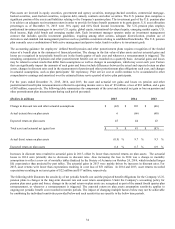

Lexmark 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

the Company believes it has adequate provisions for any such matters, litigation is inherently unpredictable. Should developments

occur that result in the need to recognize a material accrual, or should any of the Company’s legal matters result in a substantial

judgment against, or settlement by the Company, the resulting liability could have a material effect on the Company’s results of

operations, financial condition and/or cash flows.

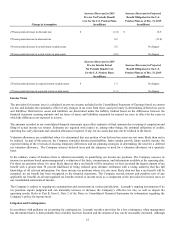

Fair Value

The Company currently uses recurring fair value measurements in several areas including pension plan assets and derivatives. The

Company also uses fair value measurements on a nonrecurring basis when testing goodwill and long-lived assets for impairment.

The Company uses third parties to report the fair values of its pension plan assets, though the responsibility remains with the

Company’s management. The Company utilizes various sources of pricing and other market data in its process of corroborating fair

values and classifying fair value measurements in the fair value hierarchy. The fair values of certain pension plan assets are measured

using the net asset value per unit as a practical expedient. The Company also uses third parties to assist with the valuation of certain

assets acquired and liabilities assumed in business combinations when it is determined that an income approach is the most

appropriate method to determine fair value.

In certain situations, there may be little or no market data available at the measurement date for the Company’s fair value

measurements, thus requiring the use of significant unobservable inputs. Such measurements require more judgment and are generally

classified as Level 3 within the fair value hierarchy.

The Company’s Level 3 recurring fair value measurements are primarily related to certain pension plan assets. The fair values are

classified as Level 3 due to the absence of corroborating pricing data. There is less certainty that the fair values of these securities

would be realized in the market due to the low level of observable market data.

Nonrecurring, nonfinancial fair value measurements are most often based on inputs or assumptions that are less observable in the

market, thus requiring more judgment on the part of the Company in estimating fair value. Determination of the highest and best use

of an asset from the perspective of market participants can result in fair value measurements that differ from estimates based on the

Company’s specific intentions for the asset.

Refer to Part II, Item 8, Notes 2 and 3 of the Notes to Consolidated Financial Statements for information regarding the Company’s fair

value accounting policies and fair value measurements, respectively. Refer to Part II, Item 8, Note 17 of the Notes to Consolidated

Financial Statements for information regarding pension plan assets.

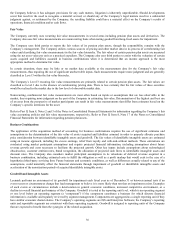

Business Combinations

The application of the acquisition method of accounting for business combinations requires the use of significant estimates and

assumptions in the determination of the fair value of assets acquired and liabilities assumed in order to properly allocate purchase

price consideration between identifiable intangible assets and goodwill. The fair values of identifiable intangible assets are estimated

using an income approach, including the excess earnings, relief from royalty and with-and-without methods. These estimations are

conducted using market participant assumptions and require projected financial information, including assumptions about future

revenue growth and costs necessary to facilitate the projected growth. Other key inputs include assumptions about technological

obsolescence, customer attrition rates, brand recognition, the allocation of projected cash flows to identifiable intangible assets and

discount rates. The Company also considers market participant assumptions in its valuations of deferred revenue acquired in a

business combination, including estimated costs to fulfill the obligation as well as a profit markup that would exist in the case of a

hypothetical third-party servicing firm. Future business and economic conditions, as well as differences actually related to any of the

assumptions, could materially affect the financial statements through impairment of goodwill or identifiable intangible assets and

acceleration of the amortization periods of acquired identifiable intangible assets.

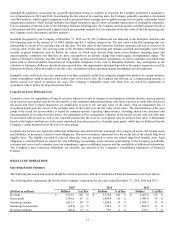

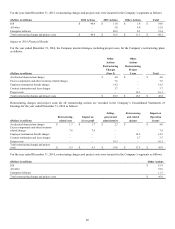

Goodwill and Intangible Assets

Lexmark performs an assessment of its goodwill for impairment each fiscal year as of December 31 or between annual tests if an

event occurs or circumstances change that lead management to believe it is more likely than not that an impairment exists. Examples

of such events or circumstances include a deterioration in general economic conditions, increased competitive environment, or a

decline in overall financial performance of the Company. Goodwill is tested at the reporting unit level, which is an operating segment

or one level below an operating segment (a “component”) if the component constitutes a business for which discrete financial

information is available and regularly reviewed by segment management. Components are aggregated as a single reporting unit if they

have similar economic characteristics. The Company’s operating segments are ISS and Enterprise Software; the Company’s reporting

units and reportable segments are consistent with these operating segments. Goodwill is assigned to reporting units of the Company

that are expected to benefit from the synergies of the related acquisition.