Lexmark 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

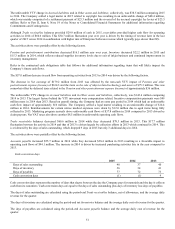

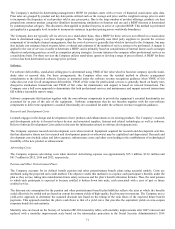

61

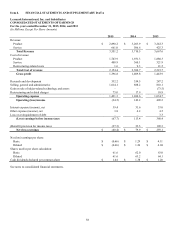

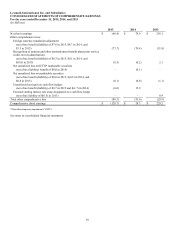

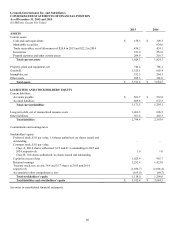

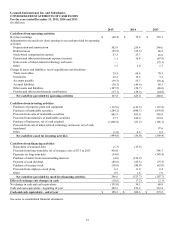

Lexmark International, Inc. and Subsidiaries

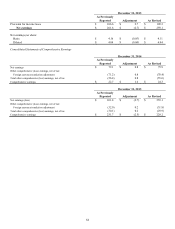

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the years ended December 31, 2015, 2014 and 2013

(In Millions)

2015

2014

2013

Cash flows from operating activities:

Net (loss) earnings

$

(40.4)

$

79.9

$

259.1

Adjustments to reconcile net (loss) earnings to net cash provided by operating

activities:

Depreciation and amortization

302.9

259.4

249.6

Deferred taxes

(55.9)

(25.5)

40.5

Stock-based compensation expense

37.3

27.7

26.6

Pension and other postretirement expense (income)

1.1

76.4

(87.9)

Gain on sale of inkjet-related technology and assets

–

–

(75.3)

Other

1.3

2.0

1.7

Change in assets and liabilities, net of acquisitions and divestiture:

Trade receivables

29.9

60.6

78.3

Inventories

22.2

15.3

7.3

Accounts payable

(39.7)

55.7

(38.4)

Accrued liabilities

(30.3)

(44.6)

89.3

Other assets and liabilities

(107.5)

(54.7)

(46.0)

Pension and other postretirement contributions

(13.1)

(29.2)

(24.8)

Net cash flows provided by operating activities

107.8

423.0

480.0

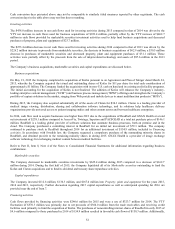

Cash flows from investing activities:

Purchases of property, plant and equipment

(112.6)

(136.3)

(167.4)

Purchases of marketable securities

(284.2)

(848.3)

(878.8)

Proceeds from sales of marketable securities

881.9

851.0

565.8

Proceeds from maturities of marketable securities

27.7

160.0

219.0

Purchase of businesses, net of cash acquired

(1,006.6)

(83.2)

(146.1)

Proceeds from sale of inkjet-related technology and assets, net of cash

transferred

–

–

97.6

Other

(1.0)

0.8

0.5

Net cash flows used for investing activities

(494.8)

(56.0)

(309.4)

Cash flows from financing activities:

Repayment of assumed debt

(1.3)

(15.9)

–

Proceeds from long-term debt, net of issuance costs of $3.3 in 2013

418.0

–

396.7

Payments on long-term debt

(54.0)

–

(349.4)

Purchase of shares from noncontrolling interests

(4.6)

(154.9)

–

Payment of cash dividend

(88.6)

(85.3)

(75.3)

Purchase of treasury stock

(30.0)

(80.0)

(82.0)

Proceeds from employee stock plans

6.2

11.0

0.4

Other

0.9

1.4

1.9

Net cash flows provided by (used for) financing activities

246.6

(323.7)

(107.7)

Effect of exchange rate changes on cash

(10.6)

(7.2)

(2.1)

Net change in cash and cash equivalents

(151.0)

36.1

60.8

Cash and cash equivalents - beginning of year

309.3

273.2

212.4

Cash and cash equivalents - end of year

$

158.3

$

309.3

$

273.2

See notes to consolidated financial statements.