, 2015 was driven by the Company’s net loss and the following

dividend activity:

Lexmark International, Inc.

Class A Common Stock

Declaration Date

Record Date

Payment Date

Dividend Per

Share

Cash Outlay

February 19, 2015

March 02, 2015

March 13, 2015

$

0.36

$

22.1

April 21, 2015

May 29, 2015

June 12, 2015

0.36

22.0

July 23, 2015

August 28, 2015

September 11, 2015

0.36

22.2

October 22, 2015

November 27, 2015

December 11, 2015

0.36

22.3

Total Dividends

$

1.44

$

88.6

The payment of the cash dividends also resulted in the issuance of additional dividend equivalent units to holders of restricted stock

units. Diluted weighted-average Lexmark Class A share amounts presented reflect this issuance. All cash dividends and dividend

equivalent units are accounted for as reductions of Retained earnings.

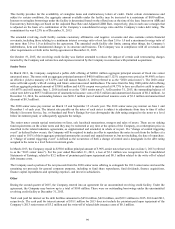

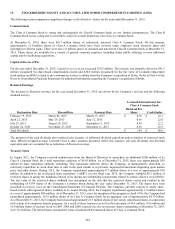

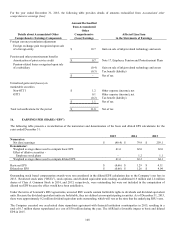

Treasury Stock

In August 2012, the Company received authorization from the Board of Directors to repurchase an additional $200 million of its

Class A Common Stock for a total repurchase authority of $4.85 billion. As of December 31, 2015, there was approximately $59

million of share repurchase authority remaining. This repurchase authority allows the Company, at management’s discretion, to

selectively repurchase its stock from time to time in the open market or in privately negotiated transactions depending upon market

price and other factors. During 2015, the Company repurchased approximately 0.7 million shares at a cost of approximately $30

million. In addition to the accelerated share repurchase (“ASR”) cost for fiscal year 2015, the Company withheld $0.3 million of

restricted shares to satisfy the minimum amount of its income tax withholding requirements related to certain officer’s vested RSUs.

The fair value of the restricted shares withheld was determined on the date that the restricted shares vested and resulted in the

withholding of 9,939 shares of the Company’s Common Stock during the year ended December 31, 2015. The shares have been

classified as treasury stock on the Consolidated Statements of Financial Position. The Company currently expects to satisfy share-

based awards with registered shares available to be issued. During 2014, the Company repurchased approximately 1.9 million shares

at a cost of approximately $80 million. As of December 31, 2015, since the inception of the program in April 1996, the Company had

repurchased approximately 112.9 million shares of its Class A Common Stock for an aggregate cost of approximately $4.79 billion.

As of December 31, 2015, the Company had reissued approximately 0.5 million shares of previously repurchased shares in connection

with certain of its employee benefit programs. As a result of these issuances as well as the retirement of 44.0 million, 16.0 million and

16.0 million shares of treasury stock in 2005, 2006 and 2008, respectively, the net treasury shares outstanding at December 31, 2015,

were 36.4 million. The retired shares resumed the status of authorized but unissued shares of Class A Common Stock.