Lexmark 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

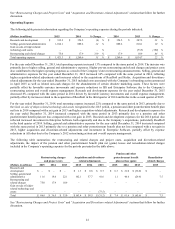

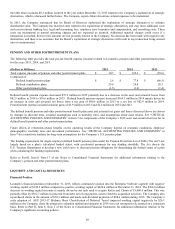

the table above includes $0.2 million incurred in the year ended December 31, 2015 related to the Company’s exploration of strategic

alternatives, which is discussed further below. The Company expects future divestiture-related expenses to be immaterial.

In 2015, the Company announced that its Board of Directors authorized the exploration of strategic alternatives to enhance

shareholder value. The Company has incurred costs related to the exploration of strategic alternatives, and may incur additional costs

such as investment banking fees, legal and accounting fees, employee travel expenses and compensation, and consulting costs. These

costs are incremental to normal operating charges and are expensed as incurred. Additional material charges could occur if a

transaction is reached, however the amounts are not presently known to the Company. No decision has been made with regard to any

alternatives, and there is no assurance that the Board’s exploration of strategic alternatives will result in any transaction being entered

into or consummated.

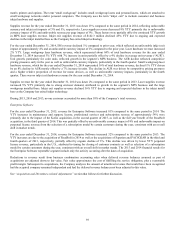

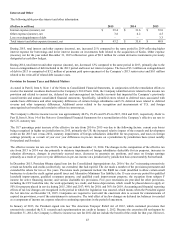

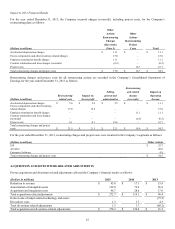

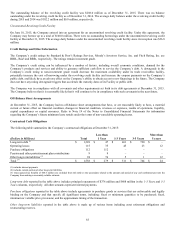

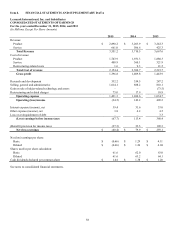

PENSION AND OTHER POSTRETIREMENT PLANS

The following table provides the total pre-tax benefit expense (income) related to Lexmark’s pension and other postretirement plans

for the years 2015, 2014, and 2013.

(Dollars in Millions)

2015

2014

2013

Total expense (income) of pension and other postretirement plans

$

30.7

$

105.2

$

(59.6)

Comprised of:

Defined benefit pension plans

$

2.6

$

77.8

$

(86.5)

Defined contribution plans

29.6

28.8

28.3

Other postretirement plans

(1.5)

(1.4)

(1.4)

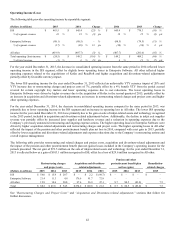

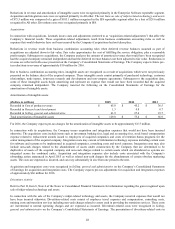

Defined benefit pension expense decreased $75.2 million in 2015 primarily due to a decrease in the asset and actuarial losses from

$82.9 million in 2014 to $10.6 million in 2015. Defined benefit pension expense increased $164.3 million in 2014 mainly driven by

an increase in asset and actuarial net losses from a net gain of $80.6 million in 2013 to a net loss of $82.9 million in 2014.

Postretirement expense included actuarial gains of $1.9 million in 2015 and $2.4 million in 2014 and 2013.

The defined benefit pension and other postretirement benefit plan asset and actuarial net gains and losses discussed above are driven

by changes in discount rates, actuarial assumptions such as mortality rates, and assumptions about asset returns. See “CRITICAL

ACCOUNTING POLICIES AND ESTIMATES” in Item 7 for components of the Company’s 2015 asset and actuarial net loss for its

defined benefit pension and other postretirement plans.

Future effects of retirement-related benefits on the operating results of the Company depend on economic conditions, employee

demographics, mortality rates and investment performance. See “CRITICAL ACCOUNTING POLICIES AND ESTIMATES” in

Item 7 for a sensitivity analysis for long-term assumptions for the Company’s U.S. pension plans.

The funding requirement for single-employer defined benefit pension plans under the Pension Protection Act of 2006 (“the Act”) are

largely based on a plan’s calculated funded status, with accelerated payments for any funding shortfalls. The Act directs the

U.S. Treasury Department to develop a new yield curve to discount pension obligations for determining the funded status of a plan

when calculating the funding requirements.

Refer to Part II, Item 8, Note 17 of the Notes to Consolidated Financial Statements for additional information relating to the

Company’s pension and other postretirement plans.

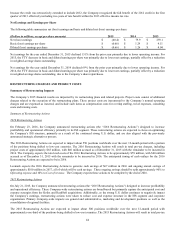

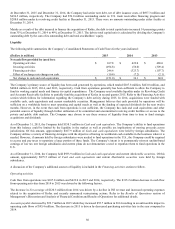

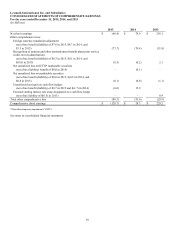

LIQUIDITY AND CAPITAL RESOURCES

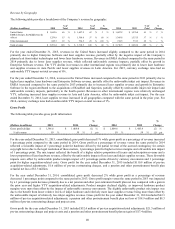

Financial Position

Lexmark’s financial position at December 31, 2015, reflects continued evolution into the Enterprise Software segment with negative

working capital of $142.2 million compared to positive working capital of $624.6 million at December 31, 2014. The $766.8 million

decrease in working capital accounts is mainly driven by net cash used to acquire Kofax and Claron of $1,006.6 million. This was

partially offset by $362.7 million in proceeds from debt, net of repayments, used to fund the acquisition activities. The Company also

repurchased shares in the amount of $30.3 million and made cash dividend payments of $88.6 million during 2015. The Company’s

early adoption of ASU 2015-17 (Balance Sheet Classification of Deferred Taxes) impacted working capital negatively by $26.1

million as the Company chose the prospective adoption method and amounts in 2014 were not retrospectively restated on a consistent

basis. Refer to Part II, Item 8, Note 2 of the Notes to Consolidated Financial Statements for additional information relation to the

Company's significant accounting policies.