Lexmark 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

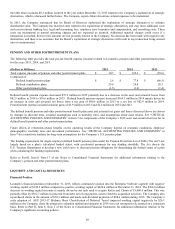

charges of approximately $55 million, with approximately $37 million incurred to date and approximately $18 million remaining to be

incurred in 2016. The Company expects the total cash costs of the 2015 Restructuring Actions to be approximately $55 million, with

$36 million incurred to date and approximately $19 million remaining to be incurred in 2016. The anticipated timing of the cash

outlays for the 2015 Restructuring Actions is $8 million through 2015 and approximately $47 million in 2016.

The 2015 Restructuring Actions generated cash savings of $2 million in 2015, and the Company expects to generate savings of $55

million in 2016 and ongoing annual savings of approximately $65 million beginning in 2017, all of which will be cash savings. These

ongoing savings should be split approximately 90% to Operating expense and 10% to Cost of revenue. The Company expects these

actions to be complete by the end of 2016.

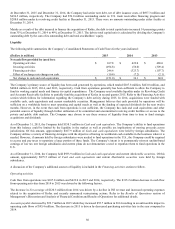

Other Restructuring Actions

As part of Lexmark’s ongoing strategy to increase the focus of its talent and resources on higher usage business platforms, the

Company announced various restructuring actions (“Other Restructuring Actions”) over the past several years. The Other

Restructuring Actions primarily include exiting the development and manufacturing of the Company’s remaining inkjet hardware,

with reductions primarily in the areas of inkjet-related manufacturing, research and development, supply chain, marketing and sales as

well as other support functions. The Other Restructuring Actions are considered substantially completed and any remaining charges to

be incurred from these actions are expected to be immaterial.

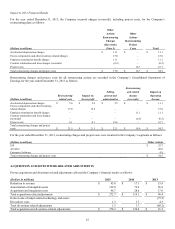

Impact to 2015 Financial Results

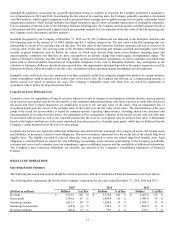

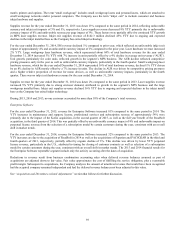

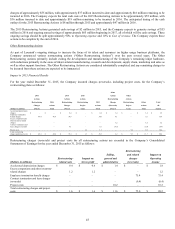

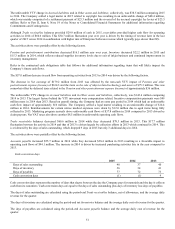

For the year ended December 31, 2015, the Company incurred charges (reversals), including project costs, for the Company’s

restructuring plans as follows:

Other

2016

2015

2015

Actions

Other

Actions

Actions

Actions

Restructuring

Actions

Restructuring

2016

Restructuring

Restructuring

2015

Charges

Restructuring

Other

Total

Charges

Actions

Charges

Project

Actions

(Reversals)

Project

Actions

All

(Dollars in millions)

(Note 5)

Total

(Note 5)

Costs

Total

(Note 5)

Costs

Total

Actions

Accelerated depreciation

charges

$

–

$

–

$

0.4

$

–

$

0.4

$

1.4

$

–

$

1.4

$

1.8

Employee termination

benefit charges

40.4

40.4

34.9

–

34.9

0.1

–

0.1

75.4

Excess components and

other inventory-related

charges

–

–

–

–

–

1.2

–

1.2

1.2

Contract termination and

lease charges (reversals)

–

–

0.1

–

0.1

(0.5)

–

(0.5)

(0.4)

Project costs

–

–

–

1.1

1.1

–

9.1

9.1

10.2

Total restructuring

charges and project costs

$

40.4

$

40.4

$

35.4

$

1.1

$

36.5

2.2

$

9.1

$

11.3

$

88.2

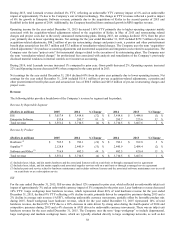

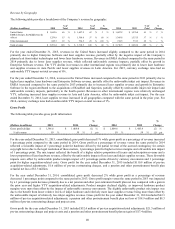

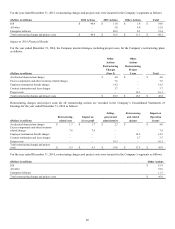

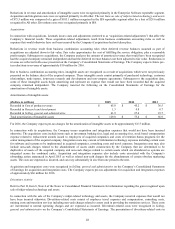

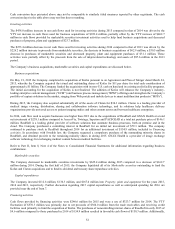

Restructuring charges (reversals) and project costs for all restructuring actions are recorded in the Company’s Consolidated

Statements of Earnings for the year ended December 31, 2015 as follows:

Restructuring

Selling,

and related

Impact on

Restructuring-

Impact on

general and

charges

Operating

(Dollars in millions)

related costs

Gross profit

administrative

(reversals)

income

Accelerated depreciation charges

$

0.4

$

0.4

$

1.4

$

–

$

1.8

Excess components and other inventory-

related charges

1.2

1.2

–

–

1.2

Employee termination benefit charges

–

–

–

75.4

75.4

Contract termination and lease charges

(reversals)

–

–

–

(0.4)

(0.4)

Project costs

–

–

10.2

–

10.2

Total restructuring charges and project

costs

$

1.6

$

1.6

$

11.6

$

75.0

$

88.2