Lexmark 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

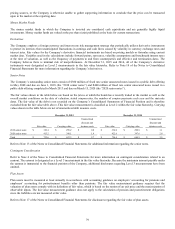

the noncontrolling interest, which had been included in Other liabilities on the Company’s Consolidated Statements of Financial

Position.

Because the current levels of revenue and net earnings for ReadSoft are not material to the Company’s Consolidated Statements of

Earnings, supplemental pro forma and actual revenue and net earnings disclosures have been omitted.

Other Acquisitions

On October 14, 2014 the Company acquired the assets of GNAX Healthcare LLC (“GNAX Health”) a subsidiary of GNAX Holdings,

LLC. GNAX Health is a provider of image exchange software technology for exchanging medical content between medical facilities.

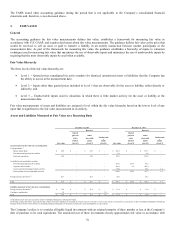

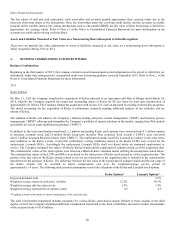

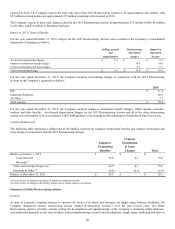

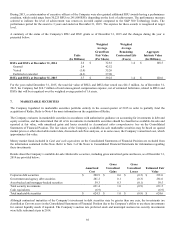

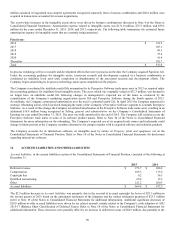

2013

During the year ended December 31, 2013, the Company completed the following acquisitions:

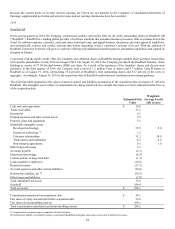

Total purchase price,

net of cash acquired

Saperion AG

$

65.7

PACSGEAR, Inc.

52.3

AccessVia, Inc. and Twistage, Inc.

28.1

Total

$

146.1

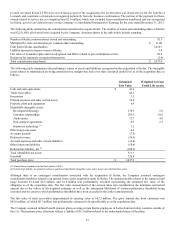

Acquisition-related costs of $1.7 million were charged directly to operations and were included in Selling, general and administrative

on the Consolidated Statements of Earnings for the year ended December 31, 2013. Acquisition-related costs include finder’s fees,

legal, advisory, valuation, accounting and other fees incurred to effect the business combination. Acquisition-related costs above do

not include travel and integration expenses.

The purchases of companies acquired in 2013 are included in Purchase of businesses, net of cash acquired on the Consolidated

Statements of Cash Flows for the year ended December 31, 2013 in the amount of $146.1 million.

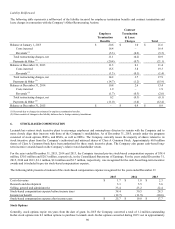

Divestiture

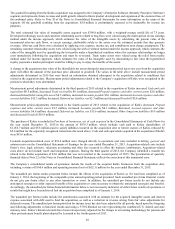

In 2013, the Company and Funai Electric Co., Ltd. (“Funai”) entered into a Master Inkjet Sale Agreement of the Company’s inkjet-

related technology and assets to Funai. Included in the sale were one of the Company’s subsidiaries, certain intellectual property and

other assets of the Company. The Company must also provide certain transition services to Funai and will continue to sell supplies for

its current inkjet installed base. The sale closed in the second quarter of 2013.

The Company recognized a gain of $73.5 million upon the sale recorded in Gain on sale of inkjet-related technology and assets on the

Consolidated Statements of Earnings for the year ended December 31, 2013. The gain consisted of total cash consideration of $100.9

million, offset partially by the carrying value of the disposal group of $19.3 million and $8.1 million of expenses incurred during 2013

to effect the sale. Of the $100.9 million of cash proceeds received, or $98.6 million net of the $2.3 million cash balance held by the

subsidiary included in the sale, $97.6 million was presented in investing activities for the sale of the business and $1.0 million was

included in operating activities for transition services on the Consolidated Statements of Cash Flows for the year ended December 31,

2013.

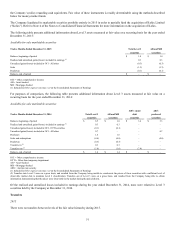

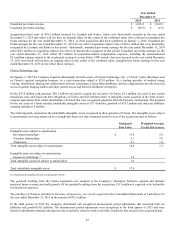

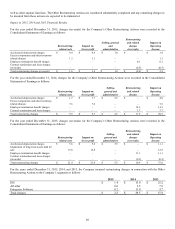

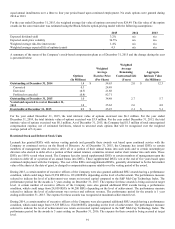

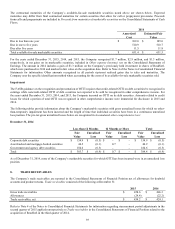

5. RESTRUCTURING CHARGES

2016 Restructuring Actions

General

On February 23, 2016, the Company announced restructuring actions (the “2016 Restructuring Actions”) designed to increase

profitability and operational efficiency primarily in its ISS segment. These restructuring actions are expected to focus on optimizing

the Company’s ISS structure, primarily as a result of the continued strong U.S. dollar, and are also aligned with the previously

announced strategic alternatives process.

The 2016 Restructuring Actions are expected to impact about 550 positions worldwide over the next 12-month period with a portion

of the positions being shifted to low-cost countries. The 2016 Restructuring Actions will result in total pre-tax charges of

approximately $47 million, with approximately $40 million accrued as of December 31, 2015, with the remainder to be incurred in