Lexmark 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

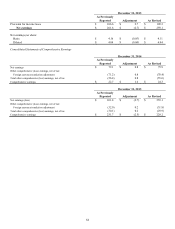

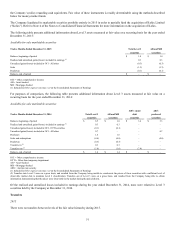

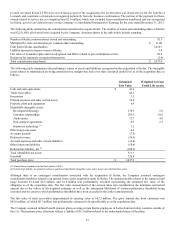

Accumulated Other Comprehensive (Loss) Earnings:

Accumulated other comprehensive (loss) earnings refers to revenues, expenses, gains and losses that under U.S. GAAP are included in

comprehensive (loss) earnings but are excluded from net income as these amounts are recorded directly as an adjustment to

stockholders’ equity, net of tax. Lexmark’s Accumulated other comprehensive (loss) earnings is composed of unrealized gains on cash

flow hedges, unamortized prior service cost or credit related to pension or other postretirement benefits, foreign currency translation

adjustments and net unrealized gains and losses on marketable securities including the non-credit loss component of OTTI. The

Company presents each item of other comprehensive (loss) earnings, on a net basis, and related tax amounts in the Consolidated

Statements of Comprehensive Earnings, displaying the combination of reclassification adjustments and other changes as a single

amount. Reclassification adjustments, including related tax amounts, are disclosed in Note 15 of the Notes to Consolidated Financial

Statements. For any item required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period, the

affected line item(s) on the Consolidated Statements of Earnings are provided. For other amounts not required to be reclassified to net

income in their entirety, such as pension-related amounts, the Company provides in Note 15 a cross-reference to related footnote

disclosures.

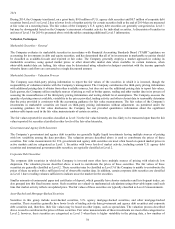

Recent Accounting Pronouncements:

Accounting Standards Updates Adopted During 2015

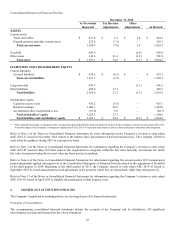

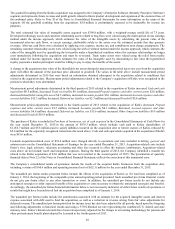

In April 2015, the FASB issued Accounting Standards Update No. 2015-03, Interest – Imputation of Interest (Subtopic 835-30):

Simplifying the Presentation of Debt Issuance Costs (“ASU 2015-03”). The amendments in ASU 2015-03 require that debt issuance

costs related to a recognized debt liability be presented as a direct deduction from the carrying amount of the debt liability rather than

as a deferred charge asset as required under current guidance. ASU 2015-03 also requires that the amortization of debt issuance costs

be reported as interest expense. The amendments in ASU 2015-03 will be effective for the Company starting January 1, 2016 and

must be applied on a retrospective basis. Early adoption is permitted. In August 2015, the FASB issued Accounting Standards Update

No. 2015-15, Interest – Imputation of Interest (Subtopic 835-30): Presentation and Subsequent Measurement of Debt Issuance Costs

Associated with Line-of-Credit Arrangements (“ASU 2015-15”). The purpose of ASU 2015-15 is to codify the SEC Staff

Announcement at the June 18, 2015 meeting of the Emerging Issues Task Force in which the SEC observer stated that reporting

entities may continue to present the cost of securing a revolving line of credit as a deferred charge asset, regardless of whether a

balance is outstanding, and amortize such costs ratably over the term of the revolving debt arrangement. The Company elected to early

adopt the new guidance regarding debt issuance costs in 2015. The financial statement effects of adoption are discussed in Note 13 of

the Notes to Consolidated Financial Statements.

In May 2015, the FASB issued Accounting Standards Update No. 2015-07, Fair Value Measurement (Topic 820): Disclosures for

Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) (“ASU 2015-07”). The amendments in

ASU 2015-07 remove the requirement to categorize within the fair value hierarchy investments for which fair value is measured using

the net asset value per share practical expedient. ASU 2015-07 affects only the Company’s disclosures and requires retrospective

application. The Company elected to early adopt this guidance during the period. Refer to the plan asset disclosures in Note 17 of the

Notes to Consolidated Financial Statements for more information.

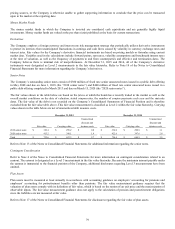

In September 2015, the FASB issued Accounting Standards Update No. 2015-16, Business Combinations (Topic 805): Simplifying the

Accounting for Measurement-Period Adjustments (“ASU 2015-16”). The amendments in ASU 2015-16 require that measurement

period adjustments be recognized in the reporting period in which the amounts are determined rather than accounted for

retrospectively as currently required if material. The Company elected to adopt this guidance to measurement period adjustments

beginning in the third and fourth quarters of 2015 as permitted by ASU 2015-16. Refer to Note 4 of the Notes to Consolidated

Financial Statements for more information.

In November 2015, the FASB issued Accounting Standards Update No. 2015-17, Income Taxes (Topic 740): Balance Sheet

Classification of Deferred Taxes (“ASU 2015-17”). The amendments in ASU 2015-17 require that all deferred tax assets and

liabilities, along with any related valuation allowance, be classified as noncurrent on the balance sheet instead of separating deferred

taxes into current and noncurrent amounts. The Company elected to early adopt the guidance during 2015 and chose the prospective

adoption method; therefore, balance sheet presentation as well as working capital in 2014 were not retrospectively restated, as

permitted by ASU 2015-17, on a consistent basis. Refer to Note 14 of the Notes to Consolidated Financial Statements for more

information regarding deferred income taxes.

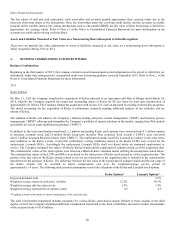

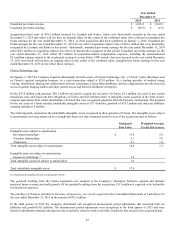

Accounting Standards Updates Recently Issued But Not Yet Effective

In May 2014, the FASB issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic

606) (“ASU 2014-09”). ASU 2014-09 is a new comprehensive standard for revenue recognition that is based on the core principle that

revenue be recognized in a manner that depicts the transfer of goods or services to customers in an amount that reflects the

consideration to which the entity expects to be entitled in exchange for those goods or services. Under the new standard, a good or

service is transferred to the customer when (or as) the customer obtains control of the good or service, which differs from the risk and