Lexmark 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

In accordance with recently updated accounting standards, certain investments in 2015 and 2014 that are measured at fair value using

the net asset value per share (or its equivalent) practical expedient have not been classified as Level 1, 2 or 3 in the above fair value

hierarchy but are included in the Total. Refer to Note 2 of the Notes to Consolidated Financial Statements for additional information.

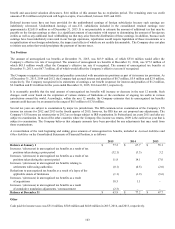

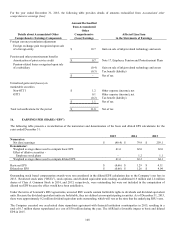

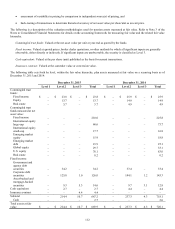

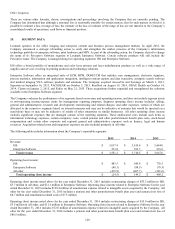

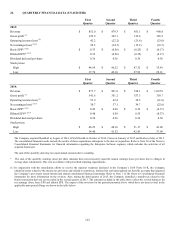

The following table sets forth a summary of changes in the fair value of Level 3 assets at December 31:

2015

2014

Total

Fixed

Income -

Corporate

debt

securities

Fixed

Income -

Asset-

backed and

mortgage-

backed

securities

Insurance

contract

Total

Fixed

Income -

Corporate

debt

securities

Fixed

Income -

Asset-

backed and

mortgage-

backed

securities

Fair value at beginning of

year

$

4.3

$

1.2

$

3.1

$

–

$

4.1

$

1.6

$

2.5

Actual return on plan assets -

assets held at reporting date

–

–

–

–

0.1

0.1

–

Purchases, sales and

settlements, net

6.2

(0.4)

2.2

4.4

0.1

(0.5)

0.6

Transfers in/(transfers out),

net

0.2

0.2

–

–

–

–

–

Fair value at end of year

$

10.7

$

1.0

$

5.3

$

4.4

$

4.3

$

1.2

$

3.1

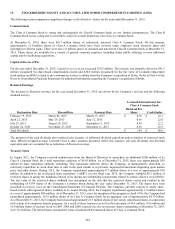

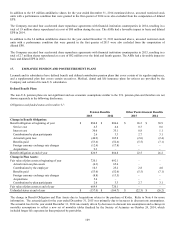

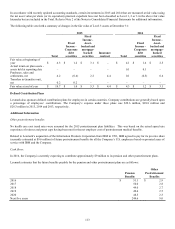

Defined Contribution Plans

Lexmark also sponsors defined contribution plans for employees in certain countries. Company contributions are generally based upon

a percentage of employees’ contributions. The Company’s expense under these plans was $29.6 million, $28.8 million and

$28.3 million in 2015, 2014 and 2013, respectively.

Additional Information

Other postretirement benefits:

No health care cost trend rates were assumed for the 2015 postretirement plan liabilities. This was based on the actual spend rate

experience of retirees and preset caps having been met for the net employer cost of postretirement medical benefits.

Related to Lexmark’s acquisition of the Information Products Corporation from IBM in 1991, IBM agreed to pay for its pro rata share

(currently estimated at $9.6 million) of future postretirement benefits for all the Company’s U.S. employees based on prorated years of

service with IBM and the Company.

Cash flows:

In 2016, the Company is currently expecting to contribute approximately $9 million to its pension and other postretirement plans.

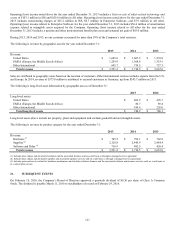

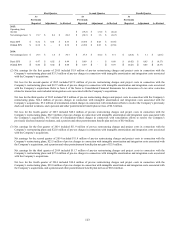

Lexmark estimates that the future benefits payable for the pension and other postretirement plans are as follows:

Other

Pension

Postretirement

Benefits

Benefits

2016

$

51.1

$

2.9

2017

50.0

2.8

2018

49.0

2.7

2019

49.6

2.5

2020

48.5

2.3

Next five years

244.6

9.0