Lexmark 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

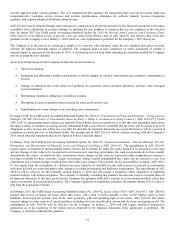

Intangible assets with finite lives are amortized over their estimated useful lives using the straight-line method. In certain instances

where consumption could be greater in the earlier years of the asset’s life, the Company has selected, as a compensating measure, a

shorter period over which to amortize the asset. The Company’s intangible assets with finite lives are tested for impairment in

accordance with its policy for long-lived assets below.

Long-Lived Assets Held and Used:

Lexmark reviews for impairment of long-lived assets whenever events or changes in circumstances indicate that the carrying amount

of an asset may not be recoverable. If the estimated undiscounted future cash flows expected to result from the use of the assets and

their eventual disposition are insufficient to recover the carrying value of the assets, then an impairment loss is recognized based upon

the excess of the carrying value of the assets over the fair value of the assets. Fair value is determined based on the highest and best

use of the assets considered from the perspective of market participants.

Lexmark also reviews any legal and contractual obligations associated with the retirement of its long-lived assets and records assets

and liabilities, as necessary, related to such obligations. The asset recorded is amortized over the useful life of the related long-lived

tangible asset. The liability recorded is relieved when the costs are incurred to retire the related long-lived tangible asset. The

Company’s asset retirement obligations are currently not material to the Company’s Consolidated Statements of Financial Position.

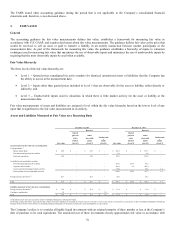

Capital Lease Receivables:

The Company assesses and monitors credit risk associated with financing receivables, namely sales-type capital lease receivables,

through an analysis of both commercial risk and political risk associated with the customer financing. Internal credit quality indicators

are developed by the Company’s credit management function, taking into account the customer’s net worth, payment history, long

term debt ratings and/or other information available from recognized credit rating services. If such information is not available, the

Company estimates a rating based on its analysis of the customer’s audited financial statements prepared and certified in accordance

with recognized generally accepted accounting principles, if available. The portfolio is assessed on an annual basis for significant

changes in credit ratings or other information indicating an increase in exposure to credit risk. Quantitative disclosures related to

capital lease receivables have been omitted from the Notes to Consolidated Financial Statements as these balances represent

approximately 2% of the Company’s total assets.

Litigation:

The Company accrues for liabilities related to litigation matters when the information available indicates that it is probable that a

liability has been incurred and the amount of the liability can be reasonably estimated. Legal costs such as outside counsel fees and

expenses are charged to expense in the period incurred and are recorded in Selling, general and administrative expenses in the

Consolidated Statements of Earnings. Refer to Note 19 of the Notes to Consolidated Financial Statements for more information

regarding loss contingencies.

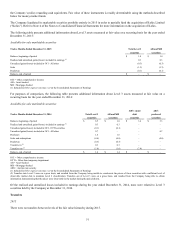

Warranty:

Lexmark provides for the estimated cost of product warranties at the time revenue is recognized. The amounts accrued for product

warranties are based on the quantity of units sold under warranty, estimated product failure rates, and material usage and service

delivery costs. The estimates for product failure rates and material usage and service delivery costs are periodically adjusted based on

actual results. For extended warranty programs, the Company defers revenue in short-term and long-term liability accounts (based on

the extended warranty contractual period) for amounts invoiced to customers for these programs and recognizes the revenue ratably

over the contractual period. Costs associated with extended warranty programs are expensed as incurred.

Shipping and Distribution Costs:

Lexmark includes shipping and distribution costs in Cost of revenue on the Consolidated Statements of Earnings.

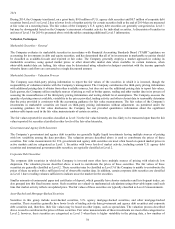

Segment Data:

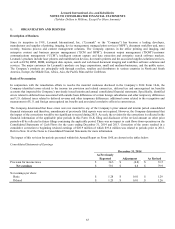

The Company is managed along two operating segments: Imaging Solutions and Services (“ISS”) and Enterprise Software. ISS offers

a broad portfolio of monochrome and color laser printers and laser multifunction products as well as a wide range of supplies and

services covering its printing products and technology solutions. Enterprise Software offers an integrated suite of ECM, BPM,

DOM/CCM that includes case management, electronic signature, process analytics, information and application integration, intelligent

content capture and data extraction, enterprise search software and medical imaging VNA software products and solutions.