Lexmark 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

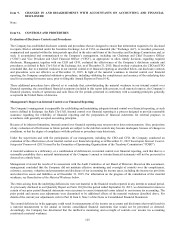

Because of this material weakness, management concluded that the Company did not maintain effective internal control over financial

reporting as of December 31, 2015, based on criteria described in Internal Control – Integrated Framework (2013) issued by COSO.

The Company’s management has excluded Kofax and Claron from its assessment of internal control over financial reporting as of

December 31, 2015, because they were acquired in business acquisitions during 2015. Kofax and Claron are wholly owned

subsidiaries whose total assets represent less than 3% and total revenue represent less than 5% of the related consolidated financial

statement amounts as of and for the year ended December 31, 2015.

The effectiveness of the Company’s internal control over financial reporting as of December 31, 2015 has been audited by

PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report which appears herein.

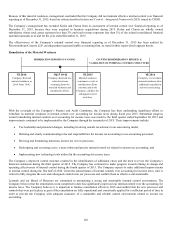

Remediation of the Material Weakness

With the oversight of the Company’s Finance and Audit Committee, the Company has been undertaking significant efforts to

remediate its material weakness in internal control over accounting for income taxes during fiscal year 2015. Substantial progress

toward remediating internal controls over accounting for income taxes was made by the third quarter ended September 30, 2015 and

improvements continued to be implemented by the Company through the remainder of 2015. These improvements include:

Tax leadership and personnel changes, including involving outside tax advisors in an outsourcing model,

Defining and clearly communicating roles and responsibilities for income tax accounting to tax accounting personnel,

Revising and formalizing numerous income tax review processes,

Redesigning and executing a new, a more robust and precise internal control set related to income tax accounting, and

Implementing new technology tools utilized in the accounting for income taxes.

The Company’s improved control structure resulted in the identification of additional errors and the need to revise the Company’s

financial statements during the third quarter of 2015. The Company has continued to make progress toward refining its design and

operating effectiveness of internal control during the fourth quarter of 2015. The Company expects to make additional improvements

in internal control during the first half of 2016. Given the annual nature of internal controls over accounting for income taxes, time is

critical to fully integrate the new and redesigned controls into our processes and confirm them as effective and sustainable.

Lexmark and our Board of Directors are committed to maintaining a strong and sustainable internal control environment. The

Company believes that the remediation work completed to date has significantly improved our internal control over the accounting for

income taxes. The Company believes it is important to finalize remediation efforts in 2016 and confirm that the new processes and

controls that were put in place as part of the remediation are fully operational and consistently applied for a sufficient period of time in

order to provide the Company with adequate assurance of a sustainable and reliable control environment related to income tax

accounting.

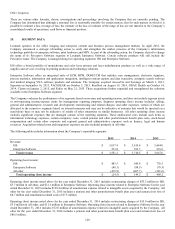

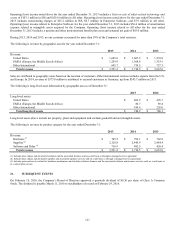

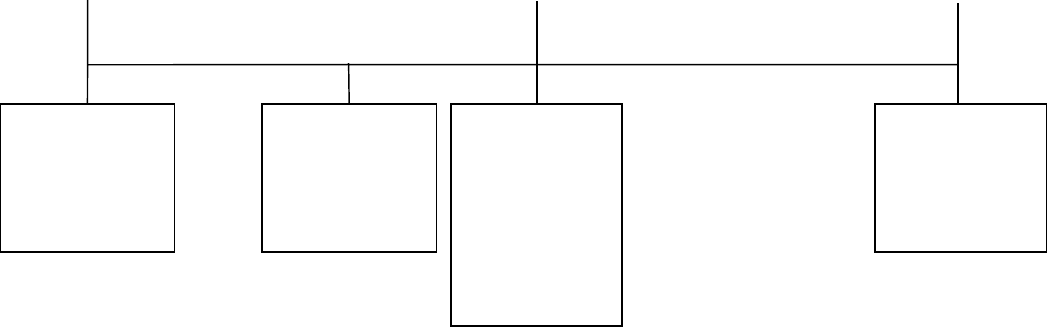

REMEDIATIO N EFFO RTS O N-GO ING

CO NTINUED REMEDIATIO N EFFO RTS &

Material weakness

continues to exist as

remediation efforts

continue and as the

Company validates the

redesigned control

activities.

YE 2016

Company to reevaluate

material weakness after

additional remediation

activities and testing.

n

VALIDATIO N O F INTERNAL C O NTRO L STRUCTURE

Company disclosed tax-

related revisions

stemming from the

material weakness and

remediation efforts.

3Q15 10-Q

YE 2014

Company disclosed

material weakness in

2014 Form 10-K.

YE 2015