Lexmark 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

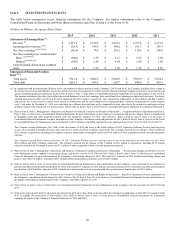

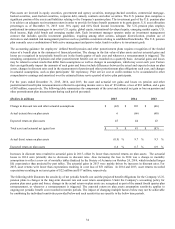

Lexmark records reductions to revenue for customer programs and incentive offerings including special pricing agreements,

promotions and other volume-based incentives at the later of the date of revenue recognition or the date the sales incentive is offered.

Estimated reductions in revenue are based upon historical trends and other known factors at the time of sale. Lexmark also records

estimated reductions to revenue for price protection, which it provides to substantially all of its distributor and reseller customers. The

amount of price protection is limited based on the amount of dealers’ and resellers’ inventory on hand (including in-transit inventory)

as of the date of the price change. If market conditions were to decline, Lexmark may take actions to increase customer incentive

offerings or reduce prices, possibly resulting in an incremental reduction of revenue at the time the incentive is offered.

The Company also records estimated reductions to revenue at the time of sale related to its customers’ right to return product.

Estimated reductions in revenue are based upon historical trends of actual product returns as well as the Company’s assessment of its

products in the channel. Provisions for specific returns from large customers are also recorded as necessary.

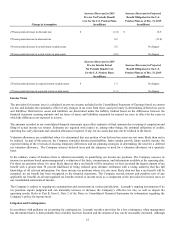

Multiple Element Arrangements

The Company enters into multiple element agreements with customers which may involve the provisions of hardware, supplies,

separately priced extended warranty and product maintenance services, and other professional services (installation, maintenance, and

enhanced warranty services). These arrangements may involve upfront purchase or lease of hardware products with services and

supplies provided per contract terms or as needed. Lexmark also enters into multiple element agreements with customers that contain

software and related services as well as contracts that include a combination of printing products and related services and software

licenses and related services. Furthermore, some contracts may include nonstandard terms and conditions. As such, significant

contract interpretation can be required to determine the appropriate accounting for some arrangements.

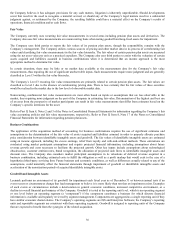

The Company uses its best estimate of selling price (“BESP”) when allocating the transaction price for many of its product and service

deliverables as permitted under the accounting guidance for multiple element arrangements when sufficient vendor specific objective

evidence (“VSOE”) and third party evidence do not exist. BESP for the Company’s product deliverables is determined by utilizing a

weighted average price approach which starts with a review of historical stand-alone sales data. Prior sales are grouped by product and

key data points utilized such as the average unit price and the weighted average price in order to incorporate the frequency of each

product sold at any given price. Due to the large number of product offerings, products are then grouped into common product

categories (families) incorporating similarities in function and use and a BESP discount is determined by common product category.

This discount is then applied to product list price to arrive at a product BESP. BESP for the Company’s service deliverables is

determined primarily by utilizing a cost plus margin approach as the Company does not typically sell its services on a stand-alone

basis. The Company generally uses third party suppliers to provide the services component of its multiple element arrangements, thus

the cost of services is generally that which is invoiced to the Company, but may also include cost estimates based on parts, labor,

overhead and estimates of the number of service actions to be performed. A margin is applied to the cost of services in order to

determine a BESP, and is primarily based on consideration of internal factors such as margin objectives and pricing practices as well

as competitor pricing strategies. For those services that are offered to customers on a stand-alone basis, the Company utilizes stand-

alone quotes to develop a range of prices offered. A BESP for these services has been determined as an average price per hour.

For multiple element agreements that include software deliverables accounted for under the industry-specific revenue recognition

guidance, stand-alone selling price of the undelivered elements must be determined by VSOE of fair value, which is based on

company specific stand-alone sales or renewal data. For software arrangements, the Company typically uses the residual method to

allocate arrangement consideration to the delivered software licenses as permitted under the industry-specific revenue recognition

guidance.

Pricing practices could be modified in the future as the Company’s go-to-market strategies evolve. Such changes could have an impact

on the Company’s ability to maintain VSOE of fair value and/or affect the determination of BESP, which could change the pattern and

timing of revenue recognition for its multiple element arrangements.

Refer to Part II, Item 8, Note 2 of the Notes to Consolidated Financial Statements for information regarding the Company’s policy for

revenue recognition.

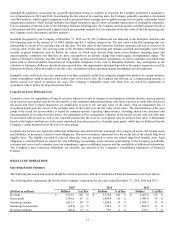

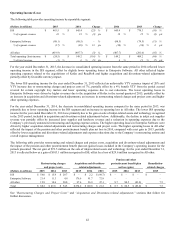

Restructuring

Lexmark records a liability for a cost associated with an exit or disposal activity at its fair value in the period in which the liability is

incurred, except for liabilities for certain employee termination benefit charges that are accrued over time. Employee termination

benefits associated with an exit or disposal activity are accrued when the obligation is probable and estimable as a postemployment

benefit obligation when local statutory requirements stipulate minimum involuntary termination benefits or when a mutual

understanding of termination benefits has been established through written policies or past practice. Employee termination benefits

accrued as probable and estimable often require judgment by the Company’s management as to the number of employees being

separated and the related salary levels, length of employment with the Company and various other factors related to the separated

employees that could affect the amount of employee termination benefits being accrued. Such estimates could change in the future as

actual data regarding separated employees becomes available.