Lexmark 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

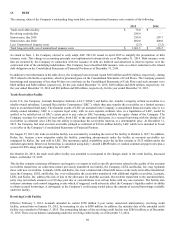

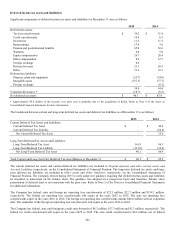

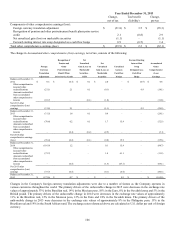

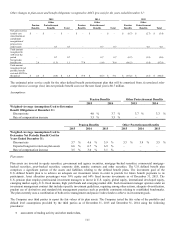

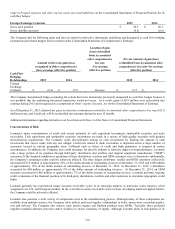

For the year ended December 31, 2013, the following table provides details of amounts reclassified from Accumulated other

comprehensive earnings (loss):

Amount Reclassified

from Accumulated

Other

Details about Accumulated Other

Comprehensive

Affected Line Item

Comprehensive Earnings Components

(Loss) Earnings

in the Statements of Earnings

Foreign currency translation adjustment

Foreign exchange gain recognized upon sale

of a foreign entity

$

10.7

Gain on sale of inkjet-related technology and assets

Pension and other postretirement benefits

Amortization of prior service credit

$

0.7

Note 17. Employee Pension and Postretirement Plans

Pension-related losses recognized upon sale

of a subsidiary

(0.4)

Gain on sale of inkjet-related technology and assets

$

(0.3)

Tax benefit (liability)

$

–

Net of tax

Unrealized gains and (losses) on

marketable securities

Non-OTTI

$

1.2

Other expense (income), net

OTTI

0.1

Other expense (income), net

(0.2)

Tax benefit (liability)

$

1.1

Net of tax

Total reclassifications for the period

$

11.8

Net of tax

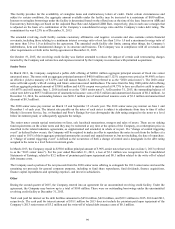

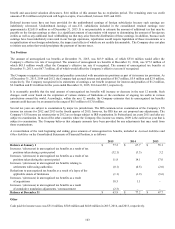

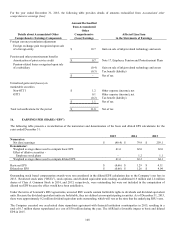

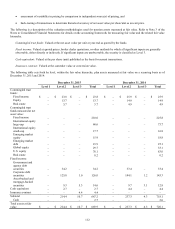

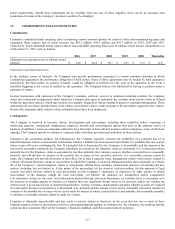

16. EARNINGS PER SHARE (“EPS”)

The following table presents a reconciliation of the numerators and denominators of the basic and diluted EPS calculations for the

years ended December 31:

2015

2014

2013

Numerator:

Net (loss) earnings

$

(40.4)

$

79.9

$

259.1

Denominator:

Weighted average shares used to compute basic EPS

61.6

62.0

63.0

Effect of dilutive securities -

Employee stock plans

–

1.2

1.1

Weighted average shares used to compute diluted EPS

61.6

63.2

64.1

Basic net EPS

$

(0.66)

$

1.29

$

4.11

Diluted net EPS

$

(0.66)

$

1.26

$

4.04

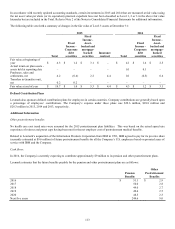

Outstanding stock based compensation awards were not considered in the diluted EPS calculation due to the Company’s net loss in

2015. Restricted stock units (“RSUs”), stock options, and dividend equivalent units totaling an additional 0.9 million and 2.4 million

shares of Class A Common Stock in 2014, and 2013, respectively, were outstanding but were not included in the computation of

diluted net EPS because the effect would have been antidilutive.

Under the terms of Lexmark’s RSU agreements, unvested RSU awards contain forfeitable rights to dividends and dividend equivalent

units. Because the dividend equivalent units are forfeitable, they are defined as non-participating securities. As of December 31, 2015,

there were approximately 0.2 million dividend equivalent units outstanding, which will vest at the time that the underlying RSU vests.

The Company executed one accelerated share repurchase agreement with financial institution counterparties in 2015, resulting in a

total of 0.7 million shares repurchased at a cost of $30 million during the year. The ASR had a favorable impact to basic and diluted

EPS in 2015.