Lexmark 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

During 2015, total Lexmark revenue declined 4% YTY, reflecting an unfavorable YTY currency impact of 6% and an unfavorable

impact of approximately 3% due to the Company’s exit of inkjet technology. The change in YTY revenues reflected a positive impact

of 6% for growth in Enterprise Software revenue, primarily due to the acquisitions of Kofax in the second quarter of 2015 and

ReadSoft in the third quarter of 2014. Additionally, the Company benefited from continued growth in MPS supplies revenue.

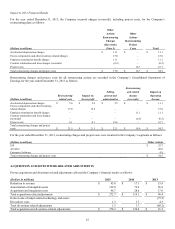

Operating income for the year ended December 31, 2015 decreased 116% YTY primarily due to higher operating expenses mainly

associated with the acquisition-related adjustments related to the acquisition of Kofax in May of 2015 and restructuring related

charges and project costs due to the newly announced restructuring plans. During 2015, net earnings declined 151% from the prior

year, primarily due to lower operating income. Net earnings for the year ended December 31, 2015 included $272.7 million of pre-tax

acquisition-related adjustments, $88.2 million of pre-tax restructuring charges and project costs, a pension and other postretirement

benefit plan actuarial net loss $8.7 million and $7.5 million of remediation-related charges. The Company uses the term “acquisition-

related adjustments” for purchase accounting adjustments and incremental acquisition and integration costs related to acquisitions. The

Company uses the term “project costs” for incremental charges related to the execution of its restructuring plans. The Company uses

the term “remediation-related charges” for professional fees associated with analysis and remediation of the Company’s previously

disclosed material weakness in internal controls over income tax accounting.

During 2014, total Lexmark revenue increased 1% compared to prior year. Gross profit decreased 2%, Operating expense increased

22% and Operating income decreased 64% when compared to the same period in 2013.

Net earnings for the year ended December 31, 2014 declined 69% from the prior year primarily due to lower operating income. Net

earnings for the year ended December 31, 2014 included $119.1 million of pre-tax acquisition-related adjustments, a pension and

other postretirement benefit plan asset and actuarial net loss of $80.5 million and $45.8 million of pre-tax restructuring charges and

project costs.

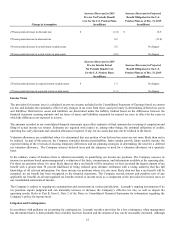

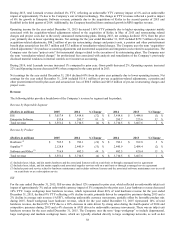

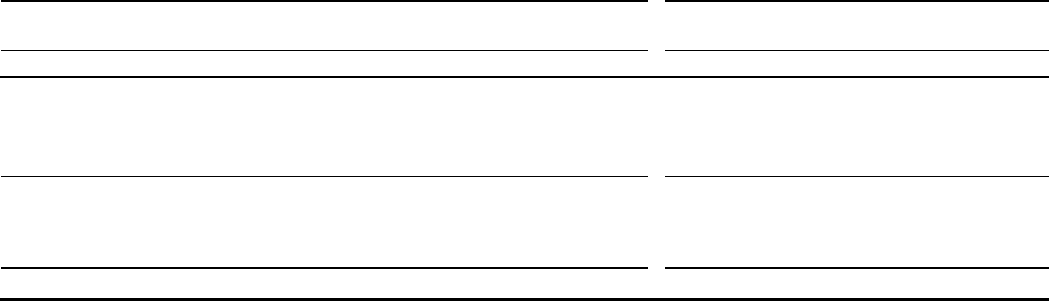

Revenue

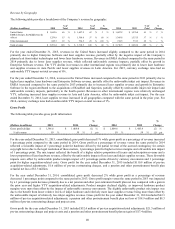

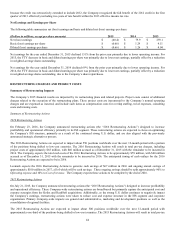

The following tables provide a breakdown of the Company’s revenue by segment and by product:

Revenue by Reportable Segment

(Dollars in millions)

2015

2014

% Change

2014

2013

% Change

ISS

$

3,017.4

$

3,414.8

(12)

%

$

3,414.8

$

3,444.0

(1)

%

Enterprise Software

533.8

295.7

81

%

295.7

223.6

32

%

Total revenue

$

3,551.2

$

3,710.5

(4)

%

$

3,710.5

$

3,667.6

1

%

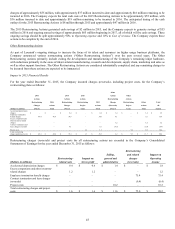

Revenue by Product

(Dollars in millions)

2015

2014

% Change

2014

2013

% Change

Hardware (1)

$

705.5

$

782.1

(10)

%

$

782.1

$

762.8

3

%

Supplies (2)

2,128.8

2,445.9

(13)

%

2,445.9

2,484.4

(2)

%

Software and Other (3)

716.9

482.5

49

%

482.5

420.4

15

%

Total revenue

$

3,551.2

$

3,710.5

(4)

%

$

3,710.5

$

3,667.6

1

%

(1) Includes laser, inkjet, and dot matrix hardware and the associated features sold on a unit basis or through a managed service agreement

(2) Includes laser, inkjet, and dot matrix supplies and associated supplies services sold on a unit basis or through a managed service agreement

(3) Includes parts and service related to hardware maintenance and includes software licenses and the associated software maintenance services sold

on a unit basis or as a subscription service

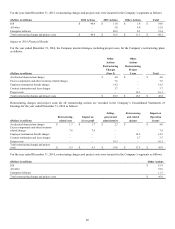

ISS

For the year ended December 31, 2015, ISS revenue declined 12% compared to prior year, which reflected an unfavorable inkjet exit

impact of approximately 3% and an unfavorable currency impact of 5% compared to the prior year. Laser hardware revenue decreased

10% YTY. Large workgroup laser hardware revenue, which represented about 86% of total hardware revenue for the year ended

December 31, 2015, declined 8% YTY reflecting a 6% decline in units, primarily driven by competitive pressures during 2015 and a

2% decline in average unit revenue (“AUR”), reflecting unfavorable currency movements, partially offset by favorable product mix

during 2015. Small workgroup laser hardware revenue, which for the year ended December 31, 2015 represented 14% of total

hardware revenue, declined 23% YTY due to a 20% decrease in units driven by strong sales during the fourth quarter of 2014 and

competitive pressures during 2015 and a 4% decrease in AUR driven by unfavorable currency movements. There was no inkjet exit

hardware revenue for the year ended December 31, 2015. The Company uses the term “large workgroup” to include departmental,

large workgroup and medium workgroup lasers, which are typically attached directly to large workgroup networks, as well as dot