Lexmark 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Other Financial Instruments

The fair values of cash and cash equivalents, trade receivables and accounts payable approximate their carrying values due to the

relatively short-term nature of the instruments. Since the borrowings under the revolving credit facility and the accounts receivable

program utilize variable interest rate setting mechanisms such as one-month LIBOR, the fair value of these borrowings is deemed to

approximate the carrying values. Refer to Note 13 of the Notes to Consolidated Financial Statements for more information on the

accounts receivable and revolving credit facilities.

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis Subsequent to Initial Recognition

There were no material fair value adjustments to assets or liabilities measured at fair value on a nonrecurring basis subsequent to

initial recognition during 2015 or 2014.

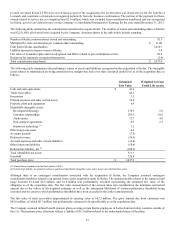

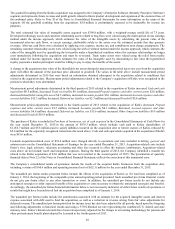

4. BUSINESS COMBINATIONS AND DIVESTITURES

Business Combinations

Beginning in the third quarter of 2015, the Company elected to record measurement period adjustments in the period in which they are

determined, rather than retrospectively, as permitted under new accounting guidance issued in September 2015. Refer to Note 2 of the

Notes to Consolidated Financial Statements for more information.

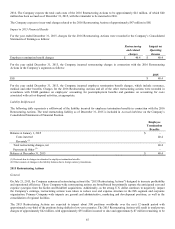

2015

Kofax Limited

On May 21, 2015 the Company completed its acquisition of Kofax pursuant to an Agreement and Plan of Merger dated March 24,

2015, whereby the Company acquired the issued and outstanding shares of Kofax for $11 per share for total cash consideration of

approximately $1 billion. The Company funded the acquisition with its non-U.S. cash on hand and its existing credit facility programs.

The initial accounting for the acquisition of Kofax is preliminary, primarily pending additional analysis of tax attributes and tax

returns of Kofax.

The addition of Kofax will enhance the Company’s industry-leading enterprise content management (“ECM”) and business process

management (“BPM”) offerings and strengthen the Company’s portfolio of capture solutions in the market, ranging from Web portals

and mobile devices to smart multifunction products (“MFPs”).

In addition to the cash consideration transferred, 1.2 million outstanding Kofax stock options were converted into 0.3 million options

to purchase Lexmark stock and 2.9 million Kofax Long-term Incentive Plan restricted stock awards (“LTIPs”) were converted

into 0.7 million Lexmark Restricted Stock Units (“RSUs”). The replacement awards issued by Lexmark are subject to the same terms

and conditions as the Kofax awards, except that performance vesting conditions related to the Kofax LTIPs were waived for the

replacement Lexmark RSUs. Accordingly the replacement Lexmark RSUs shall vest based solely on continued employment or

service. The Company estimated fair values of both the Kofax awards and the replacement Lexmark awards as of the acquisition date.

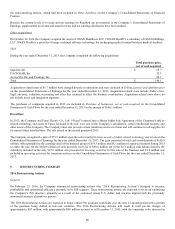

The estimated fair values of the stock options were based on a Black-Scholes valuation model utilizing the assumptions stated below.

The estimated fair values of the LTIPs and RSUs were based on the stock prices of Kofax and Lexmark as of the acquisition date. The

portion of the fair value of the Kofax awards related to service provided prior to the acquisition date is included in the consideration

transferred for the purchase of Kofax. The difference between the fair value of the replacement Lexmark awards and the fair value of

the Kofax awards will be recorded as future compensation cost over the weighted-average service period of

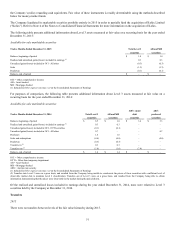

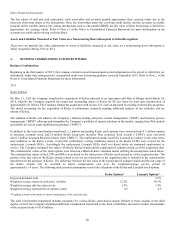

approximately 1.4 years. The following table presents assumptions used in the valuations of the Kofax and Lexmark stock options.

Kofax Options*

Lexmark Options*

Expected dividend yield

–

3.2%

Weighted average expected stock price volatility

22.5%

36.5%

Weighted average risk-free interest rate

1.4%

1.4%

Weighted average expected life of options (years)

4.5

4.5

*Weighting is based on the number of options outstanding as of the acquisition date.

The total consideration transferred includes payments for various Kofax share-based awards. Related to these awards, in the third

quarter of 2015 the Company identified additional consideration transferred in the form of liabilities incurred to former shareholders

of the acquired entity of $5.8 million.