Lexmark 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

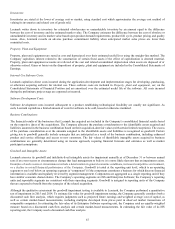

65

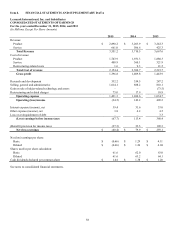

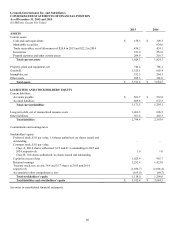

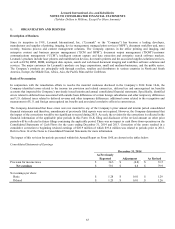

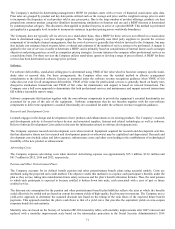

Consolidated Statement of Financial Position

December 31, 2014

As Previously

Tax Revision

Other

Reported

Adjustments

Adjustments *

As Revised

ASSETS

Current assets:

Trade receivables

$

421.6

$

0.1

$

2.4

$

424.1

Prepaid expenses and other current assets

225.8

(7.1)

–

218.7

Total current assets

1,834.3

(7.0)

2.4

1,829.7

Goodwill

605.8

–

(2.4)

603.4

Other assets

142.6

61.6

(3.2)

201.0

Total assets

$

3,633.1

$

54.6

$

(3.2)

$

3,684.5

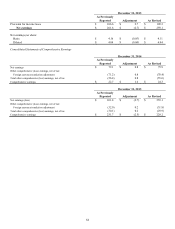

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accrued liabilities

$

678.5

$

(6.2)

$

–

$

672.3

Total current liabilities

1,211.3

(6.2)

–

1,205.1

Long-term debt

699.7

–

(3.2)

696.5

Other liabilities

458.8

33.5

–

492.3

Total liabilities

2,369.8

27.3

(3.2)

2,393.9

Stockholders' equity:

Capital in excess of par

956.2

(0.5)

–

955.7

Retained earnings

1,404.1

20.9

–

1,425.0

Accumulated other comprehensive loss

(91.6)

6.9

–

(84.7)

Total stockholders' equity

1,263.3

27.3

–

1,290.6

Total liabilities and stockholders' equity

$

3,633.1

$

54.6

$

(3.2)

$

3,684.5

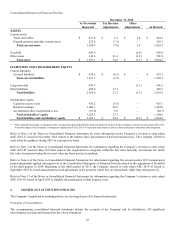

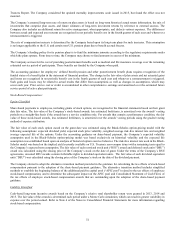

* Other Adjustments include second quarter 2015 measurement period adjustments applied retrospectively prior to the Company’s election to early adopt ASU 2015-

16 and the impact of the Company’s retrospective application of ASU 2015-03 to present debt issuance costs as a direct reduction to the related debt obligation.

Refer to Note 2 of the Notes to Consolidated Financial Statements for more information on the Company’s election to early adopt

ASU 2015-17 issued in November 2015 related to the balance sheet presentation of deferred income taxes. The Company elected to

early adopt the guidance during 2015 on a prospective basis.

Refer to Note 2 of the Notes to Consolidated Financial Statements for information regarding the Company’s election to early adopt

ASU 2015-07 issued in May 2015 that removes the requirement to categorize within the fair value hierarchy investments for which

fair value is measured using the net asset value per share practical expedient.

Refer to Note 4 of the Notes to Consolidated Financial Statements for information regarding the second quarter 2015 measurement

period adjustments applied retrospectively to the Consolidated Statements of Financial Position related to the acquisition of ReadSoft

in the third quarter of 2014. Beginning in the third quarter of 2015, the Company elected to early adopt ASU 2015-16 issued in

September 2015 to record measurement period adjustments in the period in which they are determined, rather than retrospectively.

Refer to Note 13 of the Notes to Consolidated Financial Statements for information regarding the Company’s election to early adopt

ASU 2015-03 issued in April 2015 to simplify the presentation of debt issuance costs.

2. SIGNIFICANT ACCOUNTING POLICIES

The Company’s significant accounting policies are an integral part of its financial statements.

Principles of Consolidation:

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries. All significant

intercompany accounts and transactions have been eliminated.