Lexmark 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

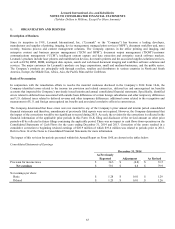

Use of Estimates:

The preparation of consolidated financial statements in conformity with accounting principles generally accepted (“GAAP”) in the

United States of America (“U.S.”) requires management to make estimates and judgments that affect the reported amounts of assets,

liabilities, revenue and expenses, as well as disclosures regarding contingencies. On an ongoing basis, the Company evaluates its

estimates, including those related to customer programs and incentives, product returns, doubtful accounts, inventories, stock-based

compensation, goodwill, intangible assets, income taxes, warranty obligations, restructurings, pension and other postretirement

benefits, contingencies and litigation, long-lived assets, and fair values that are based on unobservable inputs significant to the overall

measurement. Lexmark bases its estimates on historical experience, market conditions, and various other assumptions that are

believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values

of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different

assumptions or conditions.

Foreign Currency Translation and Remeasurement:

Assets and liabilities of non-U.S. subsidiaries that operate in a local currency environment are translated into U.S. dollars at period-

end exchange rates. Income and expense accounts are translated at average exchange rates prevailing during the period. Adjustments

arising from the translation of assets and liabilities, changes in stockholders’ equity and results of operations are accumulated as a

separate component of Accumulated other comprehensive earnings (loss) in stockholders’ equity.

Certain non-U.S. subsidiaries use the U.S. dollar as their functional currency. Local currency transactions of these subsidiaries are

remeasured using a combination of current and historical exchange rates. The effect of re-measurement is included in net earnings.

Cash Equivalents:

All highly liquid investments with an original maturity of three months or less at the Company’s date of purchase are considered to be

cash equivalents.

Fair Value:

The Company generally uses a market approach, when practicable, in valuing financial instruments. In certain instances, when

observable market data are lacking, the Company uses valuation techniques consistent with the income approach whereby future cash

flows are converted to a single discounted amount. The Company uses multiple sources of pricing as well as trading and other market

data in its process of reporting fair values and testing default level assumptions. The Company assesses the quantity of pricing sources

available, variability in pricing, trading activity, and other relevant data in performing this process. The fair values of cash and cash

equivalents, trade receivables and accounts payable approximate their carrying values due to the relatively short-term nature of the

instruments.

In determining where measurements lie in the fair value hierarchy, the Company uses default assumptions regarding the general

characteristics of the financial instrument as the starting point. The Company then adjusts the level assigned to the fair value

measurement, as necessary, based on the weight of the evidence obtained by the Company. Except for its pension plan assets, the

Company reviews the levels assigned to its fair value measurements on a quarterly basis and recognizes transfers between levels of the

fair value hierarchy as of the beginning of the quarter in which the transfer occurs. For pension plan assets, the Company reviews the

levels assigned to its fair value measurements on an annual basis and recognizes transfers between levels as of the beginning of the

year in which the transfer occurs.

The Company also performs fair value measurements on a nonrecurring basis for various nonfinancial assets including intangible

assets acquired in a business combination, impairment of long-lived assets held for sale and goodwill and indefinite-lived intangible

asset impairment testing. The valuation approach(es) selected for each of these measurements depends upon the specific facts and

circumstances.

Trade Receivables - Allowance for Doubtful Accounts:

Lexmark maintains allowances for doubtful accounts for estimated losses resulting from the inability of its customers to make required

payments. The Company estimates the allowance for doubtful accounts based on a variety of factors including the length of time

receivables are past due, the financial health of its customers, unusual macroeconomic conditions and historical experience. If the

financial condition of its customers deteriorates or other circumstances occur that result in an impairment of customers’ ability to

make payments, the Company records additional allowances as needed. The Company writes off uncollectible trade accounts

receivable against the allowance for doubtful accounts when collections efforts have been exhausted and/or any legal action taken by

the Company has concluded.