Lexmark 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

future requirements, should these components not be available from any one of these suppliers, there can be no assurance that

production of certain of the Company’s products would not be disrupted.

19. COMMITMENTS AND CONTINGENCIES

Commitments

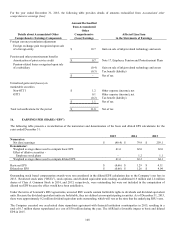

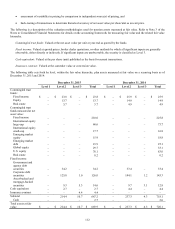

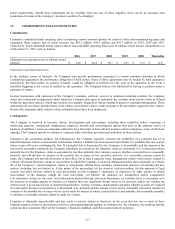

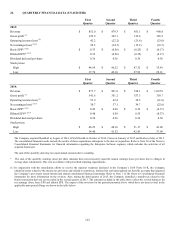

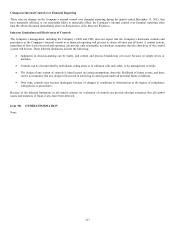

Lexmark is committed under operating leases (containing various renewal options) for rental of office and manufacturing space and

equipment. Rent expense (net of rental income) was $43.2 million, $41.9 million and $41.7 million in 2015, 2014 and 2013,

respectively. Future minimum rentals under terms of non-cancelable operating leases (net of sublease rental income commitments) as

of December 31, 2015, were as follows:

2016

2017

2018

2019

2020

Thereafter

Minimum lease payments (net of sublease rental

income)

$

34.6

$

26.4

$

18.7

$

12.5

$

11.3

$

11.6

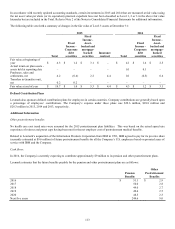

Guarantees and Indemnifications

In the ordinary course of business, the Company may provide performance guarantees to certain customers pursuant to which

Lexmark has guaranteed the performance obligation of third parties. Some of those agreements may be backed by bank guarantees

provided by the third parties. In general, Lexmark would be obligated to perform over the term of the guarantee in the event a

specified triggering event occurs as defined by the guarantee. The Company believes the likelihood of having to perform under a

guarantee is remote.

In most transactions with customers of the Company’s products, software, services or solutions, including resellers, the Company

enters into contractual arrangements under which the Company may agree to indemnify the customer from certain events as defined

within the particular contract, which may include, for example, litigation or claims relating to patent or copyright infringement. These

indemnities do not always include limits on the claims, provided the claim is made pursuant to the procedures required in the contract.

Historically, payments made related to these indemnifications have been immaterial.

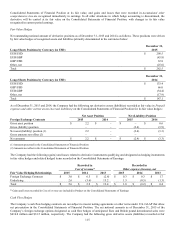

Contingencies

The Company is involved in lawsuits, claims, investigations and proceedings, including those identified below, consisting of

intellectual property, commercial, employment, employee benefits and environmental matters that arise in the ordinary course of

business. In addition, various governmental authorities have from time to time initiated inquiries and investigations, some of which are

ongoing. The Company intends to continue to cooperate fully with those governmental authorities in these matters.

Pursuant to the accounting guidance for contingencies, the Company regularly evaluates the probability of a potential loss of its

material litigation, claims or assessments to determine whether a liability has been incurred and whether it is probable that one or more

future events will occur confirming the loss. If a potential loss is determined by the Company to be probable, and the amount of the

loss can be reasonably estimated, the Company establishes an accrual for the litigation, claim or assessment. If it is determined that a

potential loss for the litigation, claim or assessment is less than probable, the Company assesses whether a potential loss is reasonably

possible, and will disclose an estimate of the possible loss or range of loss; provided, however, if a reasonable estimate cannot be

made, the Company will provide disclosure to that effect. On at least a quarterly basis, management confers with outside counsel to

evaluate all current litigation, claims or assessments in which the Company is involved. Management then meets internally to evaluate

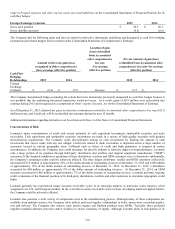

all of the Company’s current litigation, claims or assessments. During these meetings, management discusses all existing and new

matters, including, but not limited to, (i) the nature of the proceeding; (ii) the status of each proceeding; (iii) the opinions of legal

counsel and other advisors related to each proceeding; (iv) the Company’s experience or experience of other entities in similar

proceedings; (v) the damages sought for each proceeding; (vi) whether the damages are unsupported and/or exaggerated;

(vii) substantive rulings by the court; (viii) information gleaned through settlement discussions; (ix) whether there is uncertainty as to

the outcome of pending appeals or motions; (x) whether there are significant factual issues to be resolved; and/or (xi) whether the

matters involve novel legal issues or unsettled legal theories. At these meetings, management concludes whether accruals are required

for each matter because a potential loss is determined to be probable and the amount of loss can be reasonably estimated; whether an

estimate of the possible loss or range of loss can be made for matters in which a potential loss is not probable, but reasonably possible;

or whether a reasonable estimate cannot be made for a matter.

Litigation is inherently unpredictable and may result in adverse rulings or decisions. In the event that any one or more of these

litigation matters, claims or assessments result in a substantial judgment against, or settlement by, the Company, the resulting liability

could also have a material effect on the Company’s financial condition, cash flows and results of operations.