Lexmark 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

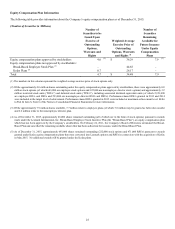

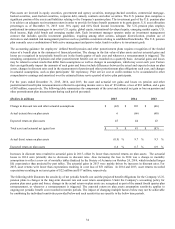

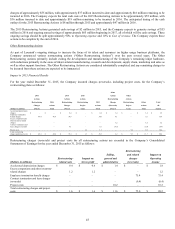

35

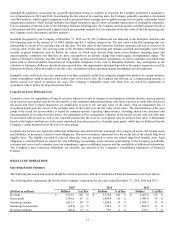

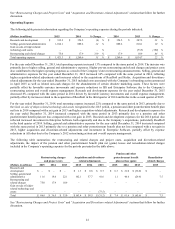

Increase (Decrease) in 2015

Increase (Decrease) in Projected

Pre-tax Net Periodic Benefit

Benefit Obligation for the U.S.

Cost for the U.S. Pension Plans

Pension Plans as of Dec. 31, 2015

Change in Assumption

(in millions)

(in millions)

25 basis points decrease in discount rate

$

(1.0)

$

16.5

25 basis points increase in discount rate

0.9

(15.8)

50 basis points decrease in actual return on plan assets

2.8

No Impact

50 basis points increase in actual return on plan assets

(2.8)

No Impact

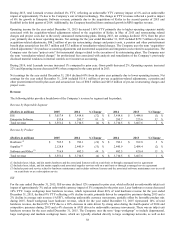

Increase (Decrease) in 2015

Pre-tax Interim Period

Increase (Decrease) in Projected

Net Periodic Benefit Cost

Benefit Obligation for the U.S.

for the U.S. Pension Plans

Pension Plans as of Dec. 31, 2015

(in millions)

(in millions)

25 basis points decrease in expected return on plan assets

$

1.3

No Impact

25 basis points increase in expected return on plan assets

(1.3)

No Impact

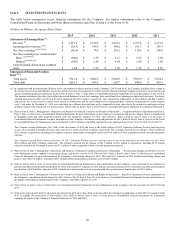

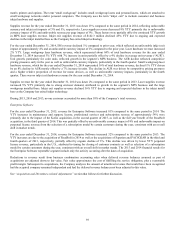

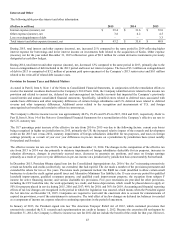

Income Taxes

The provision for income taxes is calculated on pre-tax income included in the Consolidated Statement of Earnings based on current

tax law and includes the cumulative effect of any changes in tax rates from those used previously in determining deferred tax assets

and liabilities. Deferred tax assets and liabilities are determined under the liability method based on the differences between the

financial statement carrying amounts and tax bases of assets and liabilities measured by enacted tax rates in effect for the years in

which the differences are expected to reverse.

The amounts recorded in our consolidated financial statements may reflect estimates of final amounts due to timing of completion and

filing of actual income tax returns. Estimates are required with respect to, among other things, the potential utilization of credits,

operating loss carry-forwards and valuation allowances required, if any, for tax assets that may not be realized in the future.

Valuation allowances are established when it is determined that any portion of our deferred tax assets are not more likely than not to

be realized. As part of this process, the Company considers historical profitability, future market growth, future taxable income, the

expected timing of the reversals of existing temporary differences and tax planning strategies in determining the need for a deferred

tax valuation allowance. The Company assesses deferred taxes and the adequacy or need for a valuation allowance on a quarterly

basis.

In the ordinary course of business there is inherent uncertainty in quantifying our income tax positions. The Company assesses its

income tax positions based upon management’s evaluation of the facts, circumstances, and information available at the reporting date.

For those tax positions where it is more likely than not that a tax benefit will be sustained, we have recorded the largest amount of tax

benefit with a greater than 50 percent likelihood of being realized upon ultimate settlement with a taxing authority that has full

knowledge of all relevant information. For those income tax positions where it is not more likely than not that a tax benefit will be

sustained, no tax benefit has been recognized in the financial statements. The Company records interest and penalties (net of any

applicable tax benefit) on all unrecognized tax benefits related to income taxes as a component of the provision for income taxes on

our consolidated statements of income.

The Company is subject to ongoing tax examinations and assessments in various jurisdictions. Lexmark’s ongoing assessments of its

tax positions require judgment and can materially increase or decrease the Company’s effective tax rate, as well as impact the

operating results. Refer to Part II, Item 8, Note 2 of the Notes to Consolidated Financial Statements for information regarding the

Company’s policy for income taxes.

Litigation and Contingencies

In accordance with guidance on accounting for contingencies, Lexmark records a provision for a loss contingency when management

has determined that it is both probable that a liability has been incurred and the amount of loss can be reasonably estimated. Although